Do Lyft Shares Have Enough Lift for a Turnaround?

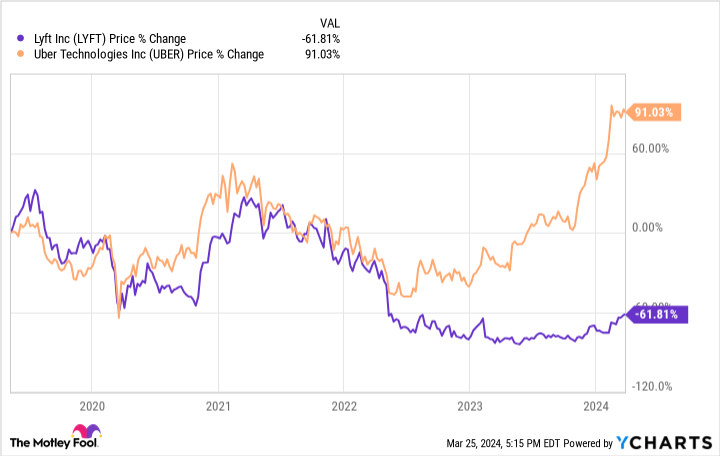

Given the growth of Uber's stock in recent months, investors who missed that opportunity might wonder if they have a second chance in Lyft's (NASDAQ: LYFT) stock. The fact that Lyft shares more than doubled in value over the last year could reinforce such a feeling.

Still, Uber and Lyft are not always in the same businesses, nor do they serve all of the same markets. Such differences call into question whether Lyft will follow in Uber's footsteps or continue to underperform its main competitor. Let's venture to find out.

Why Lyft is not (necessarily) the same as Uber

To evaluate its turnaround prospects, investors need to understand the differences between Uber and Lyft. For one, Lyft has so far limited itself to one country. In contrast, Uber users can find it in about 70 different countries. Moreover, Lyft restricts the scope of its business to a greater extent, focusing exclusively on ride-sharing.

In contrast, Uber also operates related businesses, namely delivery of food and freight. Although it competes with others in these enterprises, Uber can still make better use of its IT infrastructure to build alternative sources of revenue.

Uber's larger size points to a key challenge for Lyft

Such diversity seems to work in Uber's favor. An early criticism of Uber and Lyft was that high labor costs stood in the way of profitability, implying that both companies needed some degree of reliance on self-driving cars to succeed. Still, even in 2024, such technology is only available on a limited basis.

Also, it appears that economies of scale have helped industry financials. And through its larger size, Uber has better leveraged such improvements to its advantage. Since both stocks started traded on the exchanges, Uber has dramatically outperformed Lyft, and it is probably for that reason.

In 2023, Lyft's revenue of $4.4 billion grew 8% annually. In contrast, Uber reported $37 billion in revenue in 2023, a 17% increase. Also, although Lyft pared its losses in 2023, it still lost $340 million that year. In contrast, Uber has now turned profitable, earning almost $1.9 billion in net income during the same period.

This is not to say that Lyft's financial picture is bleak. When removing stock-based compensation and other expenses, it had adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $222 million in 2023. Moreover, for 2024, the company forecasts ridership growth in the mid-teens, an improvement that should make the company free-cash-flow positive.

Nonetheless, companies often cite adjusted EBITDA to downplay losses under generally accepted accounting principles, which can make investors leery of that particular metric. Although positive free cash flow should drastically reduce the need for outside funding, investors should not assume it will bring investors into Lyft stock by itself.

Should investors buy Lyft?

Given Lyft's current state, the stock could move higher, though it is not likely to become a second-chance stock for those who missed out on Uber. Still, it continues to grow, and it will likely reduce its losses and stabilize its business if it can meet its 2024 forecast of positive free cash flow.

But unlike Uber, it has not moved into other countries or gone into other businesses that could use its platform. This probably means that economies of scale are not working for Lyft to the same degree that they have helped Uber. Unless Lyft chooses to go bigger, it will probably continue to underperform its main competitor.

Should you invest $1,000 in Lyft right now?

Before you buy stock in Lyft, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Lyft wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 25, 2024

Will Healy has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Uber Technologies. The Motley Fool has a disclosure policy.

Do Lyft Shares Have Enough Lift for a Turnaround? was originally published by The Motley Fool