Meta Stock is Tanking. Here's Why I Still Think It's a Buy.

One of the hottest stocks among the "Magnificent Seven" has been Meta Platforms (NASDAQ: META). After a rocky performance in 2022, shares in the advertising behemoth soared 194% last year following an impressive return to growth on both the top and bottom lines.

While Meta shares are still up an impressive 22% in 2024, the stock has plunged roughly 12% since the company reported first-quarter earnings on April 24. The reason? Meta's management called for an uptick in spending this year.

Let's outline the rationale behind the rising expense profile and analyze why now is a good time to buy the dip on Meta stock.

Cash flow is king, but...

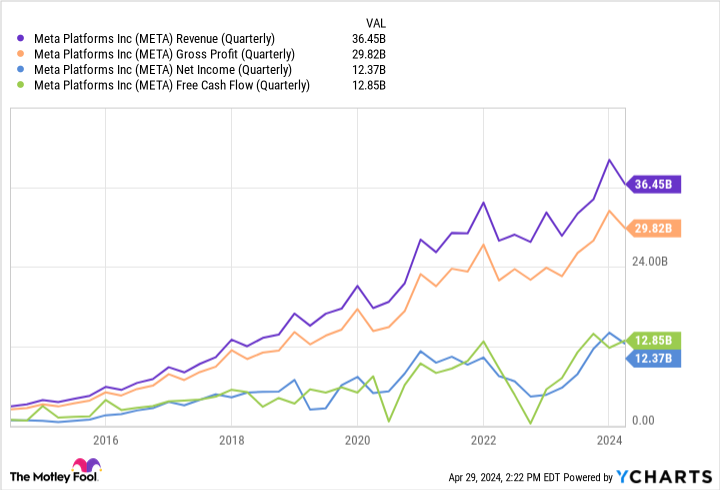

One thing investors should understand about Meta is that the company is extremely profitable. Although revenue has consistently performed at a high level, Meta also generates significant operating leverage, which is demonstrated by consistent gross profit margins and free cash flow.

This provides Meta with a high degree of financial flexibility -- allowing the company to reinvest excess profits back into the business.

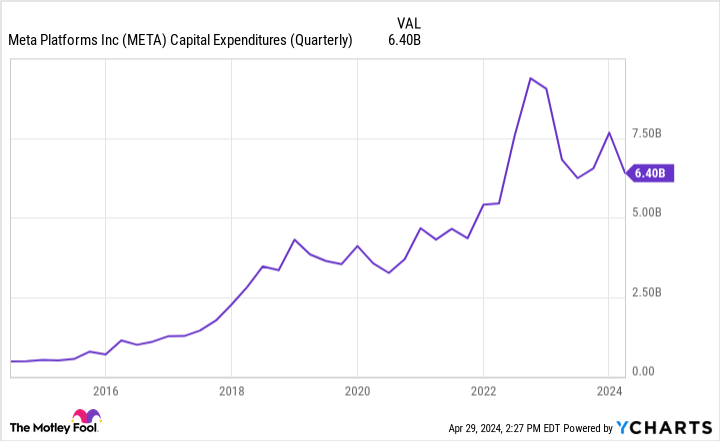

During the company's first-quarter earnings call, management told investors that capital expenditures (capex) in 2024 are expected to be in the range of $35 to $40 billion. Considering that management's previous guidance was in the range of $30 to $37 billion, investors seemed blindsided by the raise.

Are these infrastructure investments worth it?

The chart below illustrates Meta's capex trends over the past 10 years. The noticeable uptick in 2022 is mostly attributable to the company's metaverse ambitions -- a business segment that is currently unprofitable for Meta.

Given that Meta resorted to mass layoffs and extreme cost reduction efforts to return to profitability last year, I can understand why some investors soured on the company's rising capex outlook.

However, parsing through management's commentary provides a lot of useful detail surrounding why the company is investing so heavily in infrastructure. Namely, Meta is developing its own semiconductor chips in-house. The company's Meta Training and Inference Accelerator (MTIA) chip is an attempt to move away from its current provider: Nvidia's graphics processing units (GPU).

Is Meta stock a buy right now?

Keep in mind that Meta owns several leading social media platforms including Facebook, Instagram, and WhatsApp. Moreover, the company faces intense competition from the likes of Alphabet's YouTube as well as TikTok -- a favorite among the Gen Z demographic.

Developing its own chips in-house could provide Meta with a big advantage over its peers. In essence, by internalizing its AI efforts as opposed to outsourcing to a third party such as Nvidia, Meta is able to control the entire spectrum of its tech stack. What this means is that Meta can scrape data from its various social media platforms and more quickly process trends on its own compute protocols.

Keeping the tech stack closed off to third parties can be lucrative in different ways. First, Meta should be able to process data more quickly. In turn, this could help hone the company's targeted advertising algorithm and allow Meta to push strong campaigns to users, thereby accelerating revenue opportunities.

The second (and more obvious) way that Meta can benefit is by developing in-house chips, which should lead to cost savings in the long run as the company will not need to rely on outside parties.

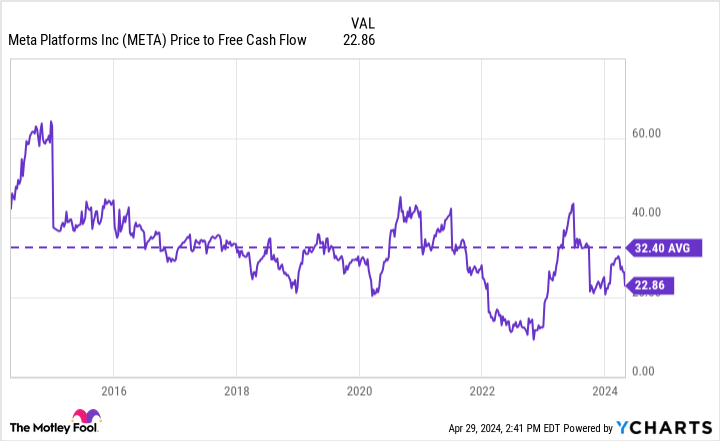

Right now, Meta stock trades at a price-to-free cash flow of 22.9 -- significantly below its 10-year average. Furthermore, its forward price-to-earnings (P/E) ratio of 22.5 is notably lower than that of peers such as Alphabet.

I am encouraged by Meta's decision to internalize its AI roadmap as much as possible. While developing its own chips is going to be a costly endeavor in the near term, I see the long-term benefits as too hard to ignore.

With shares cratering since publishing first-quarter earnings, now looks like a great time to take advantage of the sell-off.

Should you invest $1,000 in Meta Platforms right now?

Before you buy stock in Meta Platforms, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Meta Platforms wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $508,797!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 30, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Adam Spatacco has positions in Alphabet, Meta Platforms, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Meta Platforms, and Nvidia. The Motley Fool has a disclosure policy.

Meta Stock is Tanking. Here's Why I Still Think It's a Buy. was originally published by The Motley Fool