Dril-Quip (DRQ) Q1 Earnings Decline Y/Y on Increased Costs

Dril-Quip, Inc. DRQ reported a first-quarter 2024 adjusted loss of 62 cents per share, which is wider than the year-ago quarter’s loss of 1 cents.

The company’s total quarterly revenues of $110.3 million increased from the year-ago quarter’s $90.9 million. In comparison to the first quarter of 2023, the rise was primarily fueled by the inclusion of Great North, contributing $25.1 million in the quarter. This was partly counterbalanced by decreased Subsea Product sales.

Significant increases in total costs and expenses led to weak quarterly earnings.

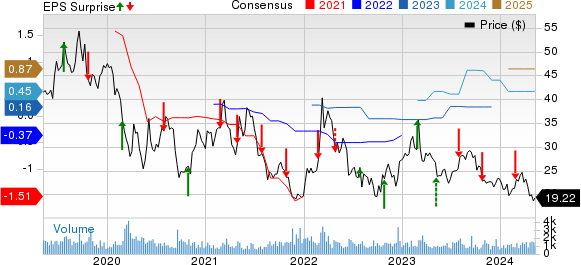

Dril-Quip, Inc. Price, Consensus and EPS Surprise

Dril-Quip, Inc. price-consensus-eps-surprise-chart | Dril-Quip, Inc. Quote

Q1 Performance

Dril-Quip reported subsea product bookings of $41.1 million for the quarter, down 4.9% year over year.

DRQ reported a first-quarter operating loss of $18.8 million, indicating a turnaround from the prior-year period’s reported profit of $3.2 million.

Total Costs & Expenses

The cost of sales increased to $78.4 million from $65.5 million in the year-ago period. This increase was primarily due to the acquisition of Great North. Engineering and product development costs also increased to $3.7 million from $3.4 million. This increase was primarily driven by enhanced testing and qualification processes to meet specific international customer requirements.

Total costs and expenses were $129.1 million compared with $87.7 million registered in the corresponding period of 2023.

Free Cash Flow

In the first quarter, Dril-Quip generated a negative free cash flow of $8.9 million compared with the $58.3 million reported a year ago.

Financials

DRQ recorded $4.8 million in capital expenditure for the quarter.

As of Mar 31, 2024, the company’s cash balance was $202.3 million. Its balance sheet is free of debt load, highlighting a sound financial position.

Zacks Ranks & Stocks to Consider

Dril-Quip currently carries a Zacks Rank #3 (Hold).

Investors interested in the energy sector may look at some better-ranked companies mentioned below. These three companies presently sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

SM Energy Company SM is an independent oil and gas company engaged in the exploration, exploitation, development, acquisition, and production of oil and gas in North America.

The Zacks Consensus Estimate for SM’s 2024 and 2025 EPS is pegged at $6.46 and $7.35, respectively. The stock has witnessed upward earnings estimate revisions for 2024 and 2025 in the past 30 days.

Hess Corporation HES is a leading oil and natural gas exploration and production company. The company’s oil and gas proved reserves increased last year by more than 8% year over year.

The Zacks Consensus Estimate for HES’s 2024 and 2025 EPS is pegged at $9.17 and $11.08, respectively. The stock has witnessed upward earnings estimate revisions for 2024 and 2025 in the past 30 days.

Ecopetrol S.A. EC operates across various sections of the oil and gas industry, including the exploration, development, and production of oil and gas, refining, transportation, and the sale of petroleum products.

Ecopetrol has witnessed upward earnings estimate revisions for 2024 and 2025 in the past seven days. The Zacks Consensus Estimate for EC’s 2024 and 2025 EPS is pegged at $2.54 and $2.61, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dril-Quip, Inc. (DRQ) : Free Stock Analysis Report

Hess Corporation (HES) : Free Stock Analysis Report

SM Energy Company (SM) : Free Stock Analysis Report

Ecopetrol S.A. (EC) : Free Stock Analysis Report