Palantir Stock (NYSE:PLTR): Should You Buy the Post-Earnings Dip?

Palantir stock (NYSE:PLTR) dipped by about 16% after its Q1 earnings report, prompting me to ponder whether this downturn presents a buying opportunity. Notably, Palantir showcased yet another quarter of solid revenue growth, promising client base expansion, and strong profitability metrics. That said, concerns persist regarding the stock’s elevated valuation. Consequently, despite my belief in Palantir’s long-term prospects as a shareholder, I maintain a neutral stance towards the stock at present and don’t believe the dip is worth buying.

Accelerating Growth Driven by Government and Commercial Clients

Palantir Q1’s marked a period of accelerating growth, driven by solid performance in both the company’s Government and Commercial segments. Revenues landed at $634.4 million, up 20.8% year-over-year. This implies an acceleration from last year’s growth of 17.7% and the third consecutive quarter of accelerating revenue growth on a sequential basis. Let’s take a deeper look at both Palantir’s segments in Q1 to better understand what precisely drove this result.

Government Revenue Fueled by Domestic Acceleration, International Expansion

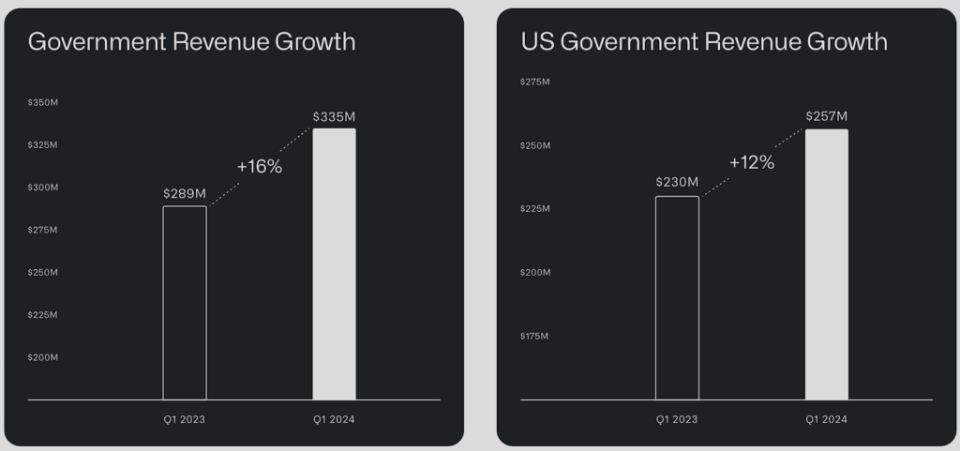

Starting with Palantir’s Government segment, which accounted for about 53% of its Q1 revenue mix, total revenue growth in this segment was 16%, at $335 million. This growth was mainly driven by accelerating revenues in the domestic division and rapid international expansion.

Domestically, revenue growth accelerated in Q1 in the U.S. Government business, increasing by 12% year-over-year and 8% quarter-over-quarter to $257 million. This compares against a 3% quarter-over-quarter increase in Q4, with Palantir’s software becoming increasingly critical for the U.S. Government in today’s unstable geopolitical environment. Palantir’s International Government division further compounded the segment’s growth, with its revenues rising by 33% to $79 million.

An important milestone in Q1 was that the U.S. Army granted Palantir an exclusive prime contract worth over $178.4 million to develop a next-generation targeting node as part of the TITAN program. This marks a historic moment for Palantir, as it became the first software company ever to win a prime contract for a hardware system. This effectively positions Palantir to establish itself as a prime vendor akin to giants like Lockheed Martin (NYSE:LMT) or Northrop Grumman (NYSE:NOC) in the field of weapons and aerospace products.

Commercial Revenue Surges Following Rapid Client Base Expansion

Transitioning to Palantir’s Commercial segment, revenues experienced another notable surge, driven by the increasing uptake of its artificial intelligence platform (AIP) and the solid expansion of the company’s clientele.

In a prior update on Palantir, I emphasized the pivotal role of Bootcamps in bolstering Palantir’s corporate customer base. Palantir organizes these hands-on workshops to showcase the capabilities of its software, notably its AIP. Successful demonstrations should allow potential clients to realize the value proposition Palantir offers and potentially commit to a contract.

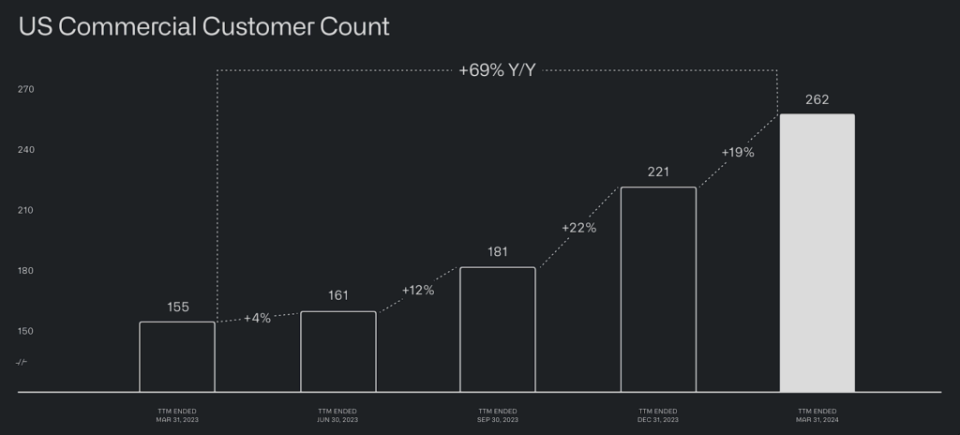

This strategy seems to be working extremely well for the company. In Q1, Palantir added 41 net new customers in its U.S. Commercial segment (see the image below). This marked a 69% increase in Palantir’s customer count year-over-year and 19% quarter-over-quarter. Palantir also recorded a significant acceleration here, compared to the 8% quarter-over-quarter growth of last year’s Q1.

Rapidly Improving Profitability, But Valuation Concerns Remain

Palantir’s strong revenue growth has gradually allowed the company to record improving unit economics, thus improving its profitability metrics. The company’s adjusted operating margin landed at 36%, up from 34% in the previous quarter and 24% last year, marking the sixth consecutive quarter of expansion. It led to an adjusted operating income of $226.5 million, up 81% compared to last year. Further, Palantir’s adjusted free cash flow came in at $149 million, also achieving a noteworthy margin of 23%.

With additional cash flowing into Palantir’s balance sheet, the company ended the quarter with a record cash position of $3.87 billion, all while maintaining a debt-free status. Nevertheless, investors should still take into account the underlying risks involved in Palantir’s current valuation, no matter how impressive its profitability metrics and robust financial standing are.

At the end of the day, Palantir is still trading at approximately 65 times this year’s expected earnings per share (EPS) and 54 times next year’s expected EPS. Its revenue growth acceleration and ongoing margin expansion may allow the company to grow into these multiples sooner rather than later. Still, Palantir’s investment case offers a notably lower margin of safety compared to last year’s levels, even after the post-earnings dip—and this is coming from a shareholder with high hopes.

Is PLTR Stock a Buy, According to Analysts?

The present sentiment on Wall Street seems bearish, even after Palantir’s post-earnings share price decline. According to Wall Street, Palantir Technologies features a Moderate Sell consensus rating based on two Buys, five Holds, and six Sells in the past three months. At $19.67, the average PLTR stock price target suggests 4.5% downside potential.

If you’re wondering which analyst you should follow if you want to buy and sell PLTR stock, the most profitable analyst covering the stock (on a one-year timeframe) is Mariana Perez from Bank of America (NYSE:BAC) Securities, with an average return of 61.42% per rating and a 92% success rate. Click on the image below to learn more.

The Takeaway

To sum up, Palantir’s Q1 report reflects an ongoing acceleration in revenue growth, evident in both its Government and Commercial segments. With Governments relying increasingly on Palantir’s software during an unstable geopolitical environment and corporate clients gradually realizing the capabilities of AIP, Palantir’s long-term prospects appear more promising than ever.

However, the persistent concern over the stock’s valuation cannot be overlooked. While Palantir shows promise for long-term investors, and I am one of them, a neutral stance on the stock seems reasonable, given its elevated valuation multiples. Accordingly, I wouldn’t buy the stock on this dip if I were looking to initiate a position in Palantir. I’d rather wait for a potentially more attractive entry point.