Blackstone Secured Lending Fund (BXSL) Reports Q1 2024 Earnings: Consistent with Analyst Projections

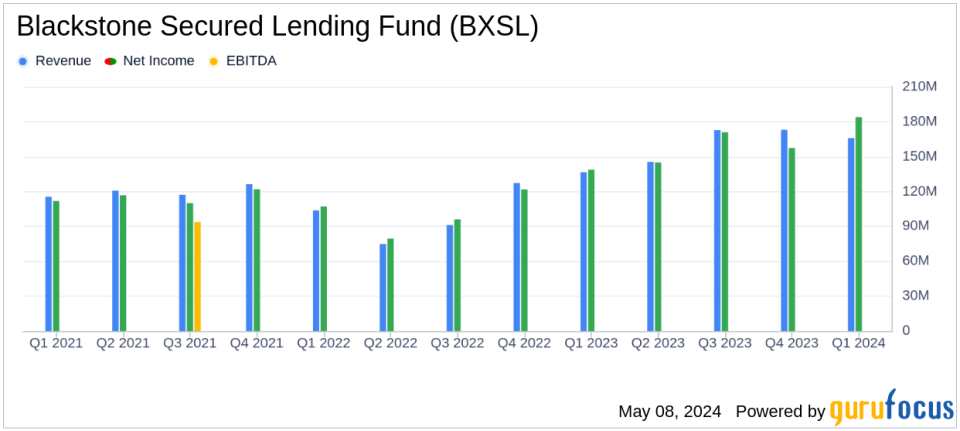

Net Investment Income: Reported $166 million, or $0.87 per share, falling short of the previous year's $0.93 per share and below the analyst estimate of $0.92 per share.

Net Income: Achieved $184 million, or $0.96 per share, surpassing the previous year's $0.86 per share and exceeding the estimated $0.92 per share.

Revenue: Total investment income reached $304 million for the quarter, showing robust growth from the previous year's $265 million.

Dividend: Declared a regular dividend of $0.77 per share, consistent with previous quarters and supported by a dividend coverage ratio of 113%.

Portfolio Health: Maintained strong credit performance with 98.5% of the portfolio in first lien, senior secured debt and non-accruals at just 0.1%.

Investment Activity: New investment commitments surged to $1.2 billion at par, with $719 million funded during the quarter, highlighting aggressive capital deployment.

Liquidity and Leverage: Reported $1.4 billion in available liquidity and a conservative leverage ratio of 1.03x, indicating a strong balance sheet.

On May 8, 2024, Blackstone Secured Lending Fund (NYSE:BXSL) disclosed its first quarter results for the year, aligning closely with analyst expectations. The detailed financial outcomes can be explored in their 8-K filing.

As a specialty finance entity focusing on the debt of private U.S. companies, BXSL continues to demonstrate a strong financial posture, underscored by a net investment income (NII) of $166 million, or $0.87 per share, and a net income of $184 million, or $0.96 per share for the quarter. These figures reflect a stable performance compared to previous quarters and align with the estimated earnings per share of $0.92 and net income of $169.20 million projected by analysts.

Company Overview and Strategic Focus

Blackstone Secured Lending Fund operates as a non-diversified, closed-end management investment company, aiming primarily to generate current income and, to a lesser extent, long-term capital appreciation through investments in senior secured loans and other securities of private U.S. companies. With an investment portfolio heavily weighted towards first lien senior secured debt, BXSL maintains a defensive posture with 98.5% of its investments in this category, showcasing a low loan-to-value ratio under 50% and minimal non-accruals, which stand at just 0.1% at cost.

Financial Performance and Market Position

The company reported a robust net asset value (NAV) of approximately $5.2 billion, or $26.87 per share, as of March 31, 2024. This financial health is supported by new investment commitments which reached $1.2 billion during the quarter, marking the highest level since 2021. The dividend for the second quarter of 2024 has been declared at $0.77 per share, consistent with the company's strong earnings coverage.

Investment and Portfolio Health

BXSL's investment strategy, focusing on low-leverage loans to companies with strong sponsor relationships, continues to bear fruit. The portfolio's performance benefits significantly from an elevated interest rate environment, with 98.8% of the debt investments being floating rate. The company's disciplined investment approach and broad industry diversification, spanning software, healthcare, and professional services, among others, position it well for sustained growth and resilience against market volatility.

Challenges and Forward Outlook

While BXSL's current positioning is robust, the management remains vigilant about potential market shifts and regulatory changes that could impact performance. The ongoing strategic focus on senior secured lending and maintaining strong sponsor ties are pivotal in navigating future uncertainties.

In summary, Blackstone Secured Lending Fund's Q1 2024 performance solidifies its market position, backed by a strong portfolio and consistent dividend payouts. The company's strategic maneuvers and financial prudence are expected to continue driving its objectives of generating attractive, risk-adjusted returns for its shareholders.

For further details and updates, stakeholders are encouraged to refer to the official BXSL communications and upcoming financial disclosures.

Explore the complete 8-K earnings release (here) from Blackstone Secured Lending Fund for further details.

This article first appeared on GuruFocus.