If EPS Growth Is Important To You, Tye Soon (SGX:BFU) Presents An Opportunity

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Tye Soon (SGX:BFU). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Tye Soon

How Fast Is Tye Soon Growing Its Earnings Per Share?

Tye Soon has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. Thus, it makes sense to focus on more recent growth rates, instead. Tye Soon's EPS skyrocketed from S$0.037 to S$0.061, in just one year; a result that's bound to bring a smile to shareholders. That's a fantastic gain of 64%.

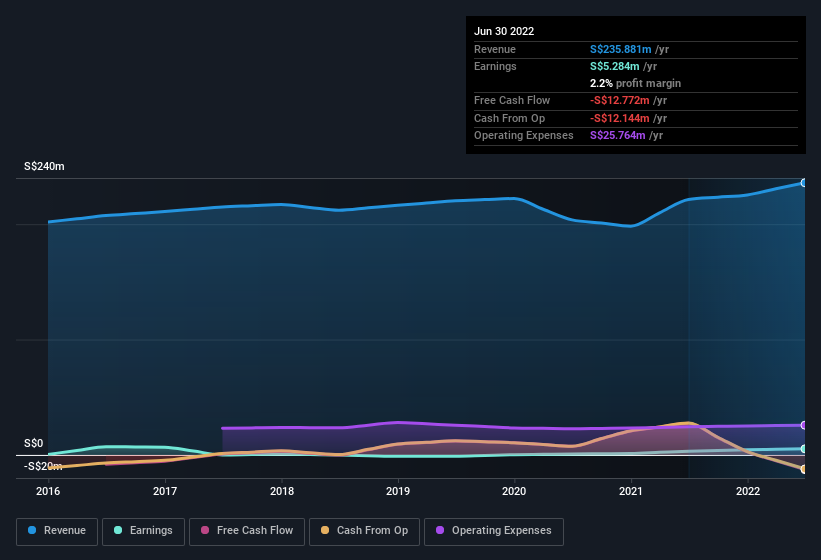

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. EBIT margins for Tye Soon remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 6.5% to S$236m. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Tye Soon isn't a huge company, given its market capitalisation of S$36m. That makes it extra important to check on its balance sheet strength.

Are Tye Soon Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

First things first, there weren't any reports of insiders selling shares in Tye Soon in the last 12 months. But the important part is that MD & Executive Director Tek Yew Chong spent S$303k buying stock, at an average price of S$0.40. Big buys like that may signal an opportunity; actions speak louder than words.

Should You Add Tye Soon To Your Watchlist?

For growth investors, Tye Soon's raw rate of earnings growth is a beacon in the night. Growth in EPS isn't the only striking feature with company insiders adding to their holdings being another noteworthy vote of confidence for the company. In essence, your time will not be wasted checking out Tye Soon in more detail. Still, you should learn about the 3 warning signs we've spotted with Tye Soon (including 1 which can't be ignored).

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Tye Soon, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here