-

市场

-

产品

-

资讯

-

Moo社区

-

课堂

-

查看更多

-

功能介绍

-

费用费用透明,无最低余额限制

投资选择、功能介绍、费用相关信息由Moomoo Financial Inc.提供

- English

- 中文繁體

- 中文简体

- 深色

- 浅色

Despite Delivering Investors Losses of 33% Over the Past 5 Years, CITIC Resources Holdings (HKG:1205) Has Been Growing Its Earnings

Despite Delivering Investors Losses of 33% Over the Past 5 Years, CITIC Resources Holdings (HKG:1205) Has Been Growing Its Earnings

While it may not be enough for some shareholders, we think it is good to see the CITIC Resources Holdings Limited (HKG:1205) share price up 26% in a single quarter. But if you look at the last five years the returns have not been good. You would have done a lot better buying an index fund, since the stock has dropped 43% in that half decade.

On a more encouraging note the company has added HK$432m to its market cap in just the last 7 days, so let's see if we can determine what's driven the five-year loss for shareholders.

See our latest analysis for CITIC Resources Holdings

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the unfortunate half decade during which the share price slipped, CITIC Resources Holdings actually saw its earnings per share (EPS) improve by 29% per year. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Or possibly, the market was previously very optimistic, so the stock has disappointed, despite improving EPS.

Due to the lack of correlation between the EPS growth and the falling share price, it's worth taking a look at other metrics to try to understand the share price movement.

We note that the dividend has remained healthy, so that wouldn't really explain the share price drop. It's not immediately clear to us why the stock price is down but further research might provide some answers.

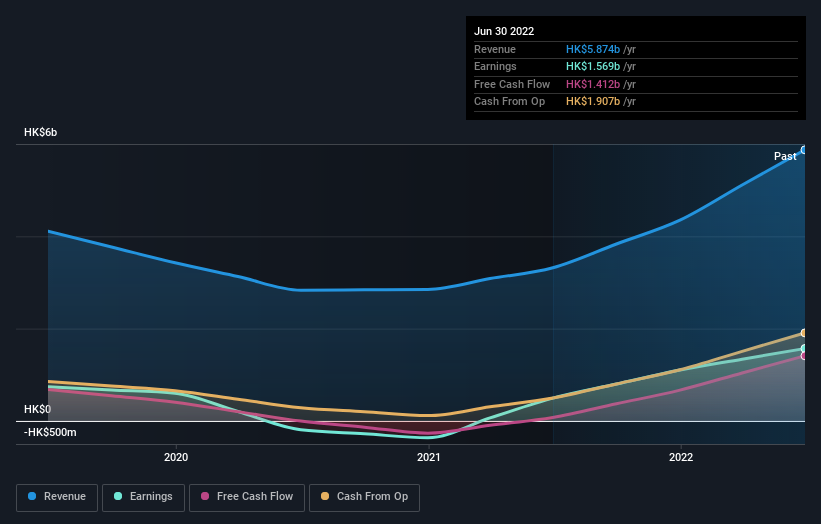

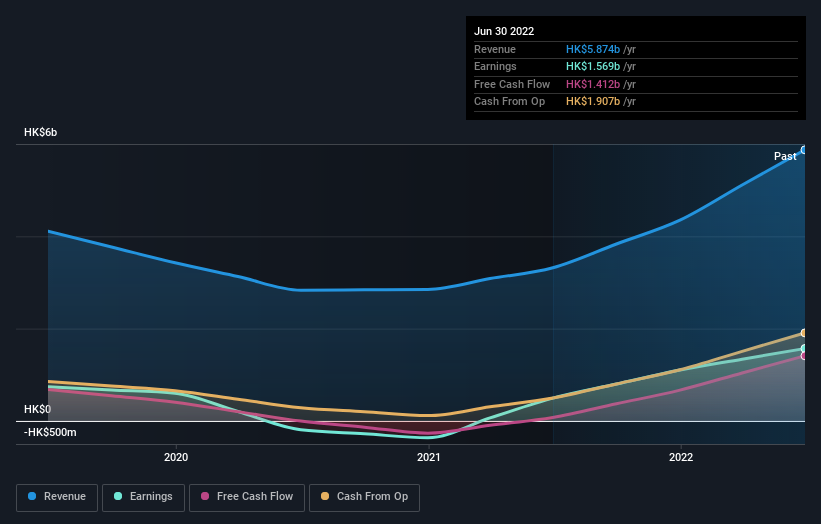

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at CITIC Resources Holdings' financial health with this free report on its balance sheet.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for CITIC Resources Holdings the TSR over the last 5 years was -33%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We're pleased to report that CITIC Resources Holdings shareholders have received a total shareholder return of 7.3% over one year. That's including the dividend. There's no doubt those recent returns are much better than the TSR loss of 6% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 1 warning sign for CITIC Resources Holdings that you should be aware of before investing here.

Of course CITIC Resources Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

While it may not be enough for some shareholders, we think it is good to see the CITIC Resources Holdings Limited (HKG:1205) share price up 26% in a single quarter. But if you look at the last five years the returns have not been good. You would have done a lot better buying an index fund, since the stock has dropped 43% in that half decade.

虽然这对一些股东来说可能还不够,但我们认为看到中信股份资源控股有限公司(HKG:1205)股价单季上涨26%。但如果你看看过去五年,你会发现回报并不好。购买指数基金会好得多,因为指数基金的股价在这五年里下跌了43%。

On a more encouraging note the company has added HK$432m to its market cap in just the last 7 days, so let's see if we can determine what's driven the five-year loss for shareholders.

更令人鼓舞的是,仅在过去的7天里,该公司的市值就增加了4.32亿港元,所以让我们看看我们能否确定是什么导致了股东五年来的亏损。

See our latest analysis for CITIC Resources Holdings

查看我们对中信股份资源控股的最新分析

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

用巴菲特的话说,“船只将在世界各地航行,但平坦的地球协会将蓬勃发展。市场上的价格和价值之间将继续存在巨大的差异……”一种不完美但简单的方法来考虑市场对一家公司的看法是如何改变的,那就是将每股收益(EPS)的变化与股价走势进行比较。

During the unfortunate half decade during which the share price slipped, CITIC Resources Holdings actually saw its earnings per share (EPS) improve by 29% per year. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Or possibly, the market was previously very optimistic, so the stock has disappointed, despite improving EPS.

不幸的是,在股价下滑的五年里,中信股份资源控股的每股收益(EPS)实际上以每年29%的速度增长。考虑到股价的反应,人们可能会怀疑,每股收益不是这段时间内业务表现的良好指南(可能是因为一次性的亏损或收益)。也有可能,此前市场非常乐观,因此尽管每股收益有所改善,但该股仍令人失望。

Due to the lack of correlation between the EPS growth and the falling share price, it's worth taking a look at other metrics to try to understand the share price movement.

由于每股收益增长和股价下跌之间缺乏相关性,因此有必要看看其他指标,试图了解股价走势。

We note that the dividend has remained healthy, so that wouldn't really explain the share price drop. It's not immediately clear to us why the stock price is down but further research might provide some answers.

我们注意到,股息一直保持健康,因此这并不能真正解释股价下跌的原因。我们目前还不清楚为什么股价会下跌,但进一步的研究可能会提供一些答案。

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

下图描述了收益和收入随时间的变化(通过单击图像来揭示确切的价值)。

Take a more thorough look at CITIC Resources Holdings' financial health with this free report on its balance sheet.

更透彻地看待中信股份资源控股的财务健康状况免费报告其资产负债表。

What About Dividends?

那股息呢?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for CITIC Resources Holdings the TSR over the last 5 years was -33%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

在考察投资回报时,重要的是要考虑到股东总回报(TSR)和股价回报。TSR包括任何剥离或贴现融资的价值,以及任何股息,基于股息再投资的假设。公平地说,TSR为支付股息的股票提供了更完整的图景。我们注意到,对于中信股份资源控股而言,过去5年的TSR为-33%,好于上述股价回报。而且,猜测股息支付在很大程度上解释了这种差异是没有好处的!

A Different Perspective

不同的视角

We're pleased to report that CITIC Resources Holdings shareholders have received a total shareholder return of 7.3% over one year. That's including the dividend. There's no doubt those recent returns are much better than the TSR loss of 6% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 1 warning sign for CITIC Resources Holdings that you should be aware of before investing here.

我们很高兴地报告,中信股份资源控股的股东在一年内获得了7.3%的总股东回报。这还包括股息。毫无疑问,最近的回报率远远好于TSR在过去五年中每年6%的损失。长期的亏损让我们保持谨慎,但短期的TSR收益肯定暗示着更光明的未来。我发现,把股价作为衡量企业业绩的长期指标是非常有趣的。但为了真正获得洞察力,我们还需要考虑其他信息。例如,我们发现中信股份资源控股公司的1个警告标志在这里投资之前你应该意识到这一点。

Of course CITIC Resources Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

当然了中信股份资源控股可能不是最值得买入的股票。所以你可能想看看这个免费成长型股票的集合。

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

请注意,本文引用的市场回报反映了目前在香港交易所交易的股票的市场加权平均回报。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有什么反馈吗?担心内容吗? 保持联系直接与我们联系。或者,也可以给编辑组发电子邮件,地址是implywallst.com。

本文由Simply Wall St.撰写,具有概括性。我们仅使用不偏不倚的方法提供基于历史数据和分析师预测的评论,我们的文章并不打算作为财务建议。它不构成买卖任何股票的建议,也没有考虑你的目标或你的财务状况。我们的目标是为您带来由基本面数据驱动的长期重点分析。请注意,我们的分析可能不会将最新的对价格敏感的公司公告或定性材料考虑在内。Simply Wall St.对上述任何一只股票都没有持仓。

moomoo是Moomoo Technologies Inc.公司提供的金融信息和交易应用程序。

在美国,moomoo上的投资产品和服务由Moomoo Financial Inc.提供,一家受美国证券交易委员会(SEC)监管的持牌主体。 Moomoo Financial Inc.是金融业监管局(FINRA)和证券投资者保护公司(SIPC)的成员。

在新加坡,moomoo上的投资产品和服务是通过Moomoo Financial Singapore Pte. Ltd.提供,该公司受新加坡金融管理局(MAS)监管(牌照号码︰CMS101000) ,持有资本市场服务牌照 (CMS) ,持有财务顾问豁免(Exempt Financial Adviser)资质。本内容未经新加坡金融管理局的审查。

在澳大利亚,moomoo上的金融产品和服务是通过Futu Securities (Australia) Ltd提供,该公司是受澳大利亚证券和投资委员会(ASIC)监管的澳大利亚金融服务许可机构(AFSL No. 224663)。请阅读并理解我们的《金融服务指南》、《条款与条件》、《隐私政策》和其他披露文件,这些文件可在我们的网站 https://www.moomoo.com/au中获取。

在加拿大,通过moomoo应用提供的仅限订单执行的券商服务由Moomoo Financial Canada Inc.提供,并受加拿大投资监管机构(CIRO)监管。

在马来西亚,moomoo上的投资产品和服务是通过Moomoo Securities Malaysia Sdn. Bhd. 提供,该公司受马来西亚证券监督委员会(SC)监管(牌照号码︰eCMSL/A0397/2024) ,持有资本市场服务牌照 (CMSL) 。本内容未经马来西亚证券监督委员会的审查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd., Futu Securities (Australia) Ltd, Moomoo Financial Canada Inc.,和Moomoo Securities Malaysia Sdn. Bhd.是关联公司。

风险及免责提示

moomoo是Moomoo Technologies Inc.公司提供的金融信息和交易应用程序。

在美国,moomoo上的投资产品和服务由Moomoo Financial Inc.提供,一家受美国证券交易委员会(SEC)监管的持牌主体。 Moomoo Financial Inc.是金融业监管局(FINRA)和证券投资者保护公司(SIPC)的成员。

在新加坡,moomoo上的投资产品和服务是通过Moomoo Financial Singapore Pte. Ltd.提供,该公司受新加坡金融管理局(MAS)监管(牌照号码︰CMS101000) ,持有资本市场服务牌照 (CMS) ,持有财务顾问豁免(Exempt Financial Adviser)资质。本内容未经新加坡金融管理局的审查。

在澳大利亚,moomoo上的金融产品和服务是通过Futu Securities (Australia) Ltd提供,该公司是受澳大利亚证券和投资委员会(ASIC)监管的澳大利亚金融服务许可机构(AFSL No. 224663)。请阅读并理解我们的《金融服务指南》、《条款与条件》、《隐私政策》和其他披露文件,这些文件可在我们的网站 https://www.moomoo.com/au中获取。

在加拿大,通过moomoo应用提供的仅限订单执行的券商服务由Moomoo Financial Canada Inc.提供,并受加拿大投资监管机构(CIRO)监管。

在马来西亚,moomoo上的投资产品和服务是通过Moomoo Securities Malaysia Sdn. Bhd. 提供,该公司受马来西亚证券监督委员会(SC)监管(牌照号码︰eCMSL/A0397/2024) ,持有资本市场服务牌照 (CMSL) 。本内容未经马来西亚证券监督委员会的审查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd., Futu Securities (Australia) Ltd, Moomoo Financial Canada Inc.,和Moomoo Securities Malaysia Sdn. Bhd.是关联公司。

- 分享到weixin

- 分享到qq

- 分享到facebook

- 分享到twitter

- 分享到微博

- 粘贴板

使用浏览器的分享功能,分享给你的好友吧