Selective Insurance Group Inc. (SIGI) Q1 2024 Earnings: Misses on EPS, Reports Strong Revenue Growth

Net Income per Diluted Common Share: Reported at $1.31, falling below the estimated $1.86.

Net Premiums Written: Increased by 16% year-over-year to $1,156.6 million, indicating strong top-line growth.

GAAP Combined Ratio: Deteriorated to 98.2% from 95.7% a year ago, reflecting increased claims and expenses.

After-tax Net Investment Income: Rose by 17% to $86 million, surpassing the previous year's figure and contributing positively to the bottom line.

Book Value per Common Share: Increased by 2% sequentially to $46.17, showing a modest improvement in shareholder equity value.

Commercial Lines: Renewal pure price increases averaged 7.6%, indicating effective pricing strategies in a competitive market.

Non-GAAP Operating Income per Diluted Common Share: Reported at $1.33, also falling below the estimated earnings per share of $1.86.

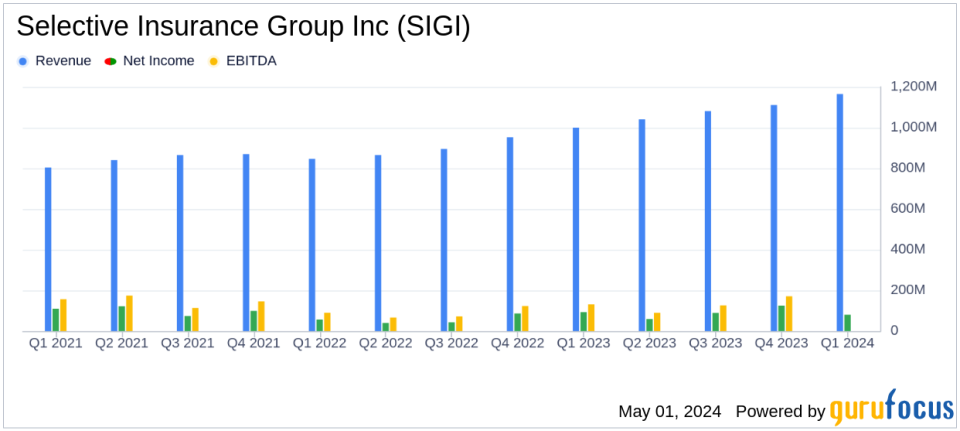

Selective Insurance Group Inc (NASDAQ:SIGI) released its 8-K filing on May 1, 2024, detailing its financial performance for the first quarter of 2024. The company reported a net income per diluted common share of $1.31, falling short of the estimated earnings per share of $1.86. Despite this, SIGI demonstrated robust revenue growth, with total revenues reaching $1,165.0 million, surpassing the estimated $1,121.48 million.

Selective Insurance Group Inc, a regional property-casualty insurer based in New Jersey, focuses primarily on the New York metropolitan area. Since its establishment in 1977, the company has concentrated on small businesses, providing commercial products such as workers' compensation, general liability, property, and auto insurance. It also maintains a smaller personal insurance segment.

Financial Performance and Challenges

In Q1 2024, SIGI reported a 16% increase in net premiums written, totaling $1,156.6 million. The company's after-tax net investment income also saw a significant rise of 17%, amounting to $86 million. However, the period was not without its challenges. The GAAP combined ratio deteriorated to 98.2% from 95.7% in the first quarter of 2023, influenced by unfavorable prior year casualty reserve development and higher catastrophe losses.

John J. Marchioni, Chairman, President, and CEO of Selective, commented on the quarter's outcomes, emphasizing the company's disciplined approach to underwriting and risk management. He noted, "Our organization is committed to disciplined underwriting and enterprise risk management. Our detailed planning and reserving, specific underwriting and pricing actions, and results monitoring process allow us to quickly identify and respond to risks, opportunities, and trends."

Segment Performance and Strategic Initiatives

The Standard Commercial Lines, representing 80% of total NPW, grew by 15% compared to the previous year. However, the segment's combined ratio worsened, primarily due to prior year casualty reserve development. On the other hand, the Standard Personal Lines and Excess and Surplus Lines segments showed improved combined ratios and strong premium growth.

Marchioni also highlighted new geographic expansions and the launch of Standard Commercial Lines in Maine and West Virginia, with plans for further expansion into Nevada, Washington, and Oregon later in the year.

Investment and Balance Sheet Insights

The Investments segment contributed significantly to the quarter's success, with a 17% increase in after-tax net investment income. The company's balance sheet remained robust, with total assets increasing to $12,056.1 million and a slight improvement in book value per common share to $46.17.

Outlook and Forward Guidance

Looking ahead, SIGI has adjusted its full-year 2024 guidance, anticipating a GAAP combined ratio of 96.5%, reflecting the impact of unfavorable prior year casualty reserve development and current year loss cost increases. The company also expects after-tax net investment income of $360 million and maintains an overall effective tax rate of approximately 21.0%.

Selective Insurance Group Inc continues to navigate the complexities of the insurance market with a strategic focus on disciplined growth and risk management, aiming to deliver value to its stakeholders and strengthen its market position.

Explore the complete 8-K earnings release (here) from Selective Insurance Group Inc for further details.

This article first appeared on GuruFocus.