Steel Dynamics (STLD) Q1 Earnings Top on Higher Selling Prices

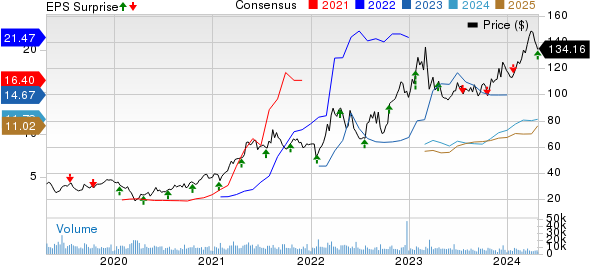

Steel Dynamics, Inc. STLD logged first-quarter 2024 earnings of $3.67 per share, down from $3.70 in the year-ago quarter. It topped the Zacks Consensus Estimate of $3.54.

Net sales in the first quarter were down around 4% year over year to $4,694 million. It missed the Zacks Consensus Estimate of $4,739.7 million.

While STLD witnessed some steel order volatility early in the reported quarter, underlying steel demand was steady in the quarter. Solid demand led to near-record shipments and higher selling prices in the company’s steel operations.

Steel Dynamics, Inc. Price, Consensus and EPS Surprise

Steel Dynamics, Inc. price-consensus-eps-surprise-chart | Steel Dynamics, Inc. Quote

Segment Highlights

Net sales for steel operations were $3,366.2 million in the reported quarter, up around 9% year over year. STLD registered steel shipments of roughly 3.3 million tons in the quarter. This compares to our estimate of 3.45 million tons. The company saw strong demand led by automotive, non-residential construction, energy and industrial sectors.

STLD's steel operations reported an average external product selling price of $1,201 per ton, up from $1,076 per ton in the year-ago quarter and $1,090 per ton in the previous quarter. It surpassed our estimate of $1,002 per ton.

Net sales of Metal’s recycling operations were $569.5 million in the quarter under review, down around 2% from the year-ago quarter. STLD registered ferrous shipments of around 1.45 million gross tons in the quarter, stable year over year. The figure was below our estimate of 1.56 million gross tons.

The company's steel fabrication operations raked in sales of around $447.2 million, down roughly 48% year over year. Steel Dynamics recorded steel fabrication shipments of 143,842 tons in the quarter, down around 17% year over year. The figure fell short of our estimate of 152,387 tons.

Financial Position

Steel Dynamics ended the quarter with cash and cash equivalents of $1,039.4 million, down around 35% year over year. Long-term debt was $2,612.2 million, down roughly 13% from the year-ago quarter.

The company generated cash flow from operations of $355 million in the reported quarter, down around 52% year over year. It maintained strong liquidity of $3.1 billion as of Mar 31, 2024.

STLD repurchased $298 million of its common stock in the quarter, accounting for 1.5% of its outstanding shares.

Outlook

Steel Dynamics noted that market conditions are in place for solid domestic steel consumption throughout 2024. Order entry activity remains strong across all of its businesses while steel prices have firmed. STLD expects steel consumption to rise in North America this year. Steel prices are expected to be supported by demand for lower-carbon emission, U.S. produced steel products and lower imports. The company also envisions automotive, non-residential construction, industrial and energy sectors to remain solid in 2024.

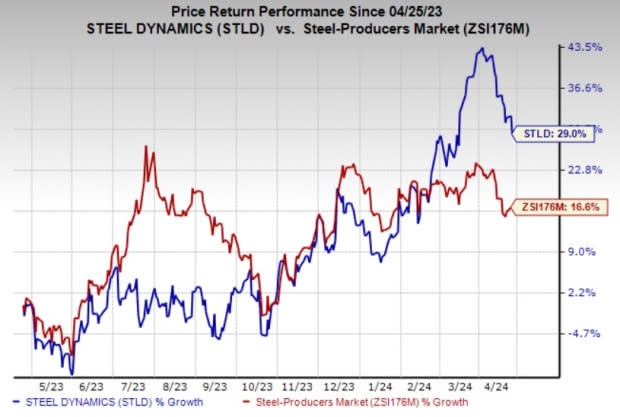

Price Performance

Shares of Steel Dynamics have gained 29% over the past year compared with 16.6% rise of its industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

STLD currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks worth a look in the basic materials space include Denison Mines Corp. DNN, Carpenter Technology Corporation CRS and Innospec Inc. IOSP.

Denison Mines beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 300%. The company’s shares have soared roughly 93% in the past year. DNN carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Carpenter Technology’s current fiscal year earnings is pegged at $3.96, indicating a year-over-year surge of 247.4%. CRS beat the Zacks Consensus Estimate in three of the last four quarters while matching it once, with the average earnings surprise being 12.2%. The company’s shares have rallied around 68% in the past year. CRS currently carries a Zacks Rank #2 (Buy).

The consensus estimate for Innospec’s current-year earnings is pegged at $6.77 per share, indicating a 11.2% year-over-year rise. IOSP, carrying a Zacks Rank #2, beat the consensus estimate in each of the last four quarters, with the average earnings surprise being 10.5%. The company’s shares have gained around 21% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Steel Dynamics, Inc. (STLD) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Denison Mine Corp (DNN) : Free Stock Analysis Report

Innospec Inc. (IOSP) : Free Stock Analysis Report