Upstart Holdings: Buy, Sell, or Hold?

Upstart (NASDAQ: UPST) has taken shareholders for a roller coaster ride since going public in 2020. The company started with a bang, and the stock climbed to $355 per share at one point. However, high interest rates and low demand for its loans weighed on the company.

Last year, things showed signs of turning around, but it continued to see slower demand for its loans compared to pandemic levels. Upstart's artificial intelligence (AI) lending models have the potential to upend consumer finance as we know it, but there are several things to consider before investing in this stock.

Upstart's mission to change consumer finance

Upstart's founders believe that traditional credit scoring systems, like Fair Isaac's FICO® scoring system, fail to accurately identify risk and therefore prevent otherwise worthy people from borrowing. Its mission is to upend this legacy scoring system and make lending accessible to more individuals through its AI-powered lending models.

Upstart's lending models rely on 1,600 variables over 58 million repayment events to measure and assess risk. These models approve more loans at lower interest rates for its borrowers. Because of its models, most of Upstart's business is highly automated. Last year, 87% of the lender's loans were fully automated from end to end.

If Upstart can crack the code to make finance available to more borrowers, achieve lower default rates, and automate most of the process, its upside potential is tremendous. However, the business faces big question marks.

Reasons to sell Upstart

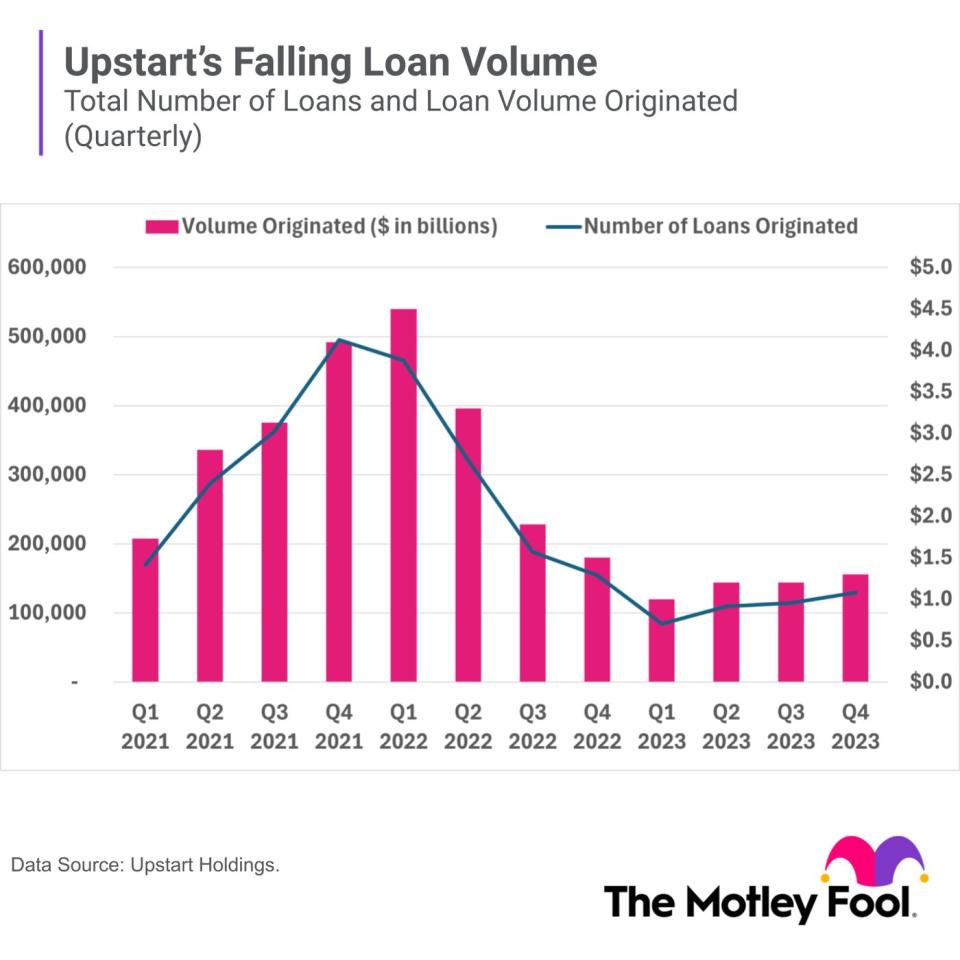

In 2021, the consumer lender made 1.3 million loans worth $11.8 billion. However, rising rates have been a drag on the lender, which has seen loan volume plummet over the past two years. After a strong start in 2022, loans originations really began to drop off. Last year, Upstart made 437,000 loans worth $4.7 billion.

Lackluster demand for Upstart's loans has weighed heavily on the business. For one, the high interest rate environment has meant less customer demand for loans. On top of that, institutional demand to buy up its loans dipped a couple of years back, and the company was forced to hold more loans on its books, which was not well-received by investors.

Last year, Upstart forged multiple partnerships with alternative asset managers and banks to buy its loans, which boosted the stock. However, it still has problems with tepid demand -- which means falling revenue and net income.

In addition, people are struggling as credit card debt piles up. Consumer credit card debt is $1.13 trillion, and delinquencies on credit card loans continue to rise. This could be a sign that people are feeling the pinch. Upstart's lending models will face their first big test if consumers continue to weaken enough to tip the economy into recession. While its models have performed well thus far, the company's models still need to withstand the test of time across various economic cycles, which will take time to play out.

Investors unwilling to deal with that uncertainty will likely want to sell the stock and invest in something with less risk.

Reasons to buy or hold Upstart

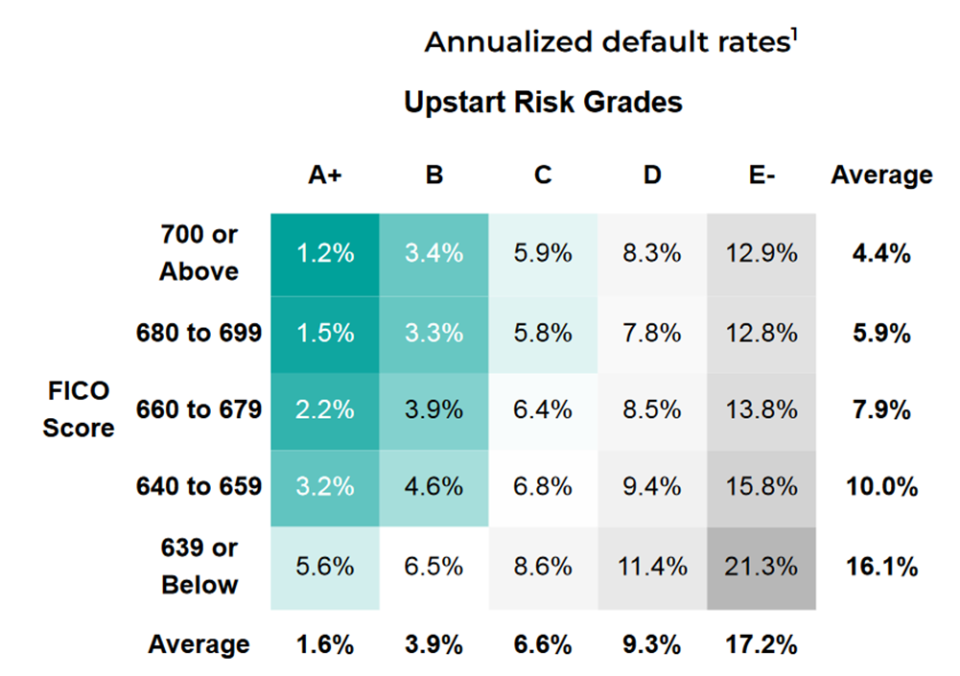

Upstart's lending models continue to perform well. The company presented its annualized default rates and showed that its models outperform the traditional FICO scoring model. The chart can be interpreted in many ways, but one important takeaway is that Upstart's models seem to assess risk better than the traditional scoring system.

As long as Upstart's models continue to perform across various points in the credit cycle, it should continue to garner interest from partners looking to buy its loans. Not only that, but its highly automated lending business also provides it with an opportunity to generate healthy margins and scale up as demand increases.

Patient investors willing to withstand some uncertainty about Upstart's future may find the stock appealing. The stock is reasonably priced relative to its recent history, at 3.9 times its sales and 3.5 times this year's projected sales.

Buy, sell, or hold Upstart?

Upstart stock has taken shareholders on a wild ride, and the stock is down 68% from its 52-week high. Although the broader market has rallied in 2024, Upstart has failed to keep pace, perhaps due to concerns about slowing loan demand, consumer health, and how its models perform going forward.

Despite this, I think Upstart is an intriguing stock to own at today's prices, as long as you have a long time horizon and are willing to tolerate the risks along the way as its growth story plays out.

Should you invest $1,000 in Upstart right now?

Before you buy stock in Upstart, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Upstart wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $537,557!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 22, 2024

Courtney Carlsen has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Upstart. The Motley Fool has a disclosure policy.

Upstart Holdings: Buy, Sell, or Hold? was originally published by The Motley Fool