Whales with a lot of money to spend have taken a noticeably bullish stance on Pfizer.

Looking at options history for Pfizer (NYSE:PFE) we detected 18 trades.

If we consider the specifics of each trade, it is accurate to state that 55% of the investors opened trades with bullish expectations and 44% with bearish.

From the overall spotted trades, 3 are puts, for a total amount of $635,420 and 15, calls, for a total amount of $588,190.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $25.0 and $31.0 for Pfizer, spanning the last three months.

Insights into Volume & Open Interest

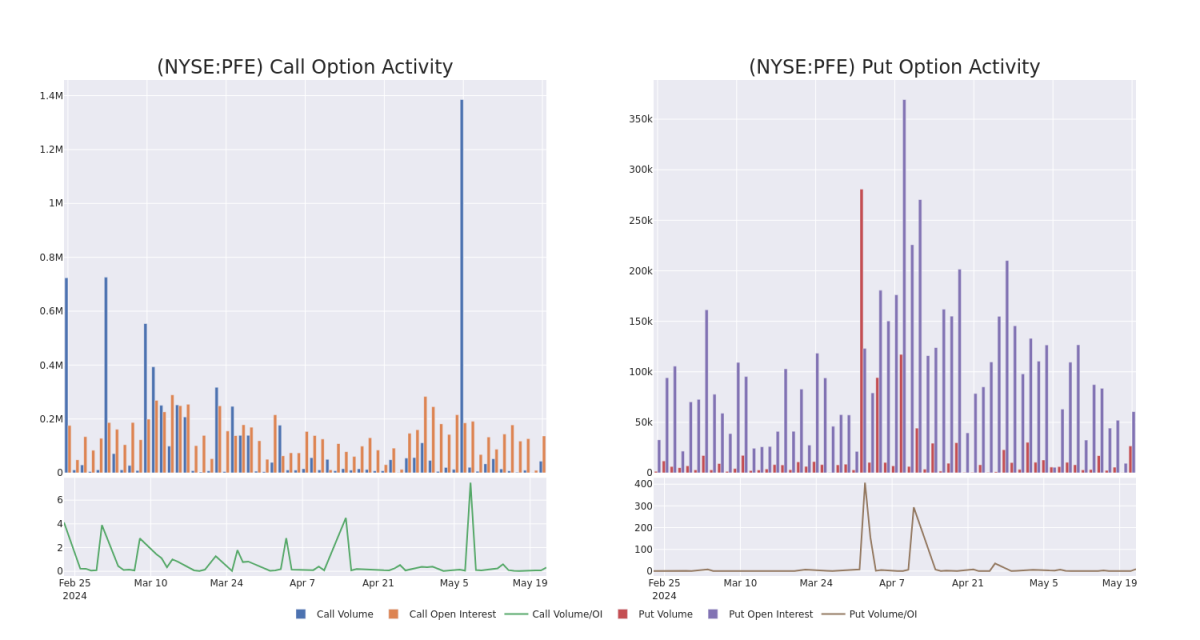

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Pfizer's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Pfizer's significant trades, within a strike price range of $25.0 to $31.0, over the past month.

Pfizer Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PFE | PUT | SWEEP | BEARISH | 01/17/25 | $0.69 | $0.61 | $0.66 | $25.00 | $327.5K | 58.9K | 5.0K |

| PFE | PUT | TRADE | BULLISH | 06/07/24 | $0.19 | $0.18 | $0.18 | $28.00 | $241.9K | 1.6K | 14.4K |

| PFE | CALL | SWEEP | BULLISH | 06/07/24 | $0.3 | $0.29 | $0.3 | $30.00 | $95.5K | 2.4K | 6.7K |

| PFE | PUT | SWEEP | BEARISH | 01/17/25 | $0.66 | $0.62 | $0.66 | $25.00 | $66.0K | 58.9K | 7.0K |

| PFE | CALL | SWEEP | BULLISH | 06/07/24 | $0.19 | $0.17 | $0.18 | $30.00 | $56.4K | 2.4K | 3.2K |

About Pfizer

Pfizer is one of the world's largest pharmaceutical firms, with annual sales close to $50 billion (excluding COVID-19 product sales). While it historically sold many types of healthcare products and chemicals, now prescription drugs and vaccines account for the majority of sales. Top sellers include pneumococcal vaccine Prevnar 13, cancer drug Ibrance, and cardiovascular treatment Eliquis. Pfizer sells these products globally, with international sales representing close to 50% of total sales. Within international sales, emerging markets are a major contributor.

Following our analysis of the options activities associated with Pfizer, we pivot to a closer look at the company's own performance.

Pfizer's Current Market Status

- With a trading volume of 17,877,955, the price of PFE is up by 2.47%, reaching $29.27.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 69 days from now.

Expert Opinions on Pfizer

In the last month, 2 experts released ratings on this stock with an average target price of $32.5.

- An analyst from BMO Capital has revised its rating downward to Outperform, adjusting the price target to $36.

- Consistent in their evaluation, an analyst from Morgan Stanley keeps a Equal-Weight rating on Pfizer with a target price of $29.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Pfizer with Benzinga Pro for real-time alerts.