Is the Vanguard S&P 500 ETF a Millionaire Maker?

Investing can be as complex or simple as you want it to be. Fortunately, keeping it simple can be a dependable route to making a ton of money in the stock market. Exchange-traded funds (ETFs) are like pushing the investing "easy button." These funds hold large portfolios of individual stocks, but trade under a single ticker symbol, allowing investors to easily gain exposure to dozens or hundreds of stocks.

Which ETF is the best? That's a tough question, but the Vanguard S&P 500 ETF (NYSEMKT: VOO) has a rock-solid argument for being at the top of the list. This single ticker can help you build life-changing wealth if you give it enough time.

What is the S&P 500?

The U.S. stock market comprises thousands of publicly traded companies. Yet when people talk about "the market" on TV or online, they're usually referring to the S&P 500. It's an index of 500 of America's largest and most prominent publicly traded companies. Though there are thousands of public companies that are not part of the index, these 500 giants together account for around 80% of the total value of the total U.S. equity market.

A committee governs the S&P 500 and determines which companies should be included. The committee occasionally removes companies if they falter and their values sink, replacing them with up-and-coming companies. The index's annual churn rate is in the low single-digit percentages, so new companies permeate the index gradually.

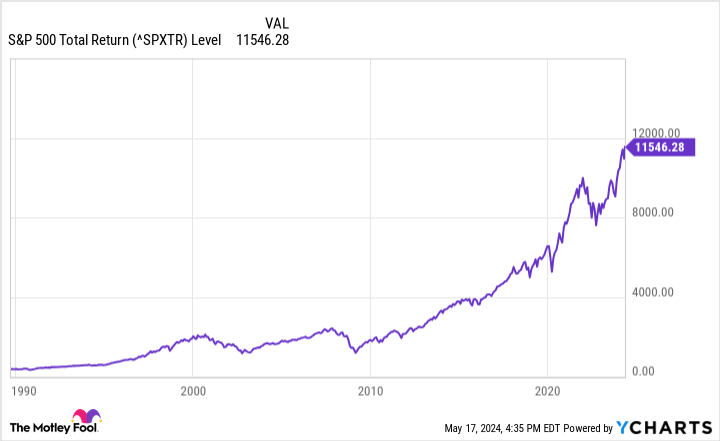

There is no arguing with its results. For those who invest in all of its components, the S&P 500 has proven a remarkable wealth-creating machine over time:

The index, like the market itself, can be volatile at times. It might rise 20% one year and fall 15% the next. But long term, the S&P 500 has historically appreciated at an average annualized rate of 10%. That means that an investment in it would double every seven years, on average. The Vanguard S&P 500 ETF is designed to mimic the index's composition and investment returns.

Why is it so good at creating wealth?

The S&P 500's effectiveness boils down to two consistent traits:

First, the S&P 500 only includes U.S.-based companies. The United States has been among the world's highest-performing economies for many years, meaning that domestic companies are growing and performing well. Having the best of this group in one index almost assures investors benefit from the best the U.S. economy offers.

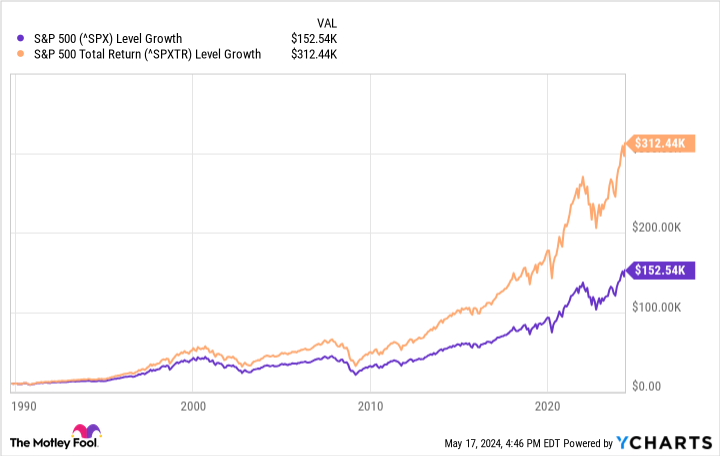

Second, many companies in the S&P 500 pay dividends. Dividends are good for multiple reasons. They are straight-up investment returns paid regularly in cash to investors, and they have tremendously impacted the index's long-term total returns, particularly for those shareholders who automatically reinvest them. Remove reinvested dividends from the equation and you'd miss out on about half the S&P 500's total returns since the late 1980s.

Additionally, dividends are cash expenses to a business. A company cannot continually pay dividends if it's not profitable enough to support that cash outlay. Dividend stocks can get a bad rap as "boring" investments, but their long-term contributions to a portfolio are anything but.

Here's how to become a millionaire with the Vanguard S&P 500 ETF

Want to invest in the S&P 500? Buy shares of the Vanguard S&P 500 ETF. It's that simple.

If you do invest a reasonable amount regularly for the long haul, your holdings in the ETF could make you a millionaire, assuming the S&P 500 performs near its historical averages (about 10% compounded return on average, not accounting for inflation). Depending on how much you invest, here is how long it might take you to reach millionaire status:

Starting Amount | Monthly Contribution | Time to Reach $1 million |

|---|---|---|

$0 | $250 | 36 years |

$0 | $500 | 29 years |

$0 | $1,000 | 23 years |

$0 | $2,000 | 17 years |

As you can see, it's all a numbers game. There's always time to invest.

Starting earlier means you won't need to contribute as much each month. That's why it's so wise to get started on investing when you're young, and time is on your side. Yet it's never too late to get started. It will mean you'll need to do some heavier financial lifting to reach that seven-figure goal, but if you're older and later in your career, you're also probably making more money than when you were starting out.

Either way, formulate a plan and take action. No investment is a sure thing, but investing in the Vanguard S&P 500 ETF might be as close as you can get if you buy and hold, consistently add funds to your position, and give it time.

Should you invest $1,000 in Vanguard S&P 500 ETF right now?

Before you buy stock in Vanguard S&P 500 ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard S&P 500 ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $580,722!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 13, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Vanguard S&P 500 ETF. The Motley Fool has a disclosure policy.

Is the Vanguard S&P 500 ETF a Millionaire Maker? was originally published by The Motley Fool