Q4 Earnings Highlights: Nike (NYSE:NKE) Vs The Rest Of The Footwear Stocks

Wrapping up Q4 earnings, we look at the numbers and key takeaways for the footwear stocks, including Nike (NYSE:NKE) and its peers.

Before the advent of the internet, styles changed, but consumers mainly bought shoes by visiting local brick-and-mortar shoe, department, and specialty stores. Today, not only do styles change more frequently as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some footwear companies have made concerted efforts to adapt while those who are slower to move may fall behind.

The 7 footwear stocks we track reported a mixed Q4; on average, revenues beat analyst consensus estimates by 2.2% Inflation (despite slowing) has investors prioritizing near-term cash flows, but footwear stocks held their ground better than others, with the share prices up 2.8% on average since the previous earnings results.

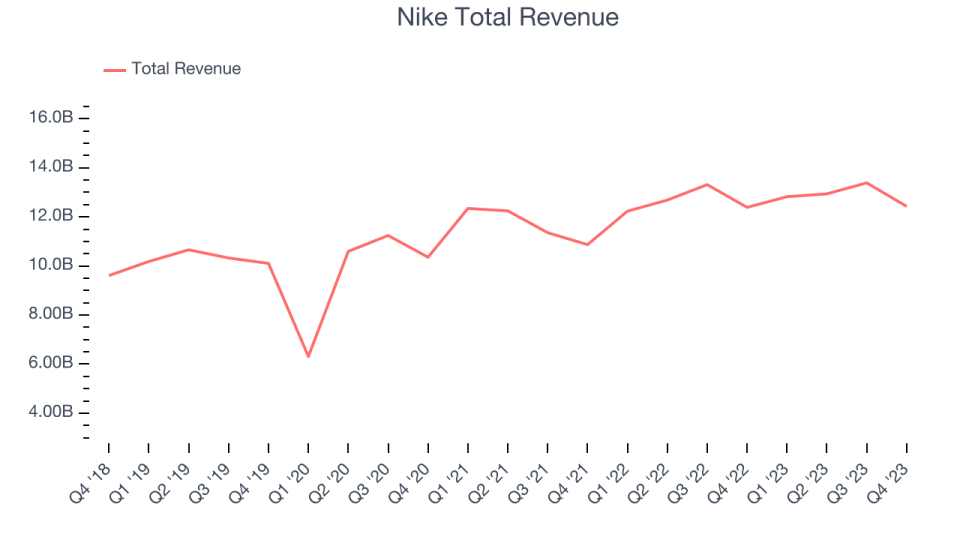

Nike (NYSE:NKE)

Originally selling Japanese Onitsuka Tiger sneakers as Blue Ribbon Sports, Nike (NYSE:NKE) is a global titan in athletic footwear, apparel, equipment, and accessories.

Nike reported revenues of $12.43 billion, flat year on year, topping analyst expectations by 1.1%. It was a strong quarter for the company, with an impressive beat of analysts' earnings estimates and a narrow beat of analysts' revenue estimates.

The stock is down 11.4% since the results and currently trades at $89.33.

Is now the time to buy Nike? Access our full analysis of the earnings results here, it's free.

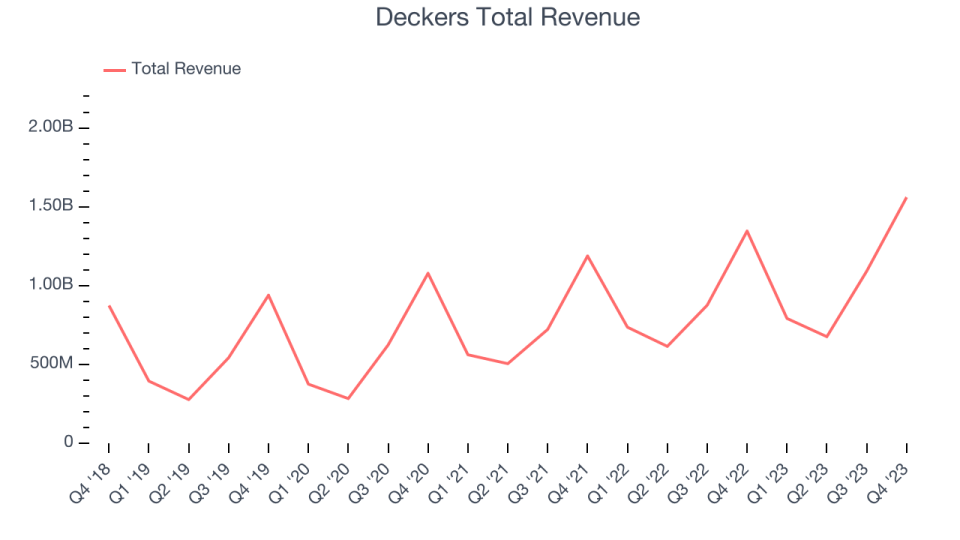

Best Q4: Deckers (NYSE:DECK)

Established in 1973, Deckers (NYSE:DECK) is a footwear and apparel conglomerate with a portfolio of lifestyle and performance brands.

Deckers reported revenues of $1.56 billion, up 16% year on year, outperforming analyst expectations by 7.3%. It was an exceptional quarter for the company, with an impressive beat of analysts' revenue and EPS estimates.

Deckers pulled off the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. The stock is up 13.9% since the results and currently trades at $878.

Is now the time to buy Deckers? Access our full analysis of the earnings results here, it's free.

Slowest Q4: Wolverine Worldwide (NYSE:WWW)

Founded in 1883, Wolverine Worldwide (NYSE:WWW) is a global footwear company with a diverse portfolio of brands including Merrell, Hush Puppies, and Saucony.

Wolverine Worldwide reported revenues of $521.2 million, down 17.9% year on year, in line with analyst expectations. It was a weak quarter for the company, with full-year revenue guidance missing analysts' expectations.

Wolverine Worldwide had the slowest revenue growth and weakest full-year guidance update in the group. The stock is up 9.9% since the results and currently trades at $10.06.

Read our full analysis of Wolverine Worldwide's results here.

Steven Madden (NASDAQ:SHOO)

As seen in the infamous Wolf of Wall Street movie, Steven Madden (NASDAQ:SHOO) is a fashion brand famous for its trendy and innovative footwear, appealing to a young and style-conscious audience.

Steven Madden reported revenues of $519.7 million, up 10.4% year on year, surpassing analyst expectations by 1.2%. It was a weak quarter for the company, with a miss of analysts' earnings estimates.

The stock is down 4.5% since the results and currently trades at $41.66.

Read our full, actionable report on Steven Madden here, it's free.

Genesco (NYSE:GCO)

Spanning a broad range of styles, brands, and prices, Genesco (NYSE:GCO) sells footwear, apparel, and accessories through multiple brands and banners.

Genesco reported revenues of $739 million, up 1.9% year on year, surpassing analyst expectations by 4.8%. It was a weaker quarter for the company, with underwhelming earnings guidance for the full year and a miss of analysts' earnings estimates.

The stock is down 8.2% since the results and currently trades at $26.91.

Read our full, actionable report on Genesco here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.