Fresh Del Monte Produce (NYSE:FDP) Misses Q1 Revenue Estimates

Fresh produce company Fresh Del Monte (NYSE:FDP) missed analysts' expectations in Q1 CY2024, with revenue down 1.8% year on year to $1.11 billion. It made a non-GAAP profit of $0.34 per share, down from its profit of $0.55 per share in the same quarter last year.

Is now the time to buy Fresh Del Monte Produce? Find out in our full research report.

Fresh Del Monte Produce (FDP) Q1 CY2024 Highlights:

Revenue: $1.11 billion vs analyst estimates of $1.15 billion (3.8% miss)

EPS (non-GAAP): $0.34 vs analyst expectations of $0.61 (43.8% miss)

Gross Margin (GAAP): 7.3%, down from 8.6% in the same quarter last year

Free Cash Flow of $6 million is up from -$19.2 million in the previous quarter

Market Capitalization: $1.24 billion

“We are pleased with the ongoing momentum in our higher-margin fresh and value-added segment. During the first quarter of 2024, this prioritized area of our business delivered 5% revenue growth driven by our strategic initiatives around distribution, pricing, and premiumization. While service level issues and competitive market pressures in North America and Europe reduced our banana revenue, we continued to generate very strong cash flow, which fuels our growth strategy tied to innovation around fresh-cut and pineapples,” said Mohammad Abu-Ghazaleh, Fresh Del Monte’s Chairman and CEO.

Translating to "of the mountain" in Spanish, Fresh Del Monte (NYSE:FDP) is a leader in providing high-quality, sustainably grown fresh fruits and vegetables.

Perishable Food

The perishable food industry is diverse, encompassing large-scale producers and distributors to specialty and artisanal brands. These companies sell produce, dairy products, meats, and baked goods and have become integral to serving modern American consumers who prioritize freshness, quality, and nutritional value. Investing in perishable food stocks presents both opportunities and challenges. While the perishable nature of products can introduce risks related to supply chain management and shelf life, it also creates a constant demand driven by the necessity for fresh food. Companies that can efficiently manage inventory, distribution, and quality control are well-positioned to thrive in this competitive market. Navigating the perishable food industry requires adherence to strict food safety standards, regulations, and labeling requirements.

Sales Growth

Fresh Del Monte Produce is larger than most consumer staples companies and benefits from economies of scale, giving it an edge over its smaller competitors.

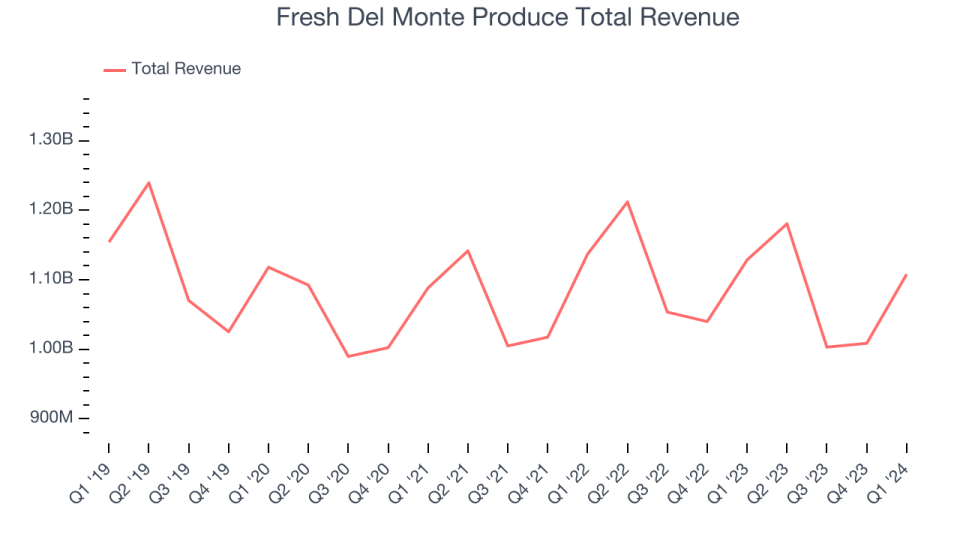

As you can see below, the company's annualized revenue growth rate of 1% over the last three years was weak for a consumer staples business.

This quarter, Fresh Del Monte Produce missed Wall Street's estimates and reported a rather uninspiring 1.8% year-on-year revenue decline, generating $1.11 billion in revenue.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

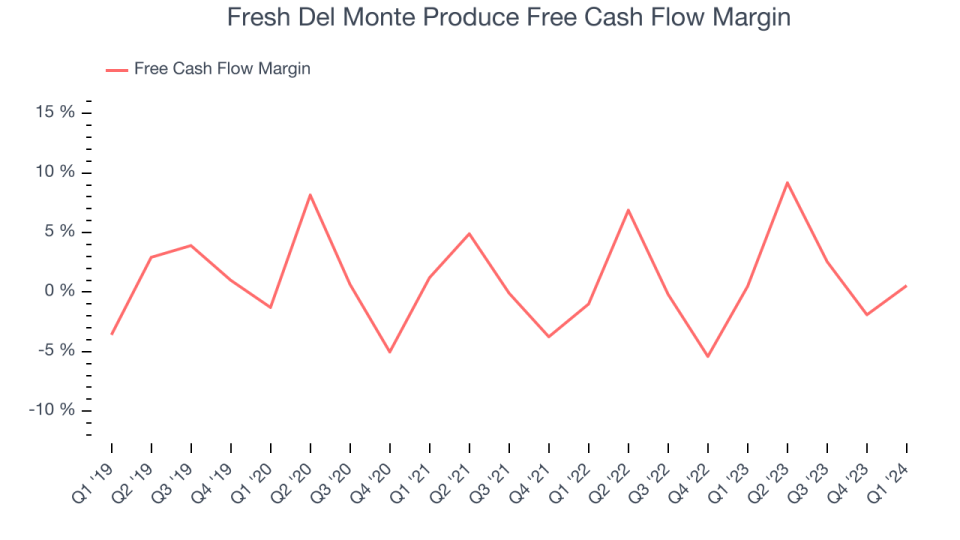

Fresh Del Monte Produce broke even from a free cash flow perspective in Q1. This quarter's result was in line with its margin in same period last year.

Over the last eight quarters, Fresh Del Monte Produce has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 1.7%, subpar for a consumer staples business. However, its margin has averaged year-on-year increases of 2.1 percentage points over the last 12 months. Continued momentum should improve its cash flow prospects.

Key Takeaways from Fresh Del Monte Produce's Q1 Results

We struggled to find many strong positives in these results. Its revenue, gross margin, and EPS missed analysts' estimates. The poor performance was mostly driven by lower banana volumes and prices.

On April 30, 2024, the company also declared a quarterly dividend of $0.25 per share, payable on June 7, 2024 to shareholders as of May 16, 2024.

Overall, this was a mediocre quarter for Fresh Del Monte Produce. The stock is flat after reporting and currently trades at $26.03 per share.

Fresh Del Monte Produce may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.