First Majestic (AG) Starts Bullion Sales at Eco-Friendly Mint

First Majestic Silver AG announced the completion of commissioning and the commencement of bullion sales at its 100% owned and operated minting facility, First Mint, LLC. The mint is set to produce more than 10% of the company's current silver production from its Mexican operations with further plans of expansion.

In September 2023, First Majestic announced it had launched First Mint in Nevada through which it can sell its silver production directly to its shareholders and bullion customers. By minting its own silver, AG will also be able to cut down unit production costs and expedite delivery time to customers. The move to open its mint ensures that the company’s bullion store will have adequate supply to fulfill customers' demand.

First Mint uses advanced equipment, which requires less electricity and emits no gasses compared with traditional minting techniques. The mint is now seeking ISO 9001 accreditation, which will allow its silver to be used in Individual Retirement Account. With this certification, First Mint will completely guarantee the weight, purity and content of its bullion products.

The company will commemorate and sell the inaugural production run of bullion bars as collectibles. The limited edition "First Strike" products will consist of 1,000 one-kilogram bars, 2,500 ten-ounce bars and 5,000 five-ounce bars. These will come with certificates of authenticity and exclusive packaging.

As output increases, investors should anticipate the mint to maintain a consistent supply of cast bars and one-ounce silver rounds, with additional capacity to service third-party projects.

The company reported an adjusted loss per share of 3 cents in fourth-quarter 2023, which beat the Zacks Consensus Estimate of a loss of 4 cents per share. The company had reported a loss of 7 cents per share in the year-ago quarter. First Majestic’s revenues decreased 7.6% year over year to $137 million in the quarter under review. The average realized silver price was $24.16 per payable silver equivalent ounce in the quarter, up 4% year over year.

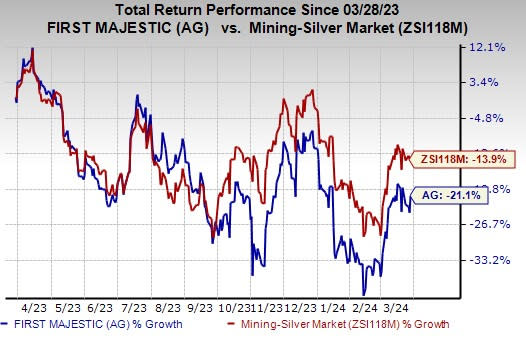

Price Performance

Shares of the company have fallen 21.1% in the past year compared with the industry’s 13.9% decline.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

First Majestic currently carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks from the basic materials space are Ecolab Inc. ECL, Carpenter Technology Corporation CRS and Hawkins, Inc. HWKN. ECL and CRS sport a Zacks Rank #1 (Strong Buy) each at present, and HWKN has a current Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Ecolab’s 2024 earnings is pegged at $6.39 per share, indicating an increase of 22.7% from the prior year’s reported number. It has an average trailing four-quarter earnings surprise of 1.7%. ECL shares have gained 41.8% in a year.

The Zacks Consensus Estimate for Carpenter Technology’s 2024 earnings is pegged at $4.00 per share. The consensus estimate for 2024 earnings has moved 1% north in the past 60 days. It has an average trailing four-quarter earnings surprise of 14.3%. CRS shares have gained 33.5% in a year.

The Zacks Consensus Estimate for Hawkins’ fiscal 2024 earnings is pegged at $3.61 per share, indicating a year-over-year rise of 26.2%. The consensus estimate for HWKN’s current-year earnings has been revised 4.3% north in the past 60 days. It has an average trailing four-quarter earnings surprise of 30.6%. The company’s shares have rallied 70% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

First Majestic Silver Corp. (AG) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report