Insider Sale: Nicolas Catoggio Sells 1,500 Shares of Post Holdings Inc (POST)

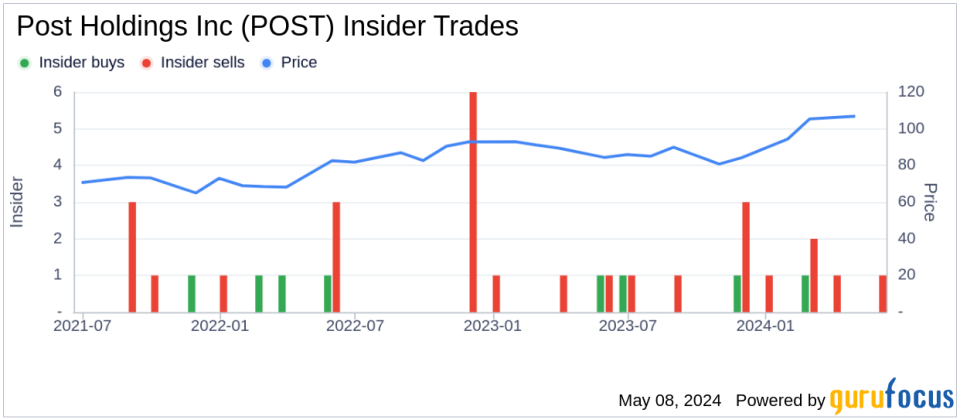

On May 7, 2024, Nicolas Catoggio, President & CEO of PCB at Post Holdings Inc (NYSE:POST), sold 1,500 shares of the company. The transaction was filed on the same day with the SEC. Over the past year, the insider has sold a total of 5,800 shares and has not made any purchases.

Post Holdings Inc, based in St. Louis, Missouri, operates within the consumer packaged goods industry. The company primarily focuses on center-of-the-store, refrigerated, foodservice, food ingredient, active nutrition, and private brand food categories.

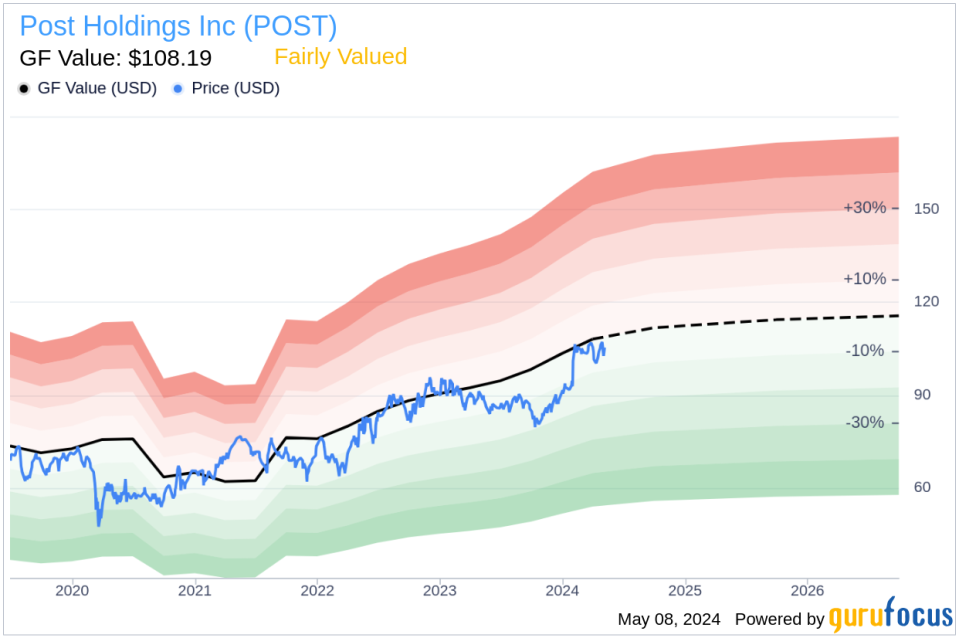

Shares of Post Holdings Inc were trading at $105.62 on the day of the sale, giving the company a market cap of approximately $6.41 billion. The price-earnings ratio of the stock stands at 20.26, which is above both the industry median of 18.865 and the historical median for the company.

The stock's valuation according to GF Value is $108.19, indicating a price-to-GF-Value ratio of 0.98. This suggests that Post Holdings Inc is Fairly Valued in the market.

Reviewing the insider transaction history for Post Holdings Inc, there have been 4 insider buys and 11 insider sells over the past year. This activity provides a broader context for the insider's recent transaction.

For more detailed information, please refer to the official SEC Filing.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.