The Returns At E.A. Technique (M) Berhad (KLSE:EATECH) Aren't Growing

What trends should we look for it we want to identify stocks that can multiply in value over the long term? Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. So while E.A. Technique (M) Berhad (KLSE:EATECH) has a high ROCE right now, lets see what we can decipher from how returns are changing.

Understanding Return On Capital Employed (ROCE)

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. To calculate this metric for E.A. Technique (M) Berhad, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.24 = RM38m ÷ (RM485m - RM328m) (Based on the trailing twelve months to December 2023).

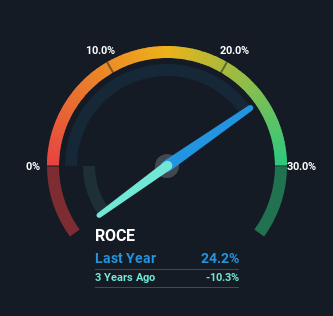

Therefore, E.A. Technique (M) Berhad has an ROCE of 24%. In absolute terms that's a great return and it's even better than the Oil and Gas industry average of 13%.

See our latest analysis for E.A. Technique (M) Berhad

Historical performance is a great place to start when researching a stock so above you can see the gauge for E.A. Technique (M) Berhad's ROCE against it's prior returns. If you're interested in investigating E.A. Technique (M) Berhad's past further, check out this free graph covering E.A. Technique (M) Berhad's past earnings, revenue and cash flow.

What Does the ROCE Trend For E.A. Technique (M) Berhad Tell Us?

Over the past five years, E.A. Technique (M) Berhad's ROCE has remained relatively flat while the business is using 69% less capital than before. When a company effectively decreases its assets base, it's not usually a sign to be optimistic on that company. However, the business's operational efficiency is still impressive considering the ROCE is high in absolute terms.

Another point to note, we noticed the company has increased current liabilities over the last five years. This is intriguing because if current liabilities hadn't increased to 68% of total assets, this reported ROCE would probably be less than24% because total capital employed would be higher.The 24% ROCE could be even lower if current liabilities weren't 68% of total assets, because the the formula would show a larger base of total capital employed. So with current liabilities at such high levels, this effectively means the likes of suppliers or short-term creditors are funding a meaningful part of the business, which in some instances can bring some risks.

What We Can Learn From E.A. Technique (M) Berhad's ROCE

In summary, E.A. Technique (M) Berhad isn't reinvesting funds back into the business and returns aren't growing. And in the last five years, the stock has given away 29% so the market doesn't look too hopeful on these trends strengthening any time soon. In any case, the stock doesn't have these traits of a multi-bagger discussed above, so if that's what you're looking for, we think you'd have more luck elsewhere.

If you want to know some of the risks facing E.A. Technique (M) Berhad we've found 3 warning signs (1 is concerning!) that you should be aware of before investing here.

If you'd like to see other companies earning high returns, check out our free list of companies earning high returns with solid balance sheets here.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.