If EPS Growth Is Important To You, XPEL (NASDAQ:XPEL) Presents An Opportunity

If EPS Growth Is Important To You, XPEL (NASDAQ:XPEL) Presents An Opportunity

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

投资者往往以发现“下一个大事件”为指导,即使这意味着在没有任何收入、更不用说利润的情况下买入“故事股”。但正如彼得·林奇在华尔街上的一位“远投几乎永远不会有回报。”亏损的公司总是在争分夺秒地实现财务可持续性,因此这些公司的投资者可能承担了比他们应该承担的更多的风险。

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in XPEL (NASDAQ:XPEL). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

如果这种公司不是你的风格,你喜欢能产生收入,甚至能赚钱的公司,那么你很可能会对XPEL(纳斯达克:XPEL)。虽然这并不一定意味着它是否被低估了,但该业务的盈利能力足以证明它有一定的升值价值--特别是如果它在增长的话。

View our latest analysis for XPEL

查看我们对XPEL的最新分析

How Quickly Is XPEL Increasing Earnings Per Share?

XPEL的每股收益增长速度有多快?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. Recognition must be given to the that XPEL has grown EPS by 52% per year, over the last three years. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

如果你相信市场是模糊有效的,那么从长期来看,你会认为一家公司的股价会跟随其每股收益(EPS)的结果。这意味着,大多数成功的长期投资者认为,每股收益的增长是一个真正的积极因素。必须承认,XPEL在过去三年中以每年52%的速度增长每股收益。这么快的增长可能是转瞬即逝的,但它应该足以激起警惕的选股者的兴趣。

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. EBIT margins for XPEL remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 33% to US$316m. That's a real positive.

仔细考虑收入增长和息税前利润(EBIT)利润率有助于了解最近利润增长的可持续性。XPEL的EBIT利润率与去年相比基本保持不变,但该公司应该很高兴地报告其收入增长33%至3.16亿美元。这是一个真正的积极因素。

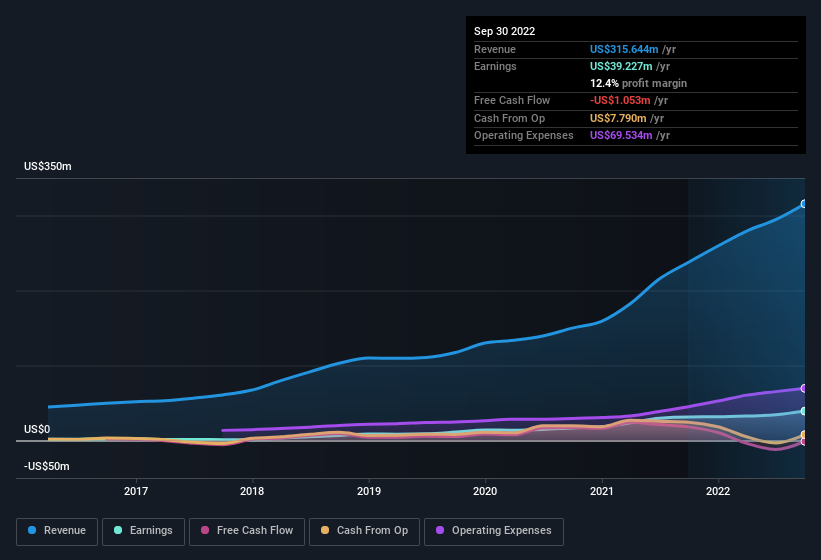

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

下面的图表显示了该公司的利润和收入是如何随着时间的推移而变化的。要查看实际数字,请点击图表。

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for XPEL's future profits.

你开车的时候眼睛不会盯着后视镜,所以你可能会对这个更感兴趣免费显示分析师对XPEL预测的报告未来利润。

Are XPEL Insiders Aligned With All Shareholders?

XPEL内部人员是否与所有股东一致?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. So it is good to see that XPEL insiders have a significant amount of capital invested in the stock. We note that their impressive stake in the company is worth US$593m. That equates to 27% of the company, making insiders powerful and aligned with other shareholders. Looking very optimistic for investors.

如果内部人士也持有一家公司的股票,这应该会给投资者带来一种安全感,使他们的利益紧密一致。因此,看到XPEL内部人士将大量资本投资于该股是件好事。我们注意到,他们在该公司令人印象深刻的股份价值5.93亿美元。这相当于公司27%的股份,这让内部人士变得强大,并与其他股东结盟。看起来对投资者来说非常乐观。

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. Well, based on the CEO pay, you'd argue that they are indeed. Our analysis has discovered that the median total compensation for the CEOs of companies like XPEL with market caps between US$1.0b and US$3.2b is about US$5.2m.

看到内部人士投资于这项业务意义重大,但股东们可能会想,薪酬政策是否符合他们的最佳利益。嗯,根据CEO的薪酬,你会说他们确实是这样的。我们的分析发现,像XPEL这样市值在10亿美元到32亿美元之间的公司的首席执行官的总薪酬中值约为520万美元。

XPEL's CEO took home a total compensation package of US$1.3m in the year prior to December 2021. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

在2021年12月之前的一年里,XPEL的首席执行官总共拿到了130万美元的薪酬。第一印象似乎表明了一种有利于股东的薪酬政策。CEO薪酬很难说是一家公司最重要的考虑因素,但当薪酬合理时,这会让人更有信心相信,领导层是在为股东利益着想。一般来说,可以认为合理的薪酬水平证明了良好的决策能力。

Should You Add XPEL To Your Watchlist?

您应该将XPEL添加到您的监视列表中吗?

XPEL's earnings per share have been soaring, with growth rates sky high. An added bonus for those interested is that management hold a heap of stock and the CEO pay is quite reasonable, illustrating good cash management. The drastic earnings growth indicates the business is going from strength to strength. Hopefully a trend that continues well into the future. XPEL certainly ticks a few boxes, so we think it's probably well worth further consideration. However, before you get too excited we've discovered 2 warning signs for XPEL (1 can't be ignored!) that you should be aware of.

XPEL的每股收益一直在飙升,增长率极高。对于那些感兴趣的人来说,一个额外的好处是,管理层持有大量股票,首席执行官的薪酬相当合理,这表明了良好的现金管理。盈利的大幅增长表明该业务正在变得越来越强大。希望这一趋势将持续到未来。XPEL当然有几个选择,所以我们认为它可能很值得进一步考虑。然而,在你过于兴奋之前,我们已经发现XPEL的2个警告标志(1不容忽视!)这一点你应该知道。

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

总是有可能做得很好,购买股票不是不断增长的收入和不要有内部人士购买股票。但对于那些考虑这些重要指标的人,我们建议您查看以下公司做拥有这些功能。你可以在这里访问它们的免费列表。

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

请注意,本文中讨论的内幕交易指的是相关司法管辖区内的应报告交易。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有什么反馈吗?担心内容吗? 保持联系直接与我们联系。或者,也可以给编辑组发电子邮件,地址是implywallst.com。

本文由Simply Wall St.撰写,具有概括性。我们仅使用不偏不倚的方法提供基于历史数据和分析师预测的评论,我们的文章并不打算作为财务建议。它不构成买卖任何股票的建议,也没有考虑你的目标或你的财务状况。我们的目标是为您带来由基本面数据驱动的长期重点分析。请注意,我们的分析可能不会将最新的对价格敏感的公司公告或定性材料考虑在内。Simply Wall St.对上述任何一只股票都没有持仓。