-

市场

-

产品

-

资讯

-

Moo社区

-

课堂

-

查看更多

-

功能介绍

-

费用费用透明,无最低余额限制

投资选择、功能介绍、费用相关信息由Moomoo Financial Inc.提供

- English

- 中文繁體

- 中文简体

- 深色

- 浅色

Shares of ABB Inc. (NYSE:ABB) increased by 10.12% in the past three months. When understanding a companies price change over a time period like 3 months, it could be helpful to look at its financials. One key aspect of a companies financials is its debt, but before we understand the importance of debt, let's look at how much debt ABB has.

ABB Debt

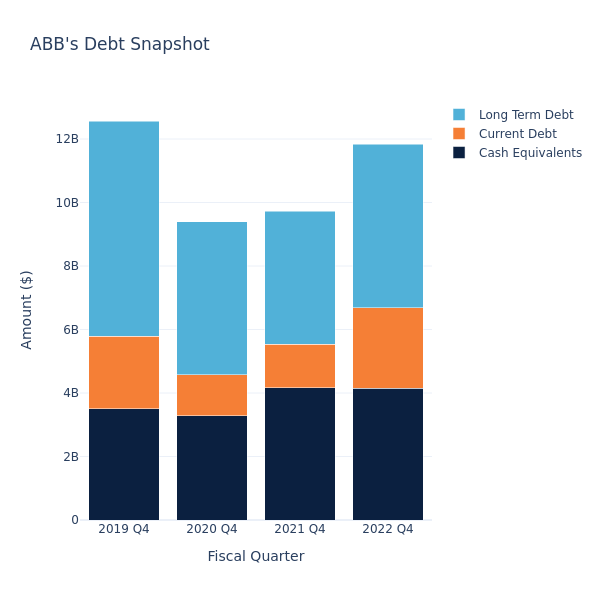

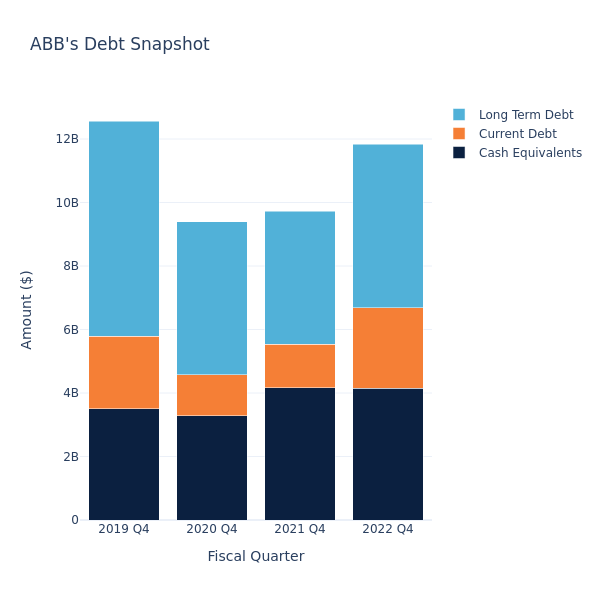

Based on ABB's balance sheet as of February 24, 2023, long-term debt is at $5.14 billion and current debt is at $2.54 billion, amounting to $7.68 billion in total debt. Adjusted for $4.16 billion in cash-equivalents, the company's net debt is at $3.52 billion.

Let's define some of the terms we used in the paragraph above. Current debt is the portion of a company's debt which is due within 1 year, while long-term debt is the portion due in more than 1 year. Cash equivalents includes cash and any liquid securities with maturity periods of 90 days or less. Total debt equals current debt plus long-term debt minus cash equivalents.

Investors look at the debt-ratio to understand how much financial leverage a company has. ABB has $39.15 billion in total assets, therefore making the debt-ratio 0.2. As a rule of thumb, a debt-ratio more than 1 indicates that a considerable portion of debt is funded by assets. A higher debt-ratio can also imply that the company might be putting itself at risk for default, if interest rates were to increase. However, debt-ratios vary widely across different industries. A debt ratio of 25% might be higher for one industry, but average for another.

Why Debt Is Important

Debt is an important factor in the capital structure of a company, and can help it attain growth. Debt usually has a relatively lower financing cost than equity, which makes it an attractive option for executives.

Interest-payment obligations can impact the cash-flow of the company. Equity owners can keep excess profit, generated from the debt capital, when companies use the debt capital for its business operations.

Looking for stocks with low debt-to-equity ratios? Check out Benzinga Pro, a market research platform which provides investors with near-instantaneous access to dozens of stock metrics - including debt-to-equity ratio. Click here to learn more.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Shares of ABB Inc. (NYSE:ABB) increased by 10.12% in the past three months. When understanding a companies price change over a time period like 3 months, it could be helpful to look at its financials. One key aspect of a companies financials is its debt, but before we understand the importance of debt, let's look at how much debt ABB has.

在过去三个月中,ABB Inc.(纽约证券交易所代码:ABB)的股价上涨了10.12%。在了解一家公司在3个月等时间内的价格变化时,查看其财务状况可能会有所帮助。公司财务状况的一个关键方面是其债务,但在我们了解债务的重要性之前,让我们先看看ABB有多少债务。

ABB Debt

ABB 债务

Based on ABB's balance sheet as of February 24, 2023, long-term debt is at $5.14 billion and current debt is at $2.54 billion, amounting to $7.68 billion in total debt. Adjusted for $4.16 billion in cash-equivalents, the company's net debt is at $3.52 billion.

根据ABB截至2023年2月24日的资产负债表,长期债务为51.4亿美元,流动债务为25.4亿美元,总债务为76.8亿美元。经41.6亿美元现金等价物调整后,该公司的净负债为35.2亿美元。

Let's define some of the terms we used in the paragraph above. Current debt is the portion of a company's debt which is due within 1 year, while long-term debt is the portion due in more than 1 year. Cash equivalents includes cash and any liquid securities with maturity periods of 90 days or less. Total debt equals current debt plus long-term debt minus cash equivalents.

让我们定义一下我们在上面段落中使用的一些术语。 当前债务 是公司在1年内到期的债务部分,而 长期债务 是 1 年以上到期的部分。 现金等价物 包括现金和任何到期期不超过 90 天的流动证券。 债务总额 等于当前债务加上长期债务减去现金等价物。

Investors look at the debt-ratio to understand how much financial leverage a company has. ABB has $39.15 billion in total assets, therefore making the debt-ratio 0.2. As a rule of thumb, a debt-ratio more than 1 indicates that a considerable portion of debt is funded by assets. A higher debt-ratio can also imply that the company might be putting itself at risk for default, if interest rates were to increase. However, debt-ratios vary widely across different industries. A debt ratio of 25% might be higher for one industry, but average for another.

投资者通过查看债务比率来了解一家公司的财务杠杆率。ABB的总资产为391.5亿美元,因此债务比率为0.2。根据经验,债务比率超过1表示相当一部分债务由资产融资。更高的债务比率也可能意味着,如果利率上升,公司可能会面临违约风险。但是,不同行业的债务比率差异很大。一个行业的债务比率为25%可能更高,但另一个行业的债务比率为平均水平。

Why Debt Is Important

为什么债务很重要

Debt is an important factor in the capital structure of a company, and can help it attain growth. Debt usually has a relatively lower financing cost than equity, which makes it an attractive option for executives.

债务是公司资本结构中的重要因素,可以帮助其实现增长。债务的融资成本通常相对低于股权,这使其成为高管的有吸引力的选择。

Interest-payment obligations can impact the cash-flow of the company. Equity owners can keep excess profit, generated from the debt capital, when companies use the debt capital for its business operations.

利息支付义务可能会影响公司的现金流。当公司将债务资本用于业务运营时,股权所有者可以保留债务资本产生的超额利润。

Looking for stocks with low debt-to-equity ratios? Check out Benzinga Pro, a market research platform which provides investors with near-instantaneous access to dozens of stock metrics - including debt-to-equity ratio. Click here to learn more.

正在寻找负债与权益比率低的股票?看看Benzinga Pro,这是一个市场研究平台,它为投资者提供了近乎即时的数十种股票指标,包括债务与权益比率。点击此处了解更多信息。

This article was generated by Benzinga's automated content engine and reviewed by an editor.

本文由Benzinga的自动内容引擎生成,并由编辑审阅。

moomoo是Moomoo Technologies Inc.公司提供的金融信息和交易应用程序。

在美国,moomoo上的投资产品和服务由Moomoo Financial Inc.提供,一家受美国证券交易委员会(SEC)监管的持牌主体。 Moomoo Financial Inc.是金融业监管局(FINRA)和证券投资者保护公司(SIPC)的成员。

在新加坡,moomoo上的投资产品和服务是通过Moomoo Financial Singapore Pte. Ltd.提供,该公司受新加坡金融管理局(MAS)监管(牌照号码︰CMS101000) ,持有资本市场服务牌照 (CMS) ,持有财务顾问豁免(Exempt Financial Adviser)资质。本内容未经新加坡金融管理局的审查。

在澳大利亚,moomoo上的金融产品和服务是通过Futu Securities (Australia) Ltd提供,该公司是受澳大利亚证券和投资委员会(ASIC)监管的澳大利亚金融服务许可机构(AFSL No. 224663)。请阅读并理解我们的《金融服务指南》、《条款与条件》、《隐私政策》和其他披露文件,这些文件可在我们的网站 https://www.moomoo.com/au中获取。

在加拿大,通过moomoo应用提供的仅限订单执行的券商服务由Moomoo Financial Canada Inc.提供,并受加拿大投资监管机构(CIRO)监管。

在马来西亚,moomoo上的投资产品和服务是通过Moomoo Securities Malaysia Sdn. Bhd. 提供,该公司受马来西亚证券监督委员会(SC)监管(牌照号码︰eCMSL/A0397/2024) ,持有资本市场服务牌照 (CMSL) 。本内容未经马来西亚证券监督委员会的审查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd., Futu Securities (Australia) Ltd, Moomoo Financial Canada Inc.,和Moomoo Securities Malaysia Sdn. Bhd.是关联公司。

风险及免责提示

moomoo是Moomoo Technologies Inc.公司提供的金融信息和交易应用程序。

在美国,moomoo上的投资产品和服务由Moomoo Financial Inc.提供,一家受美国证券交易委员会(SEC)监管的持牌主体。 Moomoo Financial Inc.是金融业监管局(FINRA)和证券投资者保护公司(SIPC)的成员。

在新加坡,moomoo上的投资产品和服务是通过Moomoo Financial Singapore Pte. Ltd.提供,该公司受新加坡金融管理局(MAS)监管(牌照号码︰CMS101000) ,持有资本市场服务牌照 (CMS) ,持有财务顾问豁免(Exempt Financial Adviser)资质。本内容未经新加坡金融管理局的审查。

在澳大利亚,moomoo上的金融产品和服务是通过Futu Securities (Australia) Ltd提供,该公司是受澳大利亚证券和投资委员会(ASIC)监管的澳大利亚金融服务许可机构(AFSL No. 224663)。请阅读并理解我们的《金融服务指南》、《条款与条件》、《隐私政策》和其他披露文件,这些文件可在我们的网站 https://www.moomoo.com/au中获取。

在加拿大,通过moomoo应用提供的仅限订单执行的券商服务由Moomoo Financial Canada Inc.提供,并受加拿大投资监管机构(CIRO)监管。

在马来西亚,moomoo上的投资产品和服务是通过Moomoo Securities Malaysia Sdn. Bhd. 提供,该公司受马来西亚证券监督委员会(SC)监管(牌照号码︰eCMSL/A0397/2024) ,持有资本市场服务牌照 (CMSL) 。本内容未经马来西亚证券监督委员会的审查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd., Futu Securities (Australia) Ltd, Moomoo Financial Canada Inc.,和Moomoo Securities Malaysia Sdn. Bhd.是关联公司。

- 分享到weixin

- 分享到qq

- 分享到facebook

- 分享到twitter

- 分享到微博

- 粘贴板

使用浏览器的分享功能,分享给你的好友吧