There's Reason For Concern Over VibroPower Corporation Limited's (SGX:BJD) Massive 34% Price Jump

There's Reason For Concern Over VibroPower Corporation Limited's (SGX:BJD) Massive 34% Price Jump

VibroPower Corporation Limited (SGX:BJD) shareholders would be excited to see that the share price has had a great month, posting a 34% gain and recovering from prior weakness. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 3.8% over the last year.

VibroPower 株式会社 (SGX: BJD) 股东们会很高兴看到股价表现良好,上涨了34%,并从先前的疲软中恢复过来。坏消息是,即使在过去30天股市回升之后,股东仍比去年下降了约3.8%。

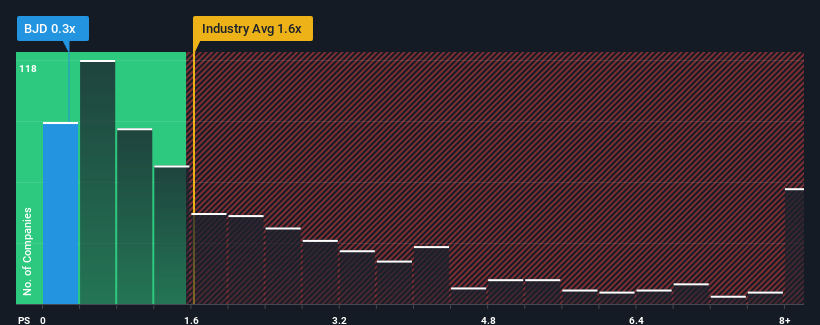

Although its price has surged higher, it's still not a stretch to say that VibroPower's price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" compared to the Electrical industry in Singapore, seeing as it matches the P/S ratio of the wider industry. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

尽管其价格飙升,但可以毫不夸张地说,与新加坡的电气行业相比,VibroPower目前的0.3倍的市销率(或 “市盈率”)似乎是 “中间路线”,因为它与整个行业的市盈率相匹配。但是,不加解释地忽视市盈率是不明智的,因为投资者可能无视一个独特的机会或一个代价高昂的错误。

See our latest analysis for VibroPower

查看我们对 VibroPower 的最新分析

How Has VibroPower Performed Recently?

VibroPower 最近的表现如何?

As an illustration, revenue has deteriorated at VibroPower over the last year, which is not ideal at all. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

举例来说,去年VibroPower的收入恶化了,这根本不理想。也许投资者认为最近的收入表现足以与该行业保持一致,这阻碍了市盈率的下滑。如果你喜欢这家公司,你至少希望是这样,这样你就有可能在不太受欢迎的时候买入一些股票。

How Is VibroPower's Revenue Growth Trending?

VibroPower 的收入增长趋势如何?

In order to justify its P/S ratio, VibroPower would need to produce growth that's similar to the industry.

为了证明其市盈率的合理性,VibroPower需要实现与行业相似的增长。

Retrospectively, the last year delivered a frustrating 7.2% decrease to the company's top line. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

回想起来,去年公司的收入下降了7.2%,令人沮丧。至少总收入没有比三年前完全倒退,这要归功于早期的增长。因此,可以公平地说,该公司最近的收入增长一直不稳定。

This is in contrast to the rest of the industry, which is expected to grow by 38% over the next year, materially higher than the company's recent medium-term annualised growth rates.

这与该行业的其他部门形成鲜明对比,后者预计明年将增长38%,大大高于该公司最近的中期年化增长率。

In light of this, it's curious that VibroPower's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

有鉴于此,奇怪的是,VibroPower的P/S与其他大多数公司保持一致。显然,该公司的许多投资者并不像最近那样看跌,他们现在也不愿意放弃股票。维持这些价格将很难实现,因为最近的收入趋势的延续最终可能会压低股价。

The Bottom Line On VibroPower's P/S

VibroPower P/S 的底线

Its shares have lifted substantially and now VibroPower's P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

其股价已大幅上涨,现在VibroPower的市盈率已恢复到行业中位数的区间内。仅使用价格与销售比率来确定是否应该出售股票是不明智的,但是它可以作为公司未来前景的实用指南。

Our examination of VibroPower revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. If recent medium-term revenue trends continue, the probability of a share price decline will become quite substantial, placing shareholders at risk.

我们对VibroPower的审查显示,其糟糕的三年收入趋势并没有导致市盈率低于我们的预期,因为市盈率看起来比当前的行业前景差。目前,我们对市盈率感到不舒服,因为这种收入表现不太可能长期支持更积极的情绪。如果最近的中期收入趋势继续下去,股价下跌的可能性将变得相当大,使股东面临风险。

Before you take the next step, you should know about the 3 warning signs for VibroPower that we have uncovered.

在你采取下一步之前,你应该知道 VibroPower 有 3 个警告信号 我们已经发现了。

If you're unsure about the strength of VibroPower's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

如果你是 不确定 VibroPower 的业务实力,为什么不浏览我们的互动股票清单,为你可能错过的其他一些公司提供坚实的商业基本面。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧? 取得联系 直接和我们联系。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St 的这篇文章本质上是一般性的。 我们仅使用公正的方法提供基于历史数据和分析师预测的评论,我们的文章无意提供财务建议。 它不构成买入或卖出任何股票的建议,也没有考虑您的目标或财务状况。我们的目标是为您提供由基本面数据驱动的长期重点分析。请注意,我们的分析可能未将最新的价格敏感型公司公告或定性材料考虑在内。简而言之,华尔街对上述任何股票都没有头寸。