Hey mooers

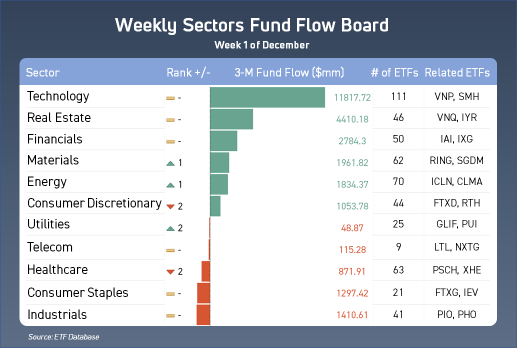

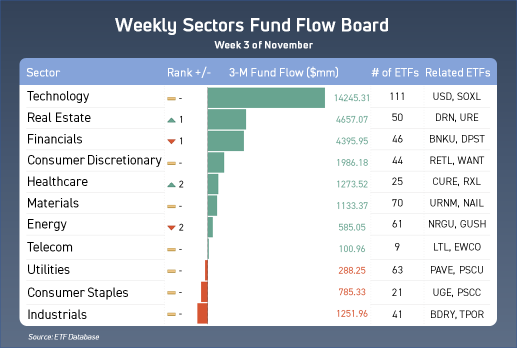

Happy Friday! Weekly Sectors Fund Flow Board is here~

From this chart, you will be able to find out what sector ETFs have most fund inflow. Fund inflow is often considered as a bullish sign of the sector and related ETFs!

^Weekly Sectors Fund Flow Board: a sector ranking based on sector ETFs aggregate 3-month fund flows.

^3-month fund flows: a metric that can be used to gauge the perceived popularity amongst investors of different sectors.

^The board includes the following information: change of rankings, 3-month fund flows, how many ETFs are in the sectors, and the related ETFs.

For this week, I covered the two highest ESG score sector-related ETFs ! Now, let's take a look at the board~You may find something to diversify your porfolio

* Follow me to know what is hot on the market

Sectors Updates:

*Tech

Technology stocks were mostly higher in late trade, with the

$The Technology Select Sector SPDR® Fund(XLK.US)$ Thursday rising 1% and the

$PHLX Semiconductor Index(.SOX.US)$ was flat, reversing a midday slide.

In company news,

$The Glimpse(VRAR.US)$ fell 8%, giving back a small mid-morning gain, after the virtual and augmented reality company announced its planned purchase of marketing agency Sector 5 Digital for $8 million upfront and up to $19 million more over the next three years.

To the upside,

$Snowflake(SNOW.US)$ rose more than 15% after the data platform company late Wednesday reported a strong reports. Revenue more than doubled compared with year-ago levels, rising 109% to $334.4 million and also beating the $306.1 million Street view.

$Okta(OKTA.US)$ added almost 13% on Thursday after the cloud-identity company overnight reported above-consensus Q3 results and also narrowed its projected FY22 net loss and raised its revenue forecast for 12 months ending Jan. 31.

*FIN

Financial stocks were ending near the peak of their Thursday advance, with the

$Financial Select Sector SPDR Fund(XLF.US)$ was gaining 3%.

Bitcoin was 0.3% lower at $57,116 while the yield for 10-year US Treasuries was 1.4 basis points higher at 1.448%.

In company news,

$Coastal Financial(CCB.US)$ rose 4.8% after Thursday announcing a new partnership with financial technology platform LendingPoint in a deal it anticipates will reduce the bank's risk and costs of lending and expand its geographic footprint. Financial terms were not disclosed.

*Real Estates

The Philadelphia Housing Index was climbing 4.3% and the

$Real Estate Select Sector Spdr Fund (The)(XLRE.US)$ was up 2.7%.

$Brixmor Property Group Inc(BRX.US)$ rose 6% after Truist Securities raised its price target for the real estate investment trust by $3 to $26 a share and reiterating its hold rating for the stock.

$Medallion Financial(MFIN.US)$ was 11.6% higher after the specialty lender said it closed on the sale of its Richard Petty Motorsports NASCAR race team to Warp Speed for $19.1 million. The company said the deal removes $26 million of intangible assets from its balance sheet and increases its tangible book value by over $1 per share.

*Health Care

Health care stocks were ending off Thursday's pace, with the NYSE Health Care Index rising 0.5% this afternoon while the

$The Health Care Select Sector SPDR® Fund(XLV.US)$ also was up 0.5%.

$Biofrontera(BFRI.US)$ soared 21% after the biopharmaceuticals company said it received a US patent for its pain-reducing illumination protocol combining its Ameluz medication with RhodoLED lamp.

$Omeros(OMER.US)$ climbed 7.3% after the biopharmaceuticals company said it was selling its OMIDRIA franchise to Rayner Surgical Group in a deal valued at more than $1 billion.

*Consumer

Consumer stocks were adding to prior gains late in Thursday trading, with the

$Consumer Staples Select Sector SPDR Fund(XLP.US)$ climbing 1% while the

$Consumer Discretionary Select Sector SPDR Fund(XLY.US)$ was rising 1.5%.

In company news,

$Duluth Holdings(DLTH.US)$ sped 18% higher after the clothier reported net income of $0.09 per share for its Q3 ended Oct. 31, triple its $0.03 per share profit last year and topping the single-analyst call expecting a GAAP loss of $0.30 per share. Net sales increased and the company also raised its FY21 earnings forecast.

$The Kroger(KR.US)$ rose over 11% after the grocery chain beat Wall Street estimates with its fiscal Q3 results and raised its FY22 earnings forecast.

*Energy

Energy stocks were racing higher this afternoon, with the NYSE Energy Sector Index climbing 3.2% while the

$Energy Select Sector SPDR Fund(XLE.US)$ was up 3%. The

$PHLX Oil Service Sector Index(.OSX.US)$ also was posting a 3.4% gain and the

$Dow Jones U.S. Utilities Index(.DJUSUT.US)$ was ahead 1.2%.

Front-month West Texas Intermediate crude oil settled $0.93 higher at $66.50 per barrel, reversing a morning decline, while the global benchmark Brent crude contract was advancing $1.49 to $70.36 per barrel.

Source: MT Newswires

Happy Friday! Weekly Sectors Fund Flow Board is here~

Happy Friday! Weekly Sectors Fund Flow Board is here~

darikus : good read

Isidro Fernandez : excellent, thanks

一买就跌一卖就涨 : Good

Tiggerpepper : We buying in All of them.