-

市场

-

产品

-

资讯

-

Moo社区

-

课堂

-

查看更多

-

功能介绍

-

费用费用透明,无最低余额限制

投资选择、功能介绍、费用相关信息由Moomoo Financial Inc.提供

- English

- 中文繁體

- 中文简体

- 深色

- 浅色

Here's Why We're Watching Stitch Fix's (NASDAQ:SFIX) Cash Burn Situation

Here's Why We're Watching Stitch Fix's (NASDAQ:SFIX) Cash Burn Situation

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

So should Stitch Fix (NASDAQ:SFIX) shareholders be worried about its cash burn? In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

Check out our latest analysis for Stitch Fix

When Might Stitch Fix Run Out Of Money?

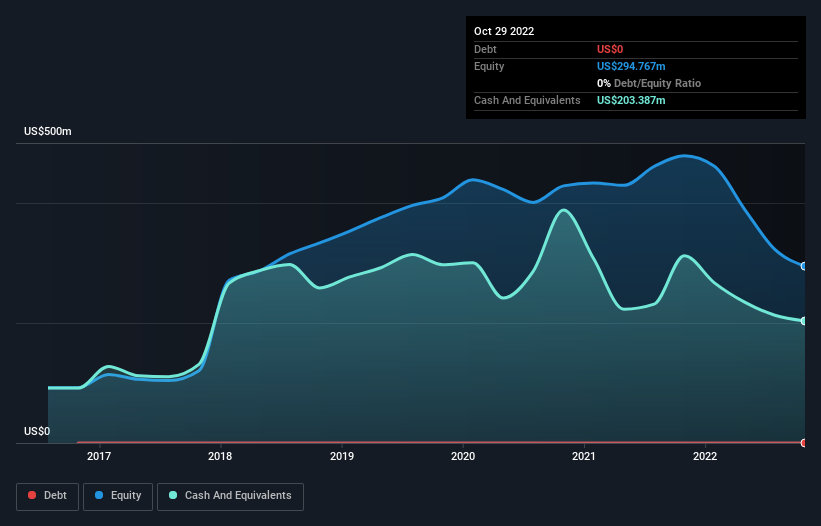

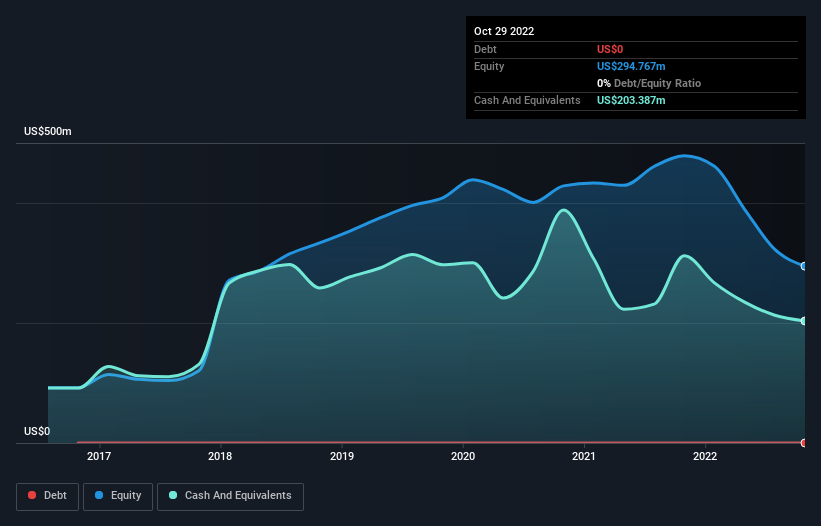

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. As at October 2022, Stitch Fix had cash of US$203m and no debt. Looking at the last year, the company burnt through US$132m. Therefore, from October 2022 it had roughly 18 months of cash runway. Importantly, analysts think that Stitch Fix will reach cashflow breakeven in 3 years. Essentially, that means the company will either reduce its cash burn, or else require more cash. The image below shows how its cash balance has been changing over the last few years.

Is Stitch Fix's Revenue Growing?

We're hesitant to extrapolate on the recent trend to assess its cash burn, because Stitch Fix actually had positive free cash flow last year, so operating revenue growth is probably our best bet to measure, right now. Regrettably, the company's operating revenue moved in the wrong direction over the last twelve months, declining by 11%. Clearly, however, the crucial factor is whether the company will grow its business going forward. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How Hard Would It Be For Stitch Fix To Raise More Cash For Growth?

Since its revenue growth is moving in the wrong direction, Stitch Fix shareholders may wish to think ahead to when the company may need to raise more cash. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Stitch Fix has a market capitalisation of US$577m and burnt through US$132m last year, which is 23% of the company's market value. That's not insignificant, and if the company had to sell enough shares to fund another year's growth at the current share price, you'd likely witness fairly costly dilution.

So, Should We Worry About Stitch Fix's Cash Burn?

On this analysis of Stitch Fix's cash burn, we think its cash runway was reassuring, while its falling revenue has us a bit worried. Shareholders can take heart from the fact that analysts are forecasting it will reach breakeven. Even though we don't think it has a problem with its cash burn, the analysis we've done in this article does suggest that shareholders should give some careful thought to the potential cost of raising more money in the future. An in-depth examination of risks revealed 2 warning signs for Stitch Fix that readers should think about before committing capital to this stock.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

毫无疑问,持有无利可图的企业的股票可以赚钱。例如,虽然亚马逊上市后多年亏损,但如果你从1999年开始买入并持有股票,你就会发大财。尽管如此,只有傻瓜才会忽视这样一个风险,即一家亏损的公司太快地烧掉了现金。

So should Stitch Fix (NASDAQ:SFIX) shareholders be worried about its cash burn? In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

所以也应该这样缝合修复(纳斯达克:SFIX)股东担心其烧钱?在本文中,我们将现金消耗定义为年度(负)自由现金流,即公司每年为实现增长而花费的资金数量。第一步是将它的现金消耗与其现金储备进行比较,给我们提供它的“现金跑道”。

Check out our latest analysis for Stitch Fix

查看我们对缝合修复的最新分析

When Might Stitch Fix Run Out Of Money?

Sstich Fix可能什么时候会用完钱?

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. As at October 2022, Stitch Fix had cash of US$203m and no debt. Looking at the last year, the company burnt through US$132m. Therefore, from October 2022 it had roughly 18 months of cash runway. Importantly, analysts think that Stitch Fix will reach cashflow breakeven in 3 years. Essentially, that means the company will either reduce its cash burn, or else require more cash. The image below shows how its cash balance has been changing over the last few years.

现金跑道的定义是,如果一家公司继续以目前的现金消耗速度支出,它需要多长时间才能耗尽资金。截至2022年10月,Sstich Fix拥有2.03亿美元的现金,没有债务。回顾去年,该公司烧掉了1.32亿美元。因此,从2022年10月开始,它有大约18个月的现金跑道。重要的是,分析人士认为,Sstich Fix将在3年内达到现金流盈亏平衡。从本质上说,这意味着该公司要么减少现金消耗,要么需要更多现金。下图显示了其现金余额在过去几年中的变化情况。

Is Stitch Fix's Revenue Growing?

Sstich Fix的收入在增长吗?

We're hesitant to extrapolate on the recent trend to assess its cash burn, because Stitch Fix actually had positive free cash flow last year, so operating revenue growth is probably our best bet to measure, right now. Regrettably, the company's operating revenue moved in the wrong direction over the last twelve months, declining by 11%. Clearly, however, the crucial factor is whether the company will grow its business going forward. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

我们不愿对最近的趋势进行推断,以评估其现金消耗,因为Sstich Fix去年实际上有正的自由现金流,所以运营收入增长可能是我们目前衡量的最佳选择。令人遗憾的是,该公司的营业收入在过去12个月里走向了错误的方向,下降了11%。然而,显然,关键因素是该公司是否会在未来实现业务增长。因此,看看我们的分析师对该公司的预测是很有意义的。

How Hard Would It Be For Stitch Fix To Raise More Cash For Growth?

Sstich Fix筹集更多现金以实现增长的难度有多大?

Since its revenue growth is moving in the wrong direction, Stitch Fix shareholders may wish to think ahead to when the company may need to raise more cash. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

由于其收入增长的方向是错误的,Sstich Fix的股东们可能希望提前考虑公司何时可能需要筹集更多现金。一般来说,上市企业可以通过发行股票或承担债务来筹集新的现金。公开上市公司的主要优势之一是,它们可以向投资者出售股票,以筹集现金和为增长提供资金。通过将一家公司的年度现金消耗与其总市值进行比较,我们可以粗略地估计出它需要发行多少股票才能维持公司下一年的运营(以相同的消耗速度)。

Stitch Fix has a market capitalisation of US$577m and burnt through US$132m last year, which is 23% of the company's market value. That's not insignificant, and if the company had to sell enough shares to fund another year's growth at the current share price, you'd likely witness fairly costly dilution.

Stitch Fix的市值为5.77亿美元,去年烧掉了1.32亿美元,占该公司市值的23%。这并不是无关紧要的,如果该公司不得不出售足够的股票,以在当前股价下为下一年的增长提供资金,你很可能会看到代价相当高昂的稀释。

So, Should We Worry About Stitch Fix's Cash Burn?

那么,我们应该担心Sstich Fix的烧钱吗?

On this analysis of Stitch Fix's cash burn, we think its cash runway was reassuring, while its falling revenue has us a bit worried. Shareholders can take heart from the fact that analysts are forecasting it will reach breakeven. Even though we don't think it has a problem with its cash burn, the analysis we've done in this article does suggest that shareholders should give some careful thought to the potential cost of raising more money in the future. An in-depth examination of risks revealed 2 warning signs for Stitch Fix that readers should think about before committing capital to this stock.

在对Sstich Fix烧钱的分析中,我们认为它的现金跑道令人放心,而它不断下降的收入让我们有点担心。分析师预测股价将达到盈亏平衡,这让股东们感到振奋。尽管我们认为它的现金消耗没有问题,但我们在本文中所做的分析确实表明,股东们应该仔细考虑未来筹集更多资金的潜在成本。对暴露出的风险进行深入检查2个缝合固定的警告标志读者在向这只股票注资之前应该考虑一下。

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

如果你更愿意看看另一家基本面更好的公司,那么不要错过这一预期免费有趣的公司名单,拥有高股本回报率和低债务的公司,或者这些预计都将增长的股票名单。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有什么反馈吗?担心内容吗? 保持联系直接与我们联系。或者,也可以给编辑组发电子邮件,地址是implywallst.com。

本文由Simply Wall St.撰写,具有概括性。我们仅使用不偏不倚的方法提供基于历史数据和分析师预测的评论,我们的文章并不打算作为财务建议。它不构成买卖任何股票的建议,也没有考虑你的目标或你的财务状况。我们的目标是为您带来由基本面数据驱动的长期重点分析。请注意,我们的分析可能不会将最新的对价格敏感的公司公告或定性材料考虑在内。Simply Wall St.对上述任何一只股票都没有持仓。

moomoo是Moomoo Technologies Inc.公司提供的金融信息和交易应用程序。

在美国,moomoo上的投资产品和服务由Moomoo Financial Inc.提供,一家受美国证券交易委员会(SEC)监管的持牌主体。 Moomoo Financial Inc.是金融业监管局(FINRA)和证券投资者保护公司(SIPC)的成员。

在新加坡,moomoo上的投资产品和服务是通过Moomoo Financial Singapore Pte. Ltd.提供,该公司受新加坡金融管理局(MAS)监管(牌照号码︰CMS101000) ,持有资本市场服务牌照 (CMS) ,持有财务顾问豁免(Exempt Financial Adviser)资质。本内容未经新加坡金融管理局的审查。

在澳大利亚,moomoo上的金融产品和服务是通过Futu Securities (Australia) Ltd提供,该公司是受澳大利亚证券和投资委员会(ASIC)监管的澳大利亚金融服务许可机构(AFSL No. 224663)。请阅读并理解我们的《金融服务指南》、《条款与条件》、《隐私政策》和其他披露文件,这些文件可在我们的网站 https://www.moomoo.com/au中获取。

在加拿大,通过moomoo应用提供的仅限订单执行的券商服务由Moomoo Financial Canada Inc.提供,并受加拿大投资监管机构(CIRO)监管。

在马来西亚,moomoo上的投资产品和服务是通过Moomoo Securities Malaysia Sdn. Bhd. 提供,该公司受马来西亚证券监督委员会(SC)监管(牌照号码︰eCMSL/A0397/2024) ,持有资本市场服务牌照 (CMSL) 。本内容未经马来西亚证券监督委员会的审查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd., Futu Securities (Australia) Ltd, Moomoo Financial Canada Inc.,和Moomoo Securities Malaysia Sdn. Bhd.是关联公司。

风险及免责提示

moomoo是Moomoo Technologies Inc.公司提供的金融信息和交易应用程序。

在美国,moomoo上的投资产品和服务由Moomoo Financial Inc.提供,一家受美国证券交易委员会(SEC)监管的持牌主体。 Moomoo Financial Inc.是金融业监管局(FINRA)和证券投资者保护公司(SIPC)的成员。

在新加坡,moomoo上的投资产品和服务是通过Moomoo Financial Singapore Pte. Ltd.提供,该公司受新加坡金融管理局(MAS)监管(牌照号码︰CMS101000) ,持有资本市场服务牌照 (CMS) ,持有财务顾问豁免(Exempt Financial Adviser)资质。本内容未经新加坡金融管理局的审查。

在澳大利亚,moomoo上的金融产品和服务是通过Futu Securities (Australia) Ltd提供,该公司是受澳大利亚证券和投资委员会(ASIC)监管的澳大利亚金融服务许可机构(AFSL No. 224663)。请阅读并理解我们的《金融服务指南》、《条款与条件》、《隐私政策》和其他披露文件,这些文件可在我们的网站 https://www.moomoo.com/au中获取。

在加拿大,通过moomoo应用提供的仅限订单执行的券商服务由Moomoo Financial Canada Inc.提供,并受加拿大投资监管机构(CIRO)监管。

在马来西亚,moomoo上的投资产品和服务是通过Moomoo Securities Malaysia Sdn. Bhd. 提供,该公司受马来西亚证券监督委员会(SC)监管(牌照号码︰eCMSL/A0397/2024) ,持有资本市场服务牌照 (CMSL) 。本内容未经马来西亚证券监督委员会的审查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd., Futu Securities (Australia) Ltd, Moomoo Financial Canada Inc.,和Moomoo Securities Malaysia Sdn. Bhd.是关联公司。

- 分享到weixin

- 分享到qq

- 分享到facebook

- 分享到twitter

- 分享到微博

- 粘贴板

使用浏览器的分享功能,分享给你的好友吧