Here's How Much Stock Qualcomm Repurchased in the Past Year

Tech giant Qualcomm (NASDAQ: QCOM) makes leading modem chips for smartphones and owns the key patents in cellular technology. Qualcomm has also recently invested in new growth markets such as automotive and Internet of Things chips.

As a large technology blue chip stock, Qualcomm has also been a regular repurchaser of its own stock. But how effective have these repurchases really been?

$2.05 billion, but there's a catch

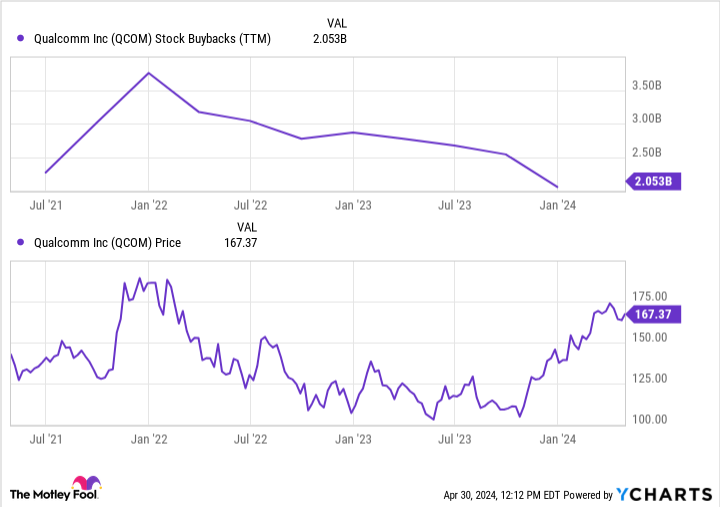

Qualcomm typically repurchases its stock in a consistent manner, buying back $2.05 billion over the past 12 months. Those buybacks also look well timed. Over the past 12 months, Qualcomm's stock is up 45%. So, those share repurchases look smart in the sense that Qualcomm bought back shares while they were undervalued.

However, Qualcomm's repurchases haven't been as exciting as at first glance.

First, Qualcomm's buyback history reveals a flaw many big companies make. Back when the smartphone market was booming in 2021, at the end of the pandemic, Qualcomm repurchased even more stock but at higher prices. Even though Qualcomm continued repurchasing stock when its earnings and stock fell, it wasn't as much because it had lower earnings at that time.

Ideally, companies would save cash when times are good so that they have more firepower to buy shares when times get tough. But it appears Qualcomm is merely returning whatever it makes regardless of stock price, choosing not to anticipate the inevitable cycles of the semiconductor industry.

Shares have actually increased!

Moreover, Qualcomm's overall share count hasn't fallen over the past year but actually increased by about 1,000 shares, from 1,115 million to 1,116 million.

How can that be? Well, Qualcomm issues generous executive and employee stock-based compensation that nearly totaled as much as Qualcomm's stock repurchase. Moreover, Qualcomm has a program whereby employees can purchase stock. While Qualcomm receives cash from employee purchases, its share count still increases when that happens.

So, overall, Qualcomm's repurchases have effectively offset dilution to employees but really haven't materially lowered the company's share count for the past four years or so.

Should you invest $1,000 in Qualcomm right now?

Before you buy stock in Qualcomm, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Qualcomm wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $537,692!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 30, 2024

Billy Duberstein has no position in any of the stocks mentioned. His clients may own shares of the companies mentioned. The Motley Fool has positions in and recommends Qualcomm. The Motley Fool has a disclosure policy.

Here's How Much Stock Qualcomm Repurchased in the Past Year was originally published by The Motley Fool