It's Down 29% But Valeo Pharma Inc. (TSE:VPH) Could Be Riskier Than It Looks

To the annoyance of some shareholders, Valeo Pharma Inc. (TSE:VPH) shares are down a considerable 29% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 30% share price drop.

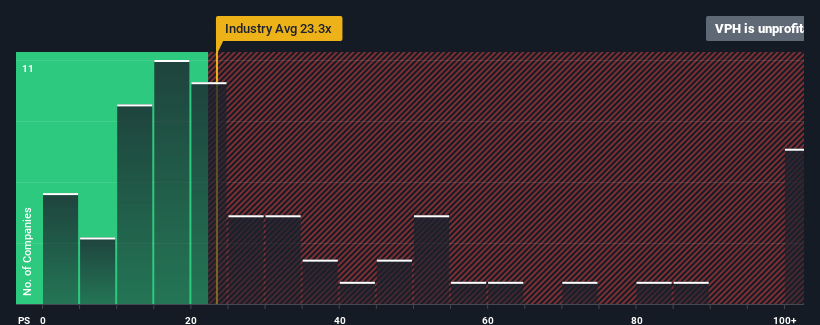

In spite of the heavy fall in price, Valeo Pharma's price-to-earnings (or "P/E") ratio of -1.2x might still make it look like a strong buy right now compared to the market in Canada, where around half of the companies have P/E ratios above 12x and even P/E's above 26x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Recent times haven't been advantageous for Valeo Pharma as its earnings have been falling quicker than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for Valeo Pharma

Want the full picture on analyst estimates for the company? Then our free report on Valeo Pharma will help you uncover what's on the horizon.

Is There Any Growth For Valeo Pharma?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Valeo Pharma's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 27%. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, EPS is anticipated to climb by 51% during the coming year according to the four analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 11%, which is noticeably less attractive.

In light of this, it's peculiar that Valeo Pharma's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Valeo Pharma's P/E?

Having almost fallen off a cliff, Valeo Pharma's share price has pulled its P/E way down as well. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Valeo Pharma's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Valeo Pharma (at least 1 which doesn't sit too well with us), and understanding these should be part of your investment process.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here