Why It Might Not Make Sense To Buy PNE Industries Ltd (SGX:BDA) For Its Upcoming Dividend

Why It Might Not Make Sense To Buy PNE Industries Ltd (SGX:BDA) For Its Upcoming Dividend

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see PNE Industries Ltd (SGX:BDA) is about to trade ex-dividend in the next 4 days. The ex-dividend date is one business day before the record date, which is the cut-off date for shareholders to be present on the company's books to be eligible for a dividend payment. The ex-dividend date is an important date to be aware of as any purchase of the stock made on or after this date might mean a late settlement that doesn't show on the record date. Accordingly, PNE Industries investors that purchase the stock on or after the 25th of May will not receive the dividend, which will be paid on the 16th of June.

普通读者会知道我们喜欢 Simply Wall St 的分红,这就是为什么看到它令人兴奋的原因 PNE 工业有限公司 (SGX: BDA) 即将在未来4天内进行除息交易。除息日是记录日期前一个工作日,这是股东在公司账簿上有资格获得股息支付的截止日期。除息日是需要注意的重要日期,因为在此日期或之后购买任何股票都可能意味着未在记录日期显示的延迟结算。因此,在5月25日或之后购买股票的PNE Industries投资者将不会获得股息,股息将在6月16日支付。

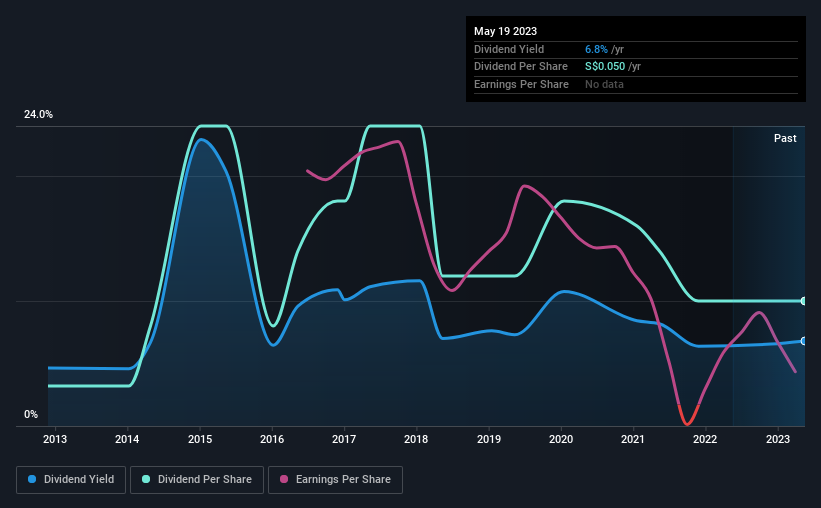

The company's next dividend payment will be S$0.01 per share. Last year, in total, the company distributed S$0.05 to shareholders. Based on the last year's worth of payments, PNE Industries stock has a trailing yield of around 6.8% on the current share price of SGD0.735. If you buy this business for its dividend, you should have an idea of whether PNE Industries's dividend is reliable and sustainable. So we need to check whether the dividend payments are covered, and if earnings are growing.

该公司的下一次股息将为每股0.01新元。去年,该公司总共向股东分配了0.05新元。根据去年的付款价值,PNE Industries股票的后续收益率约为6.8%,而目前的股价为0.735新元。如果你收购这家企业是为了获得股息,你应该知道PNE Industries的股息是否可靠和可持续。因此,我们需要检查股息支付是否包括在内,以及收益是否在增长。

Check out our latest analysis for PNE Industries

查看我们对 PNE Industries 的最新分析

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. An unusually high payout ratio of 326% of its profit suggests something is happening other than the usual distribution of profits to shareholders. A useful secondary check can be to evaluate whether PNE Industries generated enough free cash flow to afford its dividend. Over the last year, it paid out more than three-quarters (83%) of its free cash flow generated, which is fairly high and may be starting to limit reinvestment in the business.

股息通常从公司收入中支付,因此,如果公司支付的股息超过其收入,则其股息被削减的风险通常更高。其利润的326%的异常高的派息率表明,除了通常向股东分配利润之外,还有其他事情正在发生。一个有用的辅助检查可以是评估PNE Industries是否产生了足够的自由现金流来支付股息。去年,它支付了其产生的自由现金流的四分之三(83%)以上,相当高,可能开始限制对该业务的再投资。

It's good to see that while PNE Industries's dividends were not covered by profits, at least they are affordable from a cash perspective. Still, if the company repeatedly paid a dividend greater than its profits, we'd be concerned. Extraordinarily few companies are capable of persistently paying a dividend that is greater than their profits.

很高兴看到,尽管PNE Industries的股息没有被利润所覆盖,但至少从现金的角度来看,它们是负担得起的。尽管如此,如果该公司一再支付的股息超过其利润,我们会感到担忧。极少数公司能够持续支付高于其利润的股息。

Click here to see how much of its profit PNE Industries paid out over the last 12 months.

点击此处查看PNE Industries在过去12个月中支付了多少利润。

Have Earnings And Dividends Been Growing?

收益和股息一直在增长吗?

When earnings decline, dividend companies become much harder to analyse and own safely. If earnings fall far enough, the company could be forced to cut its dividend. PNE Industries's earnings have collapsed faster than Wile E Coyote's schemes to trap the Road Runner; down a tremendous 34% a year over the past five years.

当收益下降时,股息公司变得更加难以分析和安全拥有。如果收益下降得足够远,该公司可能被迫削减股息。PNE Industries的收益暴跌速度快于Wile E Coyote诱捕Road Runner的计划;在过去五年中,每年大幅下降34%。

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. PNE Industries has delivered an average of 12% per year annual increase in its dividend, based on the past 10 years of dividend payments. The only way to pay higher dividends when earnings are shrinking is either to pay out a larger percentage of profits, spend cash from the balance sheet, or borrow the money. PNE Industries is already paying out 326% of its profits, and with shrinking earnings we think it's unlikely that this dividend will grow quickly in the future.

衡量公司股息前景的另一种关键方法是衡量其历史股息增长率。根据过去10年的股息支付情况,PNE Industries的股息平均每年增长12%。在收益萎缩时支付更高股息的唯一方法是要么支付更大比例的利润,要么从资产负债表中花钱,要么借钱。PNE Industries已经支付了其利润的326%,由于收益萎缩,我们认为该股息将来不太可能迅速增长。

Final Takeaway

最后的外卖

Is PNE Industries an attractive dividend stock, or better left on the shelf? It's never fun to see a company's earnings per share in retreat. Additionally, PNE Industries is paying out quite a high percentage of its earnings, and more than half its cash flow, so it's hard to evaluate whether the company is reinvesting enough in its business to improve its situation. Bottom line: PNE Industries has some unfortunate characteristics that we think could lead to sub-optimal outcomes for dividend investors.

PNE Industries 是一只有吸引力的股息股,还是最好留在货架上?看到公司的每股收益下降从来都不是一件好事。此外,PNE Industries支付的收益占其收益的比例相当高,现金流超过一半,因此很难评估该公司对其业务的再投资是否足以改善其状况。底线:PNE Industries有一些不幸的特征,我们认为这些特征可能会给股息投资者带来不理想的结果。

Having said that, if you're looking at this stock without much concern for the dividend, you should still be familiar of the risks involved with PNE Industries. Every company has risks, and we've spotted 5 warning signs for PNE Industries (of which 2 can't be ignored!) you should know about.

话虽如此,如果你在不太担心股息的情况下看待这只股票,那么你仍然应该熟悉PNE Industries所涉及的风险。每家公司都有风险,我们已经发现 PNE Industries 的 5 个警告信号 (其中 2 个不容忽视!)你应该知道。

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

如果您在市场上寻找实力雄厚的股息支付者,我们建议 查看我们精选的顶级股息股票。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧? 取得联系 直接和我们联系。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St 的这篇文章本质上是一般性的。 我们仅使用公正的方法提供基于历史数据和分析师预测的评论,我们的文章无意提供财务建议。 它不构成买入或卖出任何股票的建议,也没有考虑您的目标或财务状况。我们的目标是为您提供由基本面数据驱动的长期重点分析。请注意,我们的分析可能未将最新的价格敏感型公司公告或定性材料考虑在内。简而言之,华尔街对上述任何股票都没有头寸。