Here's Why We Think Old Chang Kee (Catalist:5ML) Might Deserve Your Attention Today

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Old Chang Kee (Catalist:5ML). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Old Chang Kee with the means to add long-term value to shareholders.

See our latest analysis for Old Chang Kee

Old Chang Kee's Improving Profits

Old Chang Kee has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. Thus, it makes sense to focus on more recent growth rates, instead. Over the last year, Old Chang Kee increased its EPS from S$0.047 to S$0.051. That's a modest gain of 8.4%.

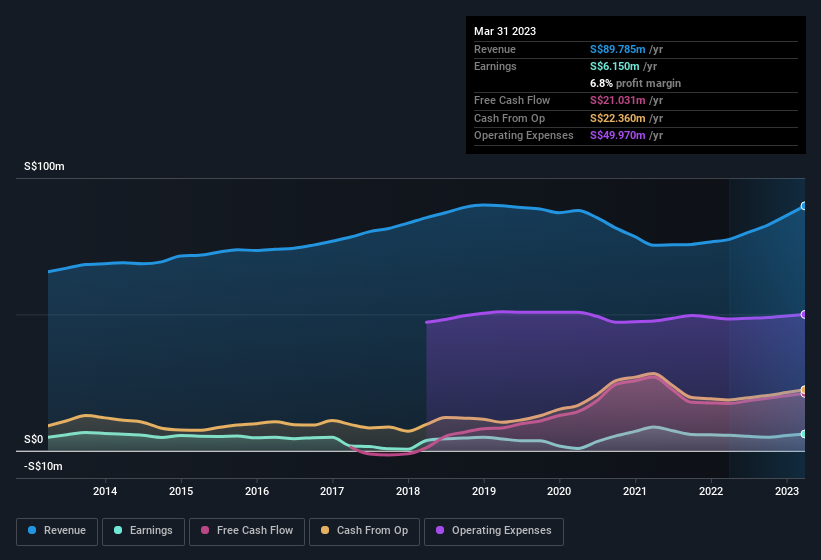

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The music to the ears of Old Chang Kee shareholders is that EBIT margins have grown from 0.1% to 7.6% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Since Old Chang Kee is no giant, with a market capitalisation of S$80m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Old Chang Kee Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So as you can imagine, the fact that Old Chang Kee insiders own a significant number of shares certainly is appealing. In fact, they own 76% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. With that sort of holding, insiders have about S$61m riding on the stock, at current prices. That's nothing to sneeze at!

Should You Add Old Chang Kee To Your Watchlist?

As previously touched on, Old Chang Kee is a growing business, which is encouraging. To add an extra spark to the fire, significant insider ownership in the company is another highlight. These two factors are a huge highlight for the company which should be a strong contender your watchlists. It's still necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Old Chang Kee (at least 1 which is a bit concerning) , and understanding them should be part of your investment process.

Although Old Chang Kee certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.