3 Highly Ranked Construction Stocks Benefitting from Top Business Industries

There continues to be an abundance of opportunity in the Zacks Construction sector which currently boasts 15 stocks on the coveted Zacks Rank #1 (Strong Buy) list.

Benefiting from strong business industries, here are three of these highly ranked construction sector stocks that were added to the strong buy list over the last few weeks.

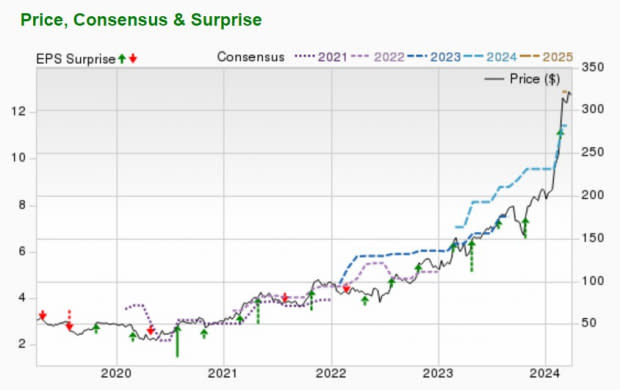

Comfort Systems USA FIX

Comfort Systems USA belongs to the Zacks Building Products-Air Conditioner and Heating Industry which is currently in the top 2% of over 250 Zacks industries.

Comfort Systems stock has soared +54% year to date and is now up +125% over the last year as a national provider of comprehensive heating, ventilation, and air conditioning services.

With an “A” Zacks Style Scores grade for Growth, Comfort Systems' annual earnings are forecasted to climb 30% in FY24 to $11.42 per share versus $8.74 a share last year. Plus, FY25 EPS is expected to jump another 13%. Furthermore, Comfort Systems stock trades at 27.5X forward earnings which is a slight discount to its industry average of 33.8X with some of the other notable names in the space being Lennox International LII and Watsco WSO.

Image Source: Zacks Investment Research

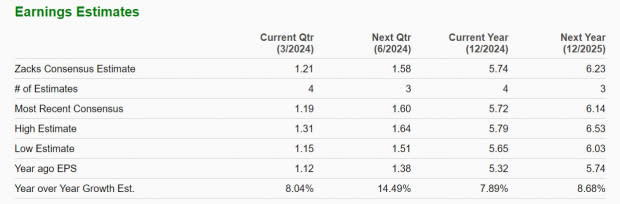

CRH CRH

The Zacks Building Products-Miscellaneous Industry is in the top 3% of all Zacks industries and has had many outperformers including CRH plc, a manufacturer of cement, concrete products, aggregates, roofing, insulation, and other building materials.

CRH shares are up +22% YTD and have risen +68% over the last year but still trade at a very reasonable 15.8X forward earnings multiple. This is nicely beneath the industry average of 18.3X and the S&P 500’s 21.8X. Even better, CRH’s annual earnings are expected to jump 15% this year and projected to rise another 8% in FY25 to $5.79 per share.

Image Source: Zacks Investment Research

Armstrong World Industries AWI

Also belonging to the Zacks Building Products-Miscellaneous Industry, Armstrong World Industries has seen its stock pop +24% in 2024. More impressive, as a leading global provider of ceiling systems used in construction and renovation, Armstrong World Industries' stock has climbed +78% in the last year.

With that being said, AWI still trades at a 20.9X forward earnings multiple which is near the industry average and below the benchmark. More importantly, annual earnings are projected to rise 8% in both FY24 and FY25.

Image Source: Zacks Investment Research

Bottom Line

Notably, earnings estimate revisions have gone up for these top construction sector stocks which is reason to believe their strong price performances will continue. This is especially true when considering their reasonable P/E valuations which makes now a good time to buy.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Armstrong World Industries, Inc. (AWI) : Free Stock Analysis Report

Comfort Systems USA, Inc. (FIX) : Free Stock Analysis Report

CRH PLC (CRH) : Free Stock Analysis Report

Watsco, Inc. (WSO) : Free Stock Analysis Report

Lennox International, Inc. (LII) : Free Stock Analysis Report