A Piece Of The Puzzle Missing From Maxnerva Technology Services Limited's (HKG:1037) 32% Share Price Climb

A Piece Of The Puzzle Missing From Maxnerva Technology Services Limited's (HKG:1037) 32% Share Price Climb

Maxnerva Technology Services Limited (HKG:1037) shares have had a really impressive month, gaining 32% after a shaky period beforehand. Notwithstanding the latest gain, the annual share price return of 6.5% isn't as impressive.

Maxnerva 技术服务有限公司 (HKG: 1037)的股价表现非常令人印象深刻,在之前的一段不稳定时期之后上涨了32%。尽管最近有所上涨,但6.5%的年股价回报率并不那么令人印象深刻。

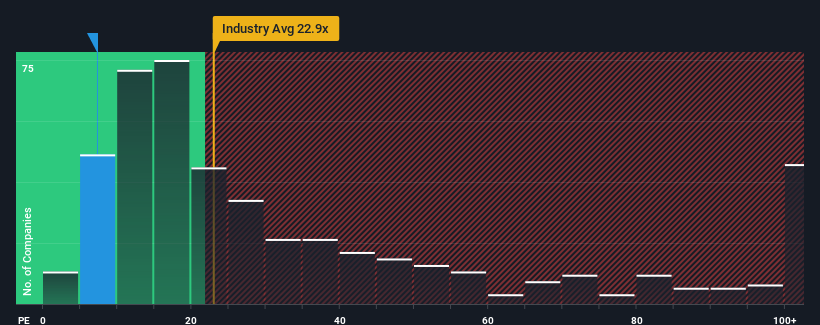

In spite of the firm bounce in price, Maxnerva Technology Services' price-to-earnings (or "P/E") ratio of 7.3x might still make it look like a buy right now compared to the market in Hong Kong, where around half of the companies have P/E ratios above 10x and even P/E's above 22x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

尽管该公司价格反弹,但与香港市场相比,Maxnerva Technology Services7.3倍的市盈率(或 “市盈率”)现在可能仍像买入。在香港,大约一半的公司的市盈率超过10倍,甚至市盈率超过22倍也很常见。但是,仅按面值计算市盈率是不明智的,因为可以解释为什么市盈率有限。

For example, consider that Maxnerva Technology Services' financial performance has been poor lately as its earnings have been in decline. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

例如,假设Maxnerva Technology Services最近的财务表现不佳,因为其收益一直在下降。许多人可能预计,令人失望的收益表现将持续或加速,这抑制了市盈率。但是,如果最终无法做到这一点,那么现有股东可能会对股价的未来走向感到乐观。

Check out our latest analysis for Maxnerva Technology Services

查看我们对 Maxnerva 技术服务的最新分析

Is There Any Growth For Maxnerva Technology Services?

Maxnerva 技术服务有增长吗?

There's an inherent assumption that a company should underperform the market for P/E ratios like Maxnerva Technology Services' to be considered reasonable.

人们固有的假设是,如果像Maxnerva Technology Services这样的市盈率被认为是合理的,那么一家公司的表现应该低于市场。

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 20%. Even so, admirably EPS has lifted 124% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

首先回顾一下,该公司去年的每股收益增长并不令人兴奋,因为该公司公布了令人失望的20%的下降。即便如此,令人钦佩的是,尽管在过去的12个月中,每股收益总共比三年前增长了124%。尽管这是一个坎坷的旅程,但可以公平地说,最近的收益增长对公司来说已经足够了。

Comparing that to the market, which is only predicted to deliver 24% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

相比之下,市场预计在未来12个月内仅实现24%的增长,根据最近的中期年化收益业绩,该公司的势头更加强劲。

With this information, we find it odd that Maxnerva Technology Services is trading at a P/E lower than the market. It looks like most investors are not convinced the company can maintain its recent growth rates.

有了这些信息,我们觉得奇怪的是,Maxnerva Technology Services的市盈率低于市场。看来大多数投资者并不相信该公司能够维持其最近的增长率。

The Key Takeaway

关键要点

The latest share price surge wasn't enough to lift Maxnerva Technology Services' P/E close to the market median. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

最近的股价上涨不足以使Maxnerva Technology Services的市盈率接近市场中位数。通常,我们倾向于将市盈率的使用限制在确定市场对公司整体健康状况的看法上。

We've established that Maxnerva Technology Services currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

我们已经确定,Maxnerva Technology Services目前的市盈率远低于预期,因为其最近三年的增长高于更广泛的市场预期。当我们看到强劲的收益和快于市场的增长时,我们认为潜在风险可能会给市盈率带来巨大压力。如果最近的中期收益趋势持续下去,至少价格风险看起来很低,但投资者似乎认为未来的收益可能会出现很大的波动。

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Maxnerva Technology Services, and understanding them should be part of your investment process.

始终需要考虑永远存在的投资风险幽灵。我们已经确定了 Maxnerva 技术服务有 3 个警告信号,理解它们应该是你投资过程的一部分。

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

如果你对市盈率感兴趣,你可能希望看到这个 免费的 其他盈利增长强劲且市盈率低的公司集合。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧? 取得联系 直接和我们联系。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St 的这篇文章本质上是一般性的。 我们仅使用不偏不倚的方法根据历史数据和分析师预测提供评论,我们的文章并非旨在提供财务建议。 它不构成买入或卖出任何股票的建议,也没有考虑您的目标或财务状况。我们的目标是为您提供由基本面数据驱动的长期重点分析。请注意,我们的分析可能未将最新的价格敏感型公司公告或定性材料考虑在内。简而言之,华尔街对上述任何股票都没有头寸。