Middleby Corp (MIDD) Q1 Earnings: Misses Analyst Revenue Forecasts with Adjusted EPS Below ...

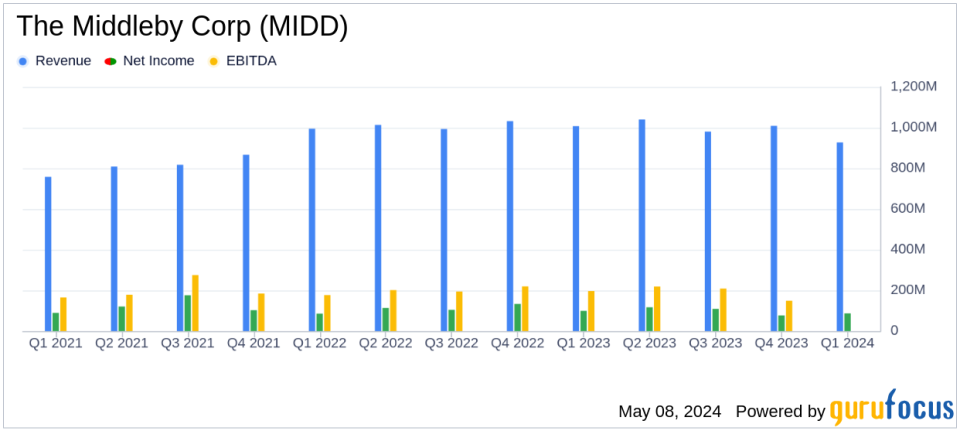

Reported Revenue: $927M, down 8% year-over-year, falling short of estimates of $978.58M.

Net Earnings: $86.57M, down from $99.09M in the previous year, falling short of estimates of $112.37M.

Deluted Earnings Per Share (EPS): $1.59, less than $1.82 year-over-year, below the estimated $2.06.

Adjusted EBITDA: $185.8M, decreased from $210.9M in the prior year, indicating a reduction in profitability.

Operating Cash Flows: Increased significantly to $141M from $92M in the previous year, highlighting improved cash generation.

Organic Adjusted EBITDA Margin: Reported at 20.1%, reflecting operational efficiency amidst challenging market conditions.

Net Leverage: Reduced to 2.4x, down from previous levels, improving the company's financial stability.

On May 8, 2024, The Middleby Corporation (NASDAQ:MIDD), a leader in the design, manufacture, and distribution of foodservice equipment, reported its first quarter results. The company's detailed financial performance can be accessed through its 8-K filing. Despite challenging market conditions, Middleby expressed optimism about the upcoming quarters.

Company Overview

The Middleby Corp operates through three primary segments: Commercial Foodservice Equipment Group, Food Processing Equipment Group, and Residential Kitchen Equipment Group. The majority of its revenue is generated from the Commercial Foodservice Equipment segment, serving an international clientele.

First Quarter Financial Highlights

Middleby reported net sales of $927 million for the quarter, marking an 8.0% decrease compared to the previous year, and falling short of the estimated $978.58 million. The adjusted earnings per share (EPS) were $1.89, also below the analyst expectation of $2.06. Despite these figures, the company managed to reduce its net leverage to 2.4x and reported a significant increase in operating cash flows to $141 million from $92 million in the prior year.

Segment Performance and Challenges

The decrease in net sales was observed across all segments, with the Residential Kitchen segment experiencing the most substantial decline of 21.0%. This segment's performance was notably impacted by low order volumes. However, the company's Commercial Foodservice and Food Processing segments also faced declines, though they were less pronounced.

Operational and Financial Metrics

Adjusted EBITDA for the quarter stood at $186 million with an organic adjusted EBITDA margin of 20.1%. The company's efforts to optimize its product offerings and operational efficiency are evident in its strong cash flow generation and reduced debt levels. Middleby's total assets amounted to $6.93 billion as of March 30, 2024, with a slight increase from the end of the previous fiscal year.

Management's Outlook and Strategic Moves

CEO Tim FitzGerald highlighted the difficulties in near-term demand but remained optimistic about the future, citing normalized channel inventories and positive trends in order activity. Middleby is also gearing up to showcase its innovations at the upcoming National Restaurant Show, which includes several products that have received the Kitchen Innovations Award.

Investor and Analyst Perspectives

While the first quarter results did not meet analyst expectations, Middleby's strategic positioning and robust product pipeline provide a basis for potential recovery and growth in the upcoming quarters. Investors and analysts will likely keep a close watch on the company's ability to convert its innovations and market strategies into financial performance.

The scheduled conference call to discuss these results could provide further insights into the company's strategies and outlook, making it a critical event for stakeholders.

In conclusion, while Middleby faces short-term challenges, its strong innovation focus and market adaptation strategies could pave the way for improved performance in the highly competitive foodservice equipment industry.

Explore the complete 8-K earnings release (here) from The Middleby Corp for further details.

This article first appeared on GuruFocus.