What is a spread

In forex trading, the spread is the difference between the bid (buy) price and the ask (sell) price of a currency pair. The ask price is always higher than the bid price, with the underlying market price being somewhere in-between. Most forex currency pairs are traded without commission, but the spread is one cost that applies to any forex trade that you place. Rather than charging a commission, all leveraged trading providers will incorporate a spread into the cost of placing a trade, as they factor in a higher ask price relative to the bid price. The size of the spread can be influenced by different factors, such as which currency pair you are trading and how volatile it is, the size of your trade and which provider you are using.

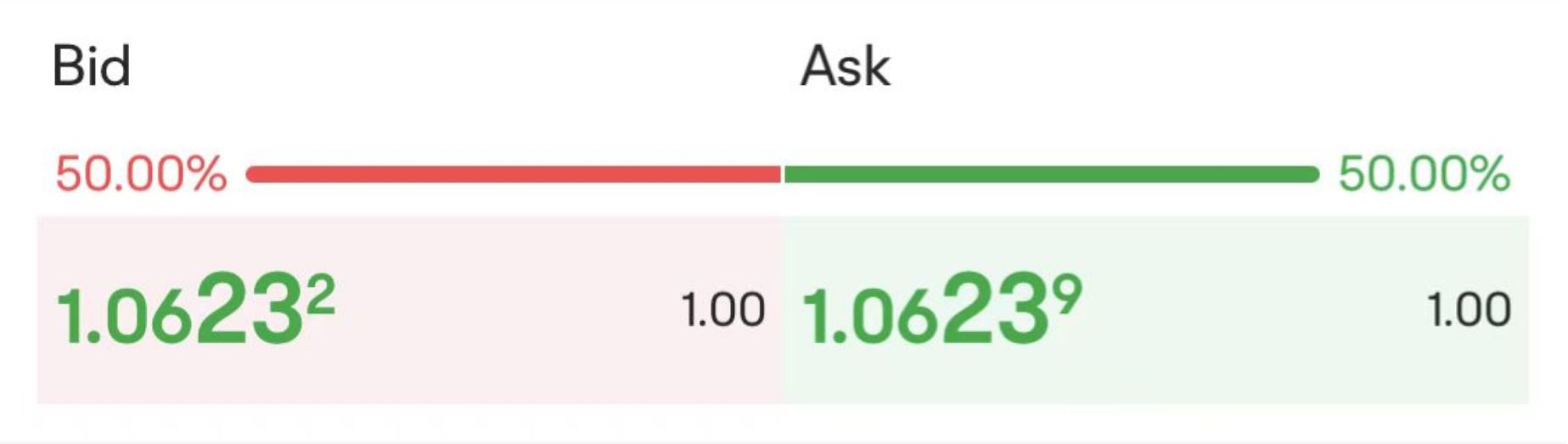

The spread is measured in pips, which is a small unit of movement in the price of a currency pair, and the fourth decimal point on the price quote (equal to 0.0001). This is true for the majority of currency pairs, aside from the Japanese yen where the pip is the second decimal point (0.01).

Taking EUR/USD as an example, if the ask price is 1.06239 and the bid price is 1.06232, then the spread will be 1.06239 – 1.06232 = 0.00007, or 0.7 pip.