Alibaba Tops Revenue Estimates, but Shares Fall. Is This a Great Opportunity to Buy the Stock?

Shares of Alibaba (NYSE: BABA) fell following mixed fiscal fourth-quarter earnings results that saw the Chinese e-commerce giant handily top analyst revenue estimates. The stock has had a difficult past five years, with its shares cut in half over that period. Let's look at the company's most recent results and see if a turnaround could be in the cards.

Solid revenue growth

Fourth-quarter revenue rose 7% to $30.7 billion, which topped analyst estimates calling for about $30.4 billion. The company's largest segment -- comprising its e-commerce sites Taobao and Tmall -- grew revenue 4% to $12.9 billion. The segment saw orders and gross merchandise value (GMV) on its platform grow by double-digits.

The e-commerce segment has seen increased competitive pressure over the past few years, especially from Pinduoduo, owned by PDD Holdings. As a result, Alibaba has invested in being more price competitive to help drive customer growth. Its segment EBITA (earnings before interest taxes and amortization), however, fell 1%.

Looking ahead, the company said it expects Taobao and Tmall GMV to return to healthy growth this new fiscal year and that it will launch new products to help better monetize the platform.

The cloud intelligence group, which is akin to Amazon's AWS and Microsoft's Azure, saw revenue grow 3% to $3.5 billion. Artificial intelligence (AI) related revenue soared triple-digits. Alibaba has been letting low-margin project-based contracts roll off in an effort to be more profitable. The benefits of this strategy could be seen in the segment's adjusted EBITA, which rose 45% to $198 million.

Alibaba is expecting to return to double-digit cloud growth in the second half of fiscal 2025, as it becomes the premier AI development platform in China.

Revenue for its international commerce retail business soared 45% to $3.8 billion, driven by strong cross-border business from AliExpress and Trendyol. However, the loss in the segment increased due to continued investment.

The company's Cainiao smart logistics network revenue jumped 30% to $3.4 billion, powered by cross-border fulfillment services supporting AliExpress. The segment, however, lost money due to retention incentives given to employees after the company pulled an IPO that was planned for the unit.

Its local services segment revenue climbed 19% to $2 billion, led by food delivery business Ele.me and navigation service Amap. Its digital media and entertainment unit, meanwhile, saw revenue decline -1% to $685 million. Both units lost money in the quarter.

Adjusted earnings per ADS (American depositary share) fell 5% in the quarter to $1.40, while adjusted EBITDA also fell 5% to $3.3 billion. Free cash flow came in at $2.1 billion.

The quarter was mixed with revenue rising and profitability falling, but overall it looks like the company is moving in the right direction. Growth had slowed at Alibaba, but the company is using its ample cash flow to reinvest back into the business to spur future growth.

While these investments dampened profitability in the near term, it should pay off longer term. Alibaba is often compared to Amazon in the U.S. and this is a common strategy its U.S. counterpart has used over the years. The company needed to invest across its business units, and early progress is clearly being made, from growing its GMV double-digits last quarter to triple-digit growth for AI services in its cloud business to strong growth in its cross-border international commerce businesses.

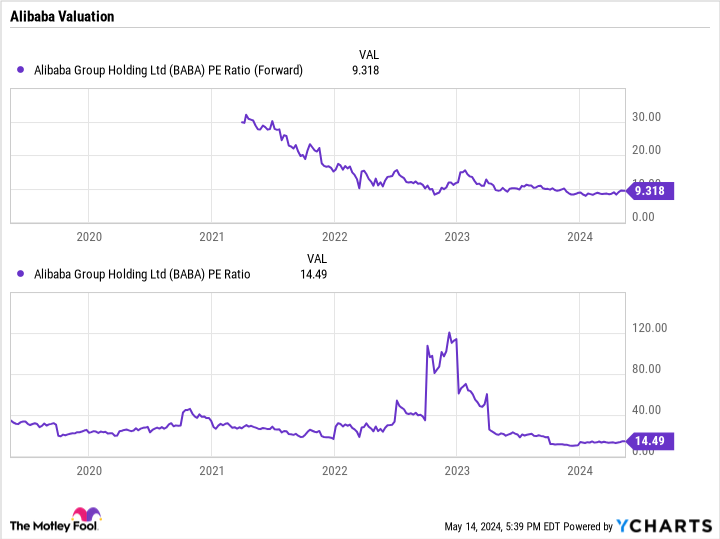

A cheap stock

Trading at a forward P/E of just over 9 times, Alibaba is selling for a big discount to what it has in the past. The stock is trading as if the company is in secular decline, but it has continued to grow its revenue despite a difficult Chinese economy the last few years and increased e-commerce competition. The company also has $85.5 billion in cash on its balance sheet.

The market's malaise with the stock, however, could be good news for investors. The stock is cheap, and there are certainly signs that a turnaround could be coming. The company has made its business units more independent and is allowing them to make the necessary investments to grow. Given its cash horde and cash flow, the company has a lot of money to invest to both drive future growth and buy back its inexpensive stock.

That should be a solid recipe for success. With shares down following the recent earnings report, now is a good time to bet on this cheap stock. Its various businesses are showing signs of improvement, and getting ahead of a potential company turnaround would be a good move for long-term investors.

Should you invest $1,000 in Alibaba Group right now?

Before you buy stock in Alibaba Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alibaba Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $578,143!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 13, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Geoffrey Seiler has positions in Alibaba Group. The Motley Fool has positions in and recommends Amazon and Microsoft. The Motley Fool recommends Alibaba Group and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Alibaba Tops Revenue Estimates, but Shares Fall. Is This a Great Opportunity to Buy the Stock? was originally published by The Motley Fool