ArcBest misses mark in Q1

ArcBest missed first-quarter expectations on Tuesday, reporting a net loss of $2.9 million, or 12 cents per share. The unadjusted result included a $21.6 million charge from the closure of a tech company it was backing.

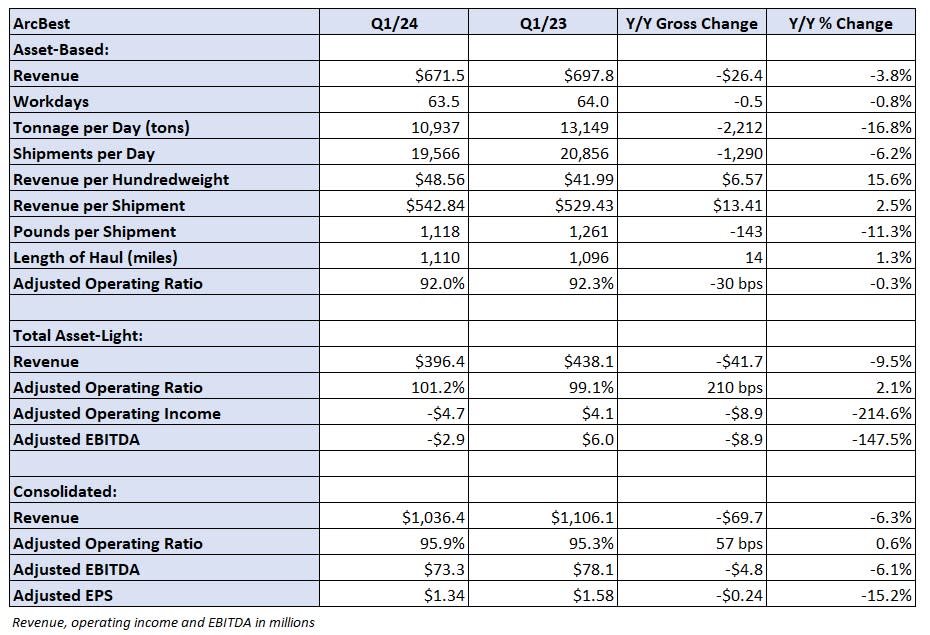

After adjusting for several items the company considers nonrecurring (various technology costs including a freight handling pilot, acquisition-related expenses and a write off of an equity investment) it reported adjusted earnings per share of $1.34, which was 19 cents worse than the consensus estimate and 24 cents lower year over year (y/y).

The write-off was related to ArcBest’s $25 million investment in Phantom Auto, a software company enabling the remote operation of forklifts, robots and yard trucks. Phantom Auto ceased operations during the first quarter.

Click for full report – “Change in freight mix continues to weigh on ArcBest’s volumes”

ArcBest’s (NASDAQ: ARCB) asset-based segment, which includes less-than-truckload operations, reported a 4% y/y decline in revenue to $672 million. Tonnage per day was down 17% y/y, which was mostly offset by a 16% increase in revenue per hundredweight, or yield.

The tonnage decline was the combination of a 6% decline in daily shipments and an 11% decline in weight per shipment.

The volume reduction was tied to the carrier’s shift away from a dynamic pricing strategy, which captures more loads from transactional customers to keep the network full, to a mix favoring better-priced contractual freight from core customers. Rate increases on its spot business resulted in a volume decline among the company’s noncore accounts. Also, severe storms in January resulted in 130 terminal closures compared to a 10-year average of 57, the company said on its fourth-quarter call in February.

Shipments from core accounts increased 12% y/y and tonnage was up 9% in the quarter.

A large decline in weight per shipment favorably impacted the yield metric but the metric includes fuel surcharges and diesel prices were down 9% y/y in the quarter. Pricing on contract renewals and deferred agreements was up 5.3% y/y in the period, following a 5.6% increase in the fourth quarter.

So far in April, revenue per day is down 4% y/y. Tonnage is down 22% but yield is up 24%. Shipments from core customers are up 13% and tonnage is 9% higher.

The LTL segment posted a 92% adjusted operating ratio, which was 30 basis points better y/y but 430 bps worse than the fourth quarter. Salaries, wages and benefits as a percentage of revenue increased 330 bps, mostly due to the new labor contract with its union workforce.

The asset-light unit, which includes truck brokerage, reported a $15.3 million operating loss (a $4.7 million loss when excluding acquisition-related items). Revenue was down 10% y/y to $396 million as managed transportation shipments per day increased 14%, offset by a 20% decline in revenue per shipment.

ArcBest will host a call on Tuesday at 9:30 a.m. EDT to discuss first-quarter results.

Click for full report – “Change in freight mix continues to weigh on ArcBest’s volumes”

More FreightWaves articles by Todd Maiden

The post ArcBest misses mark in Q1 appeared first on FreightWaves.