Valvoline's (VVV) Earnings and Revenues Beat Estimates in Q2

Valvoline Inc. VVV reported earnings from continuing operations of 33 cents per share in second-quarter fiscal 2024 (ended Mar 31, 2024), up from the year-ago quarter's earnings of 19 cents.

Barring one-time items, adjusted earnings were 37 cents per share for the quarter, up from 23 cents per share a year ago. It beat the Zacks Consensus Estimate of 36 cents.

Valvoline Price, Consensus and EPS Surprise

Valvoline price-consensus-eps-surprise-chart | Valvoline Quote

Revenues

Net sales increased around 13% year over year to $388.7 million in the quarter. The metric beat the Zacks Consensus Estimate of $388.5 million. In the fiscal second quarter, system-wide same-store sales (SSS) increased 7.7%.

Financials

At the end of the quarter, Valvoline had cash and cash equivalents of $494.5 million, up around 18% sequentially. Long-term debt was $951.3 million, down roughly 39% sequentially.

For the six months ended Mar 31, 2024, operating cash flows from continuing operations were $92 million and free cash flow was $5 million.

In the second quarter, VVV repurchased $40 million of shares, thereby completing the $1.6 billion share buyback authorization.

Outlook

The company expects net revenues in the band of $1.6-$1.65 billion for fiscal 2024. System-wide SSS growth is expected to be 6-8%. Adjusted EBITDA is forecast be in the range of $430-$455 million for fiscal 2024. VVV also sees fiscal 2024 adjusted earnings of $1.45-$1.65 per share.

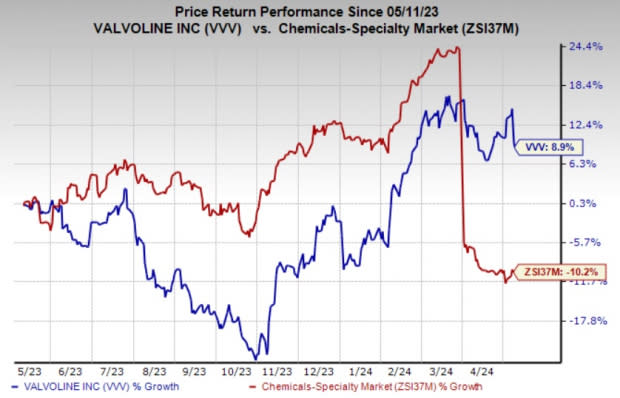

Price Performance

Valvoline’s shares have increased 8.9% in the past year compared with a 10.2% decline of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Other Chemicals Releases

VVV currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Celanese Corporation CE logged adjusted earnings for the first quarter of $2.08 per share, up 3.5% from $2.01 reported a year ago. The bottom line surpassed the Zacks Consensus Estimate of $1.91.

Celanese sees adjusted earnings in the band of $2.60 to $3 per share for the second quarter of 2024. CE expects to deliver higher earnings performance in the second quarter and into the second half of 2024.

Ingevity Corporation NGVT reported adjusted earnings of 52 cents per share for the first quarter, down from $1.09 in the year-ago quarter. The figure beat the Zacks Consensus Estimate of 37 cents.

NGVT sees its sales for 2024 in the band of $1.4-$1.55 billion and adjusted EBITDA in the range of $365-$390 million.

Element Solutions Inc’s ESI adjusted earnings of 34 cents per share for the first quarter beat the Zacks Consensus Estimate of 32 cents.

ESI now expects adjusted EBITDA in the range of $515-$530 million for 2024. For second-quarter 2024, it sees adjusted EBITDA to be around $125 million.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Element Solutions Inc. (ESI) : Free Stock Analysis Report

Celanese Corporation (CE) : Free Stock Analysis Report

Ingevity Corporation (NGVT) : Free Stock Analysis Report

Valvoline (VVV) : Free Stock Analysis Report