1 Magnificent Growth Stock to Buy and Hold

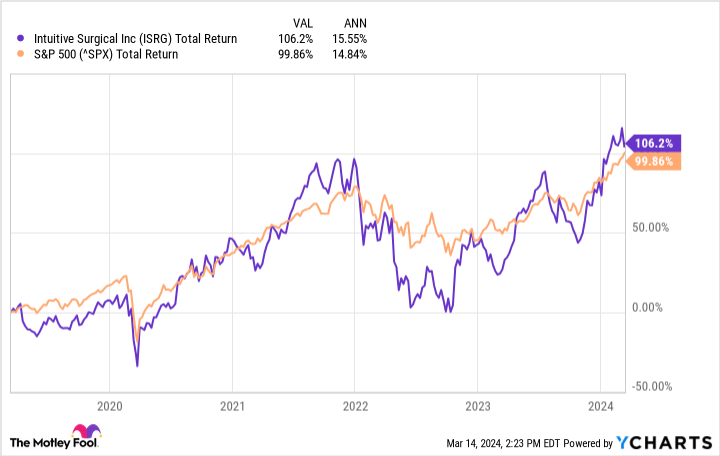

Over the past five years, Intuitive Surgical (NASDAQ: ISRG) has gone through numerous trials and tribulations. The pandemic significantly disrupted its operations, initially leading to worse financial results than hoped. Various economic issues, including supply chain problems, have also affected Intuitive Surgical in the past half a decade. Still, the medical device specialist has delivered solid returns during this period.

Though Intuitive Surgical still has some challenges to deal with (more on that later), the company has all the makings of an outstanding stock to hold onto for a while. Let's find out why.

The core business is rock solid

Intuitive Surgical develops robotic-assisted surgery (RAS) systems. The da Vinci system is the company's flagship product. Though these cost between $700,000 and $2.5 million, the medical device specialist makes most of its money from its instruments and accessories segment. The more procedures performed with its machine, the more instruments physicians need to order, and the higher the company's revenue.

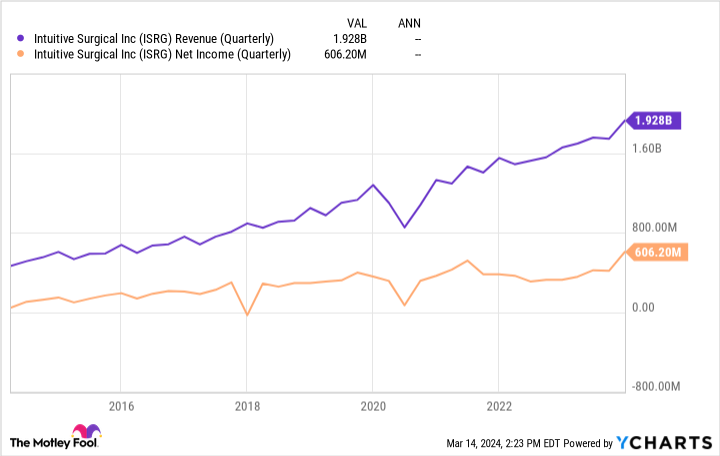

Intuitive's top line should continue moving in the right direction as long as it expands its installed base, which it has been doing for a long time. It ended 2023 with 8,606 installed da Vinci systems, an increase of 14% year over year. Furthermore, a general rise in demand for the kinds of procedures done with the da Vinci system should also lead to higher revenue.

The da Vinci system is used to perform a range of surgeries, from hernia repairs to colon resection procedures. With an aging population, many of these operations will become much more common, a powerful tailwind from which Intuitive Surgical will benefit. The company has been riding the wave of the increased adoption of RAS for a while (the da Vinci system was first cleared in the U.S. in 2000), leading to excellent financial results. Can the medical device specialist keep it up?

There are challenges, but they're not insurmountable

Several things could get in Intuitive Surgical's way. Let's consider two of them. The first is competition. Other healthcare giants, most notably Johnson & Johnson and Medtronic, are trying to get a piece of the RAS market. However, both have some ways to go before catching up to Intuitive Surgical. J&J's robot system, Ottava, has not yet been cleared in the U.S. The company plans to submit an application in the second half of this year to start clinical trials in the country.

The U.S. is generally the most lucrative market, so Johnson & Johnson is far behind. Medtronic's Hugo is already running clinical trials in the U.S., but it has yet to receive full regulatory clearance. Even if those two companies join the market, the RAS industry is severely underpenetrated. As Medtronic's management recently noted, only 5% of procedures that can be performed robotically currently are.

So there is room for multiple winners here over the long run.

Second, Intuitive Surgical runs the risk that demand for some of the procedures performed with its crown jewel will decrease. That has happened with the recent rise in popularity of weight loss medicines like Wegovy, which reduced volume growth in bariatric procedures. But as management notes, these make up only between 4% and 5% of total worldwide procedures. Even if these are cut in half, given the massive runway for growth in the RAS market, it shouldn't matter too much for Intuitive Surgical's financial results over the long run.

Buy and forget

Intuitive Surgical has shown incredible resilience in the past few years, handling difficult conditions and slightly outperforming the broader market. That speaks volumes about the company's underlying business. Given its position in the RAS industry and the opportunities this field offers, Intuitive Surgical could deliver outsize returns over the long run to patient investors.

Should you invest $1,000 in Intuitive Surgical right now?

Before you buy stock in Intuitive Surgical, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Intuitive Surgical wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 20, 2024

Prosper Junior Bakiny has positions in Intuitive Surgical and Johnson & Johnson. The Motley Fool has positions in and recommends Intuitive Surgical. The Motley Fool recommends Johnson & Johnson and Medtronic. The Motley Fool has a disclosure policy.

1 Magnificent Growth Stock to Buy and Hold was originally published by The Motley Fool