Backblaze Inc (BLZE) Q1 2024 Earnings: Revenue Growth Exceeds Expectations, Narrowing Losses

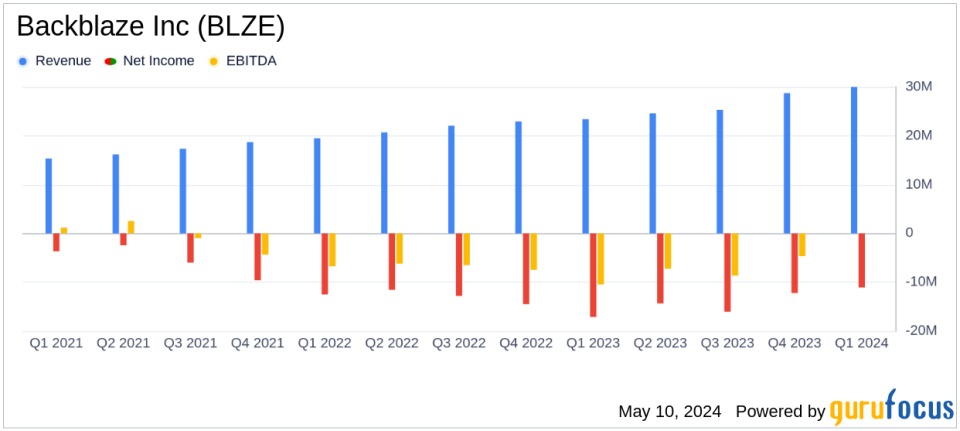

Revenue: Reported at $30.0 million, marking a 28% year-over-year increase, exceeding the estimate of $29.74 million.

Net Loss: Recorded at $11.1 million, an improvement from the previous year's $17.1 million, but fell short of the estimated loss of $9.46 million.

Earnings Per Share (EPS): Reported a net loss per share of $0.27, an improvement from the prior year's loss of $0.50 per share, slightly above the estimated loss per share of $0.29.

Gross Margin: Increased to 53% of revenue from 47% in the previous year, with adjusted gross profit reaching $23.0 million or 77% of revenue.

Annual Recurring Revenue (ARR): Grew by 27% year-over-year to $122.1 million, driven by significant growth in B2 Cloud Storage ARR, which increased by 43%.

Net Revenue Retention (NRR): Improved slightly to 112%, with B2 Cloud Storage NRR at 126%, indicating strong revenue retention and expansion among existing customers.

Adjusted EBITDA: Turned positive at $1.9 million, or 6% of revenue, a significant improvement from the previous year's negative $2.9 million or -12% of revenue.

On May 8, 2024, Backblaze Inc (NASDAQ:BLZE), a specialized storage cloud platform, disclosed its financial results for the first quarter ended March 31, 2024, through its 8-K filing. The company reported significant revenue growth and a reduction in net loss, indicating robust operational performance and effective cost management.

Company Overview

Backblaze Inc provides cloud storage solutions, including the Backblaze B2 Cloud Storage and Backblaze Computer Backup services. These offerings cater to a variety of needs such as data storage, application development, and ransomware protection. The company primarily operates in the United States but also has a presence in the United Kingdom, Canada, and other regions.

Financial Performance Highlights

For Q1 2024, Backblaze reported a revenue of $30.0 million, marking a 28% increase year-over-year (YoY). This growth was significantly bolstered by a 47% increase in B2 Cloud Storage revenue, which totaled $14.6 million. The Computer Backup segment also performed well, contributing $15.3 million, up 14% YoY. The company achieved a gross profit of $15.8 million, or 53% of revenue, improving from 47% in Q1 2023.

The adjusted gross profit stood at $23.0 million, or 77% of revenue, compared to 72% in the previous year. Despite these gains, Backblaze posted a net loss of $11.1 million, an improvement from a net loss of $17.1 million in Q1 2023. The net loss per share was reduced to $0.27 from $0.50 YoY.

Operational and Strategic Highlights

Backblaze's Annual Recurring Revenue (ARR) reached $122.1 million, up 27% YoY. The B2 Cloud Storage segment's ARR saw a notable increase of 43%, amounting to $59.5 million. The company also reported a Net Revenue Retention (NRR) rate of 112%, indicating strong customer retention and revenue expansion capabilities.

Recent strategic initiatives include the launch of Event Notifications for automated workflows and partnerships aimed at enhancing data security and AI capabilities. These developments underscore Backblaze's commitment to innovation and market expansion.

Financial Outlook and Analyst Expectations

Looking ahead to Q2 2024, Backblaze anticipates revenue to be between $30.7 million and $31.1 million, with an adjusted EBITDA margin of 6% to 8%. For the full year, the company expects revenue to range from $126.0 million to $128.0 million.

These projections compare favorably against analyst estimates, which had anticipated a quarterly revenue of $29.74 million and an annual revenue of $127.04 million. The actual and forecasted performance suggests a positive trajectory for Backblaze, aligning with market expectations for sustained growth and profitability improvement.

Conclusion

Backblaze Inc's first quarter results for 2024 reflect a company that is not only growing its top line robustly but also improving its profitability metrics. The strategic initiatives and operational efficiencies are set to bolster the company's market position in the cloud storage industry. Investors and stakeholders may look forward to continued growth and an enhanced financial profile as the company progresses through the year.

For further details, you can access the full earnings report and join the upcoming conference call as outlined in the company's Investor Relations section.

Explore the complete 8-K earnings release (here) from Backblaze Inc for further details.

This article first appeared on GuruFocus.