Insider Buying: Director Weston Hicks Acquires Shares of White Mountains Insurance Group Ltd

Insider buying is often regarded as a bullish signal for a company's stock, as it suggests that insiders are confident in the firm's future prospects. In a recent transaction, Director Weston Hicks demonstrated such confidence by purchasing shares of White Mountains Insurance Group Ltd (NYSE:WTM). This article will delve into the details of the transaction, provide an overview of Weston Hicks's role within the company, and analyze the business of White Mountains Insurance Group Ltd. Additionally, we will discuss the implications of insider buying and selling trends, as well as the company's valuation in the context of its market performance.

Who is Weston Hicks of White Mountains Insurance Group Ltd?

Weston Hicks is a notable figure within the insurance industry and has been associated with White Mountains Insurance Group Ltd for several years. Hicks has served in various capacities, including leadership roles that have given him a deep understanding of the company's operations and strategic direction. His insider status and decision to invest personally in the company's stock is a testament to his belief in the firm's value and potential for growth.

White Mountains Insurance Group Ltd's Business Description

White Mountains Insurance Group Ltd is a diversified insurance and financial services holding company. The company's principal business operations are conducted through its insurance subsidiaries and other affiliates. White Mountains' strategy focuses on providing insurance, reinsurance, and related services to clients and policyholders. The company's approach to business is characterized by a conservative underwriting philosophy, a focus on long-term relationships, and a commitment to maintaining financial strength and stability.

Description of Insider Buy/Sell

Insider transactions, including buys and sells, are closely monitored by investors as they can provide insights into the sentiment of those with the most intimate knowledge of a company's inner workings. An insider buy, such as the one executed by Weston Hicks, indicates that the insider believes the stock is undervalued or that it has strong future prospects. Conversely, insider sells may suggest that insiders believe the stock is fully valued or that they are diversifying their investments for personal financial planning reasons.

According to the data provided, over the past year, Weston Hicks has purchased 1,000 shares in total and has not sold any shares. This pattern of behavior underscores a commitment to the company and a positive outlook on its future performance.

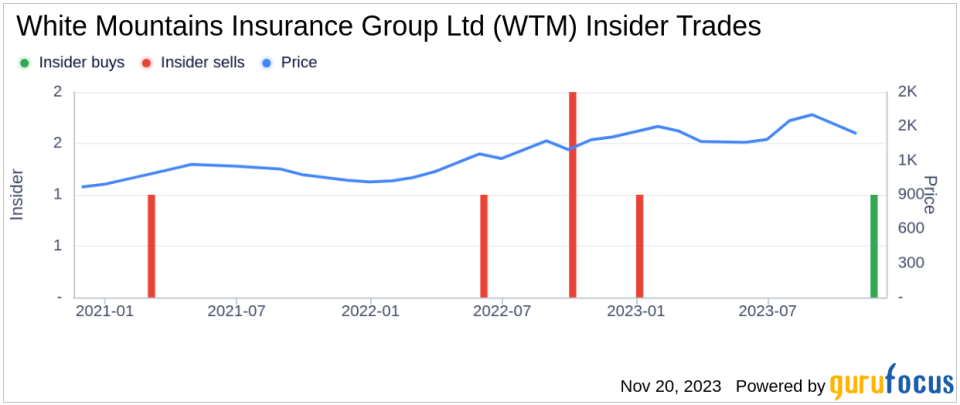

Insider Trends

The insider transaction history for White Mountains Insurance Group Ltd shows a balanced picture of insider activity over the past year, with 1 insider buy and 1 insider sell. This could indicate a neutral sentiment among insiders or reflect individual investment decisions rather than a collective view of the company's prospects.

Valuation

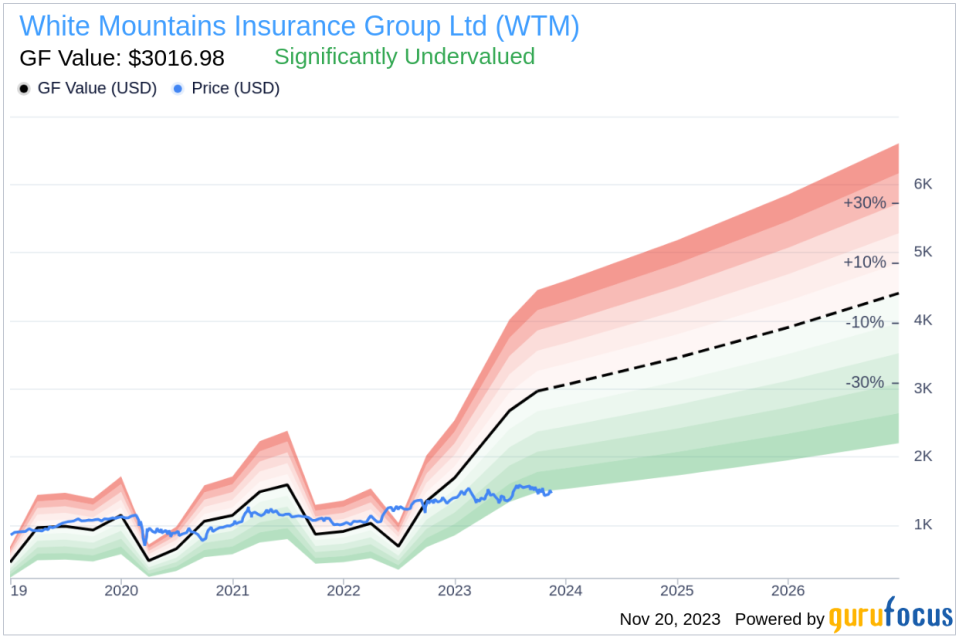

On the day of Weston Hicks's recent buy, shares of White Mountains Insurance Group Ltd were trading at $1,480.56, giving the company a market cap of $3.732 billion. The price-earnings ratio stands at 14.24, which is higher than the industry median of 10.77 and also above the company's historical median price-earnings ratio. This suggests that the stock is trading at a premium compared to its peers and its own historical valuation.

However, with a price of $1,480.56 and a GuruFocus Value of $3,016.98, White Mountains Insurance Group Ltd has a price-to-GF-Value ratio of 0.49. This indicates that the stock is significantly undervalued based on its GF Value.

The GF Value is an intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. The significant undervaluation suggested by the GF Value could be a key factor in Weston Hicks's decision to increase his stake in the company.

Conclusion

The insider buying activity by Director Weston Hicks at White Mountains Insurance Group Ltd is a noteworthy event that warrants investor attention. While the company's stock is trading at a higher price-earnings ratio than the industry median, the GF Value suggests that it is significantly undervalued. This discrepancy between market price and intrinsic value could present an opportunity for investors who agree with the insider's assessment of the company's prospects.

As with any investment decision, it is important for investors to conduct their own due diligence and consider the broader market context, the company's financial health, and their investment strategy. However, insider buying, such as that demonstrated by Weston Hicks, can often serve as a useful piece of the puzzle when evaluating a company's stock for potential investment.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.