Brenntag And Two Other Leading Dividend Stocks In Germany

Amid a mixed performance in European markets, with Germany's DAX experiencing a slight decline, investors continue to navigate through an environment marked by cautious optimism and policy adjustments. In such a landscape, focusing on dividend stocks like Brenntag can offer potential stability and income, qualities particularly valued in times of economic uncertainty.

Top 10 Dividend Stocks In Germany

Name | Dividend Yield | Dividend Rating |

Allianz (XTRA:ALV) | 5.16% | ★★★★★★ |

Edel SE KGaA (XTRA:EDL) | 6.44% | ★★★★★★ |

Deutsche Post (XTRA:DHL) | 4.72% | ★★★★★★ |

MLP (XTRA:MLP) | 4.88% | ★★★★★☆ |

Deutsche Telekom (XTRA:DTE) | 3.48% | ★★★★★☆ |

FRoSTA (DB:NLM) | 3.01% | ★★★★★☆ |

DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 6.13% | ★★★★★☆ |

SAF-Holland (XTRA:SFQ) | 4.85% | ★★★★★☆ |

Mercedes-Benz Group (XTRA:MBG) | 7.93% | ★★★★★☆ |

Uzin Utz (XTRA:UZU) | 3.20% | ★★★★★☆ |

Click here to see the full list of 28 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

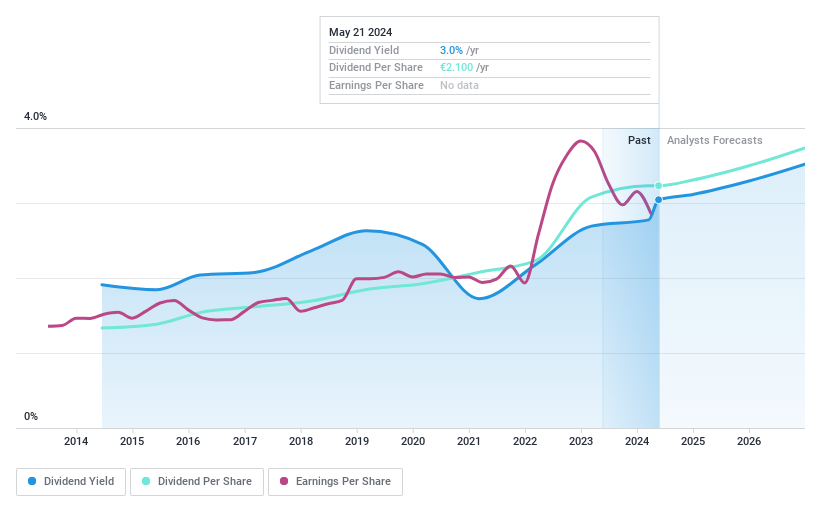

Brenntag

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Brenntag SE operates as a distributor of industrial and specialty chemicals and ingredients across regions including Germany, Europe, the Middle East, Africa, the Americas, and Asia Pacific, with a market capitalization of approximately €9.96 billion.

Operations: Brenntag SE generates its revenue from various regional segments, with Brenntag Essentials - North America contributing €4.28 billion, followed by Brenntag Essentials - Europe, Middle East & Africa (EMEA) at €3.34 billion, Brenntag Essentials - Asia Pacific (APAC) at €0.71 billion, and Brenntag Essentials - Latin America at €0.67 billion.

Dividend Yield: 3%

Brenntag SE, trading 60% below our estimated fair value, is anticipated by analysts to see a price increase of 23%. The company's earnings are expected to grow by 10.55% annually. Brenntag has demonstrated a reliable dividend history over the past decade with an increasing trend and stability in payments. Dividends are well-supported, evidenced by a payout ratio of 48.9% and a cash payout ratio of 28.1%. Despite these strengths, its dividend yield of 3.04% is low compared to the top quartile of German dividend payers at 4.64%. Recent financials show a downturn with Q1 sales dropping from €4,527.1 million to €4,002.6 million year-over-year and net income falling from €215.9 million to €141.4 million.

Delve into the full analysis dividend report here for a deeper understanding of Brenntag.

Our expertly prepared valuation report Brenntag implies its share price may be lower than expected.

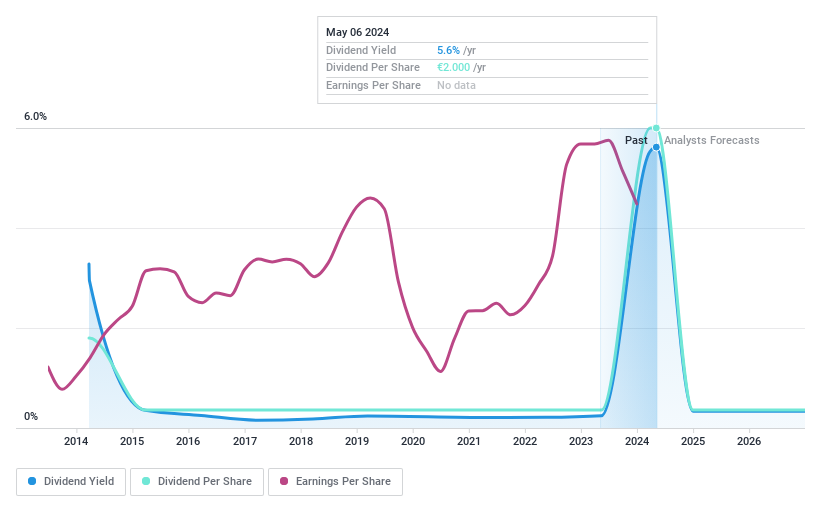

DATA MODUL Produktion und Vertrieb von elektronischen Systemen

Simply Wall St Dividend Rating: ★★★★★☆

Overview: DATA MODUL Aktiengesellschaft, Produktion und Vertrieb von elektronischen Systemen is a company based in Germany that specializes in developing, manufacturing, and distributing flatbed displays, monitors, electronic subassemblies, and information systems globally with a market capitalization of €114.95 million.

Operations: DATA MODUL Produktion und Vertrieb von elektronischen Systemen generates revenue primarily through two segments: €98.96 million from Systems and €175.39 million from Displays.

Dividend Yield: 6.1%

DATA MODUL's dividend history shows variability, with significant fluctuations over the past decade. Despite this, dividends have grown in that period, supported by a payout ratio of 50.7% and a cash payout ratio of 26.9%, indicating reasonable coverage by both earnings and cash flows. The dividend yield stands at 6.14%, ranking in the top quartile for German stocks. However, recent performance reveals a decline, with Q1 sales dropping from €72.41 million to €63.53 million year-over-year and net income decreasing from €3.31 million to €2.74 million.

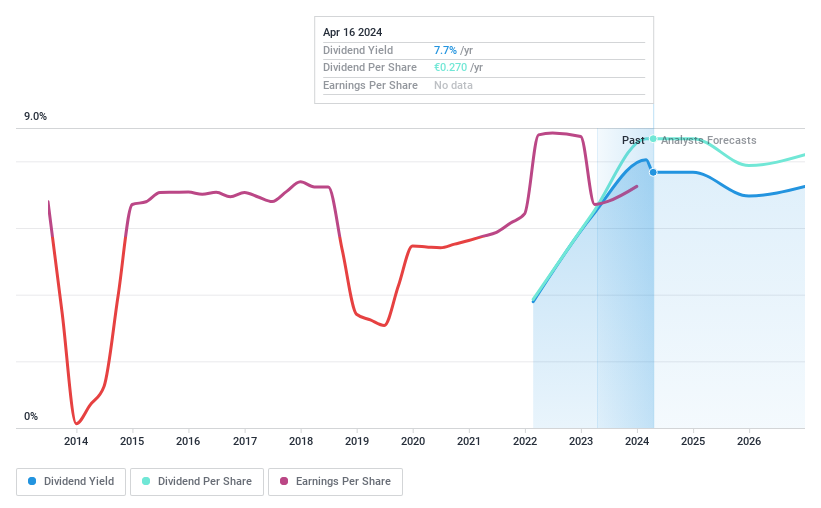

MPC Münchmeyer Petersen Capital

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MPC Münchmeyer Petersen Capital AG is a publicly owned investment manager based in Germany, with a market capitalization of approximately €140.29 million.

Operations: MPC Münchmeyer Petersen Capital AG does not have detailed revenue segments provided in the available information.

Dividend Yield: 6.8%

MPC Münchmeyer Petersen Capital AG, despite a short dividend history of 2 years, shows promise with increasing dividends and a high yield of 6.78%, above the German market average. Earnings have grown by 78.1% over the past year, supporting a sustainable payout ratio of 72.6%. Recent results indicate solid performance with Q1 sales up to €9.6 million from €8.63 million and net income rising to €5.88 million from €3.72 million year-over-year, suggesting potential stability under new CEO Constantin Baack starting June 2024.

Seize The Opportunity

Discover the full array of 28 Top Dividend Stocks right here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include XTRA:BNR XTRA:DAM and XTRA:MPCK.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance