What is a red herring prospectus

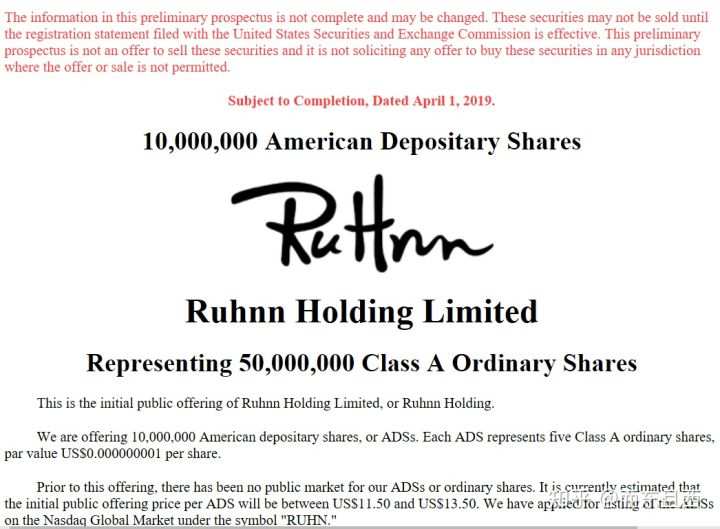

Red herring refers to the due diligence at the company IPO to gain public trust and approval from government agencies. Red Herring Prospectus, is called the preliminary prospectus, in addition to the specific issuing price, it contains almost all the information about the listing and issuance. Although it does not include a specific price, it includes the range of the issuing price. Usually, as soon as the registration statement is submitted, the underwriter begins to issue the preliminary offering statement. Since the securities registration has not yet taken effect, SEC requires that the specification must be stated in scarlet letters on the cover (see picture below for example). The red herring is named after it.

This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. Moomoo makes no representation or warranty as to its adequacy, completeness, accuracy or timeliness for any particular purpose of the above content.