Spotting Winners: eXp World (NASDAQ:EXPI) And Real Estate Services Stocks In Q4

Earnings results often indicate what direction a company will take in the months ahead. With Q4 now behind us, let’s have a look at eXp World (NASDAQ:EXPI) and its peers.

Technology has been a double-edged sword in real estate services. On the one hand, internet listings are effective at disseminating information far and wide, casting a wide net for buyers and sellers to increase the chances of transactions. On the other hand, digitization in the real estate market could potentially disintermediate key players like agents who use information asymmetries to their advantage.

The 12 real estate services stocks we track reported a weaker Q4; on average, revenues beat analyst consensus estimates by 1.9%. while next quarter's revenue guidance was 20.9% below consensus. Inflation (despite slowing) has investors prioritizing near-term cash flows, but real estate services stocks held their ground better than others, with share prices down 0.8% on average since the previous earnings results.

eXp World (NASDAQ:EXPI)

Founded in 2009, eXp World (NASDAQ:EXPI) is a real estate company known for its virtual, cloud-based approach to real estate brokerage.

eXp World reported revenues of $983 million, up 5.3% year on year, topping analyst expectations by 2.5%. It was a mixed quarter for the company, with revenue exceeding analysts' estimates. On the profitability side, things were less rosy as the company missed analysts' EBITDA and EPS estimates.

The stock is down 1.4% since the results and currently trades at $10.91.

Read our full report on eXp World here, it's free.

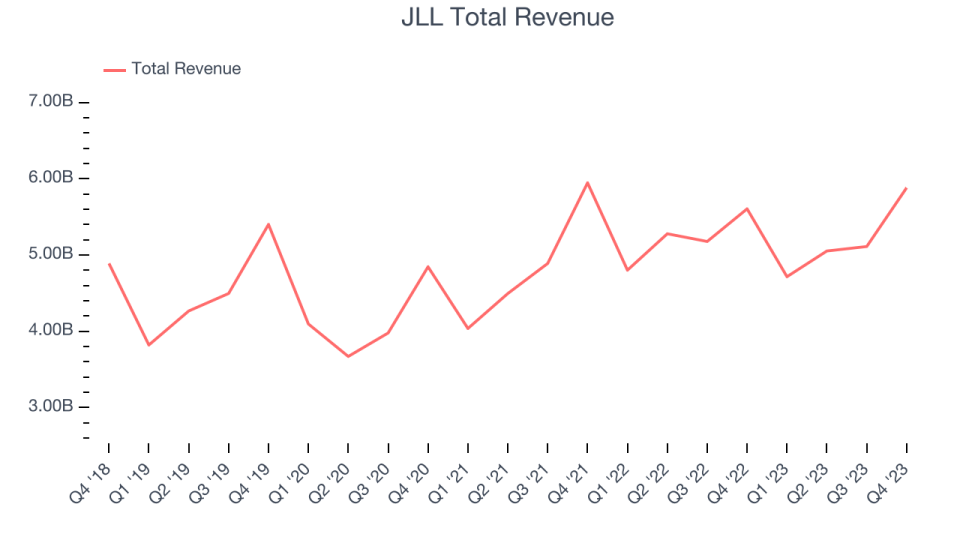

Best Q4: JLL (NYSE:JLL)

Founded in 1999 through the merger of Jones Lang Wootton and LaSalle Partners, JLL (NYSE:JLL) is a company specializing in real estate advisory and investment management services.

JLL reported revenues of $5.88 billion, up 4.9% year on year, outperforming analyst expectations by 1.5%. It was a decent quarter for the company, with revenue and EPS outperforming expectations thanks to better-than-expected results in its Capital Markets segment ($537 million vs estimates of $462 million).

The stock is up 5.3% since the results and currently trades at $194.5.

Is now the time to buy JLL? Access our full analysis of the earnings results here, it's free.

Weakest Q4: Anywhere Real Estate (NYSE:HOUS)

Formerly known as Realogy Holdings, Anywhere Real Estate (NYSE:HOUS) is a residential real estate company with a network of brokerages, franchises, and settlement services.

Anywhere Real Estate reported revenues of $1.25 billion, down 5.5% year on year, falling short of analyst expectations by 2.1%. It was a weak quarter for the company, with a miss of analysts' revenue and EPS estimates.

The stock is down 22.6% since the results and currently trades at $5.92.

Read our full analysis of Anywhere Real Estate's results here.

Redfin (NASDAQ:RDFN)

Founded by a former medical school student, electrical engineer, and Amazon data engineer, Redfin (NASDAQ:RDFN) is a real estate company offering brokerage services through an online platform.

Redfin reported revenues of $218.1 million, down 54.5% year on year, falling short of analyst expectations by 1%. It was a decent quarter for the company, with an impressive beat of analysts' earnings estimates. Guidance was mixed, with Q1 2024 revenue guidance in line with expectations but adjusted EBITDA guidance below, showing lower margins than Wall Street is estimating.

The stock is down 8.9% since the results and currently trades at $6.52.

Read our full, actionable report on Redfin here, it's free.

Zillow (NASDAQ:ZG)

Founded by Expedia co-founders Lloyd Frink and Rich Barton, Zillow (NASDAQ:ZG) is the leading U.S. online real estate marketplace.

Zillow reported revenues of $474 million, up 9% year on year, surpassing analyst expectations by 5%. It was a strong quarter for the company, with an impressive beat of analysts' earnings estimates and a solid beat of analysts' revenue estimates.

The stock is down 9.1% since the results and currently trades at $47.31.

Read our full, actionable report on Zillow here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.