Arch Resources Inc. (ARCH) Q1 2024 Earnings: Misses EPS Estimates, Declines in Revenue and Net ...

Net Income: Reported at $56.0 million, falling short of the estimated $64.79 million.

Earnings Per Share (EPS): Achieved $2.98, below the estimated $3.49.

Revenue: Totaled $680.2 million, surpassing the estimated $596.59 million.

Dividend: Declared a quarterly cash dividend of $20.7 million, or $1.11 per share.

Share Repurchases: Reduced diluted share count by an incremental 3% during the quarter.

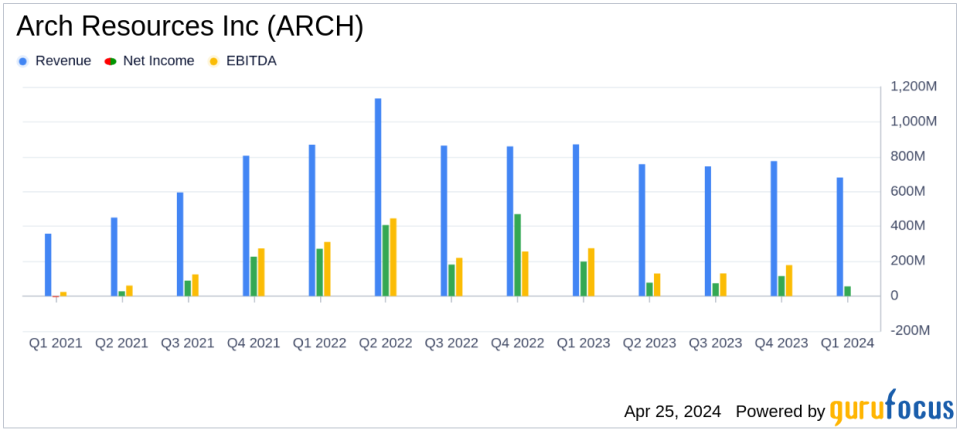

Adjusted EBITDA: Recorded at $102.9 million, compared to $277.3 million in the same quarter the previous year.

Capital Return Program: Continued with a total deployment of more than $1.3 billion since February 2022, emphasizing share buybacks.

Arch Resources Inc (NYSE:ARCH) released its 8-K filing on April 25, 2024, reporting a challenging first quarter with significant declines in revenue and net income compared to the previous year. The company, a leading producer of metallurgical and coking coal, faced a weaker pricing environment and logistical disruptions, impacting its overall performance.

Fiscal Summary and Comparison with Analyst Estimates

For Q1 2024, Arch Resources reported net income of $56.0 million, or $2.98 per diluted share, falling short of the analyst's estimated earnings per share of $3.49. This represents a significant decrease from the $198.1 million, or $10.02 per diluted share, recorded in the same period last year. Revenue also declined to $680.2 million from $869.9 million year-over-year, yet surpassed the estimated revenue of $596.59 million. Adjusted EBITDA was reported at $102.9 million, a decrease from $277.3 million in Q1 2023.

Operational Challenges and Strategic Adjustments

CEO Paul A. Lang highlighted the operational challenges faced by the company, including a weaker pricing environment for metallurgical coal and logistical issues that affected shipping and productivity. The company's thermal segment experienced a break-even performance due to cooling domestic demand and a significant reduction in U.S. thermal coal production. Despite these challenges, Arch Resources continues to focus on aligning production with market demands and improving its cost structure.

Financial and Operational Highlights

The metallurgical segment, despite facing lower productivity and unfavorable geological conditions, managed a first-quartile cost performance with a $56 per-ton cash margin. The segment sold 2.2 million tons of coal, with sales per ton at $149.98, down from $204.25 in Q1 2023. The thermal segment, on the other hand, broke even, selling 12.8 million tons at $17.60 per ton, slightly down from $18.49 per ton in the prior year.

Capital Return and Shareholder Value Enhancement

Arch Resources declared a quarterly cash dividend of $20.7 million, or $1.11 per share, and continued its share repurchase program, emphasizing its commitment to returning value to shareholders. The company retired an additional 3 percent of its diluted share count during the quarter, demonstrating its focus on enhancing shareholder value through capital return initiatives.

Market and Future Outlook

Looking forward, Arch Resources expects to navigate through the current market challenges with strategic adjustments and operational improvements. The company remains optimistic about the long-term fundamentals of the metallurgical coal market, despite near-term pressures. Management is focused on maintaining robust capital returns and driving continuous operational improvements.

Conclusion

Arch Resources Inc. faces a challenging market environment but is taking strategic steps to align its operations with current market conditions and improve its financial performance. The company's commitment to returning capital to shareholders remains strong, as evidenced by its ongoing dividend payments and share repurchases. Investors and stakeholders will be watching closely to see how the company's adjustments will translate into performance improvements in the upcoming quarters.

Explore the complete 8-K earnings release (here) from Arch Resources Inc for further details.

This article first appeared on GuruFocus.