Meme stocks are back in the news. But rather than attempt to ride the meme stock roller coaster, a likely better strategy is to eschew meme stocks and consider companies that have strong businesses in their own right that can benefit from the increased activity surrounding meme stocks. This includes companies like market maker Virtu Financial (NASDAQ:VIRT).

I’m bullish on Virtu stock because it is well-positioned to take advantage of increased trading activity and volatility. I’m also bullish because of its attractive valuation and propensity to reward shareholders with both dividends and share repurchases.

Why Is a Meme Stock Resurgence Good for Virtu Financial?

On May 13, Roaring Kitty (aka Keith Gill), who became the face of 2021’s meme stock mania, posted a meme on X, marking his return to the social media platform after several years out of the limelight. Shares of 2021’s favorite meme stocks like Gamestop (NYSE:GME) and AMC (NYSE:AMC), as well as newly anointed meme stocks like Faraday Future (NASDAQ:FFIE), skyrocketed as many retail investors took it as a signal to pile into these stocks.

While shares of many of these meme stocks have since pulled back, they have been volatile, and the volatility and increased trading volume is an opportunity not just for traders but for companies like Virtu. Bank of America (NYSE:BAC) Securities defines Virtu as an “electronic market maker, supplying liquidity to the global financial markets.”

As a top electronic market maker and liquidity provider, Virtu stands to benefit from a surge in equities and options trading activity. It will also benefit from higher volatility and a heightened “risk-on” mood in the markets, driven by a meme stock revival.

Heightened volatility typically benefits market makers like VIRT because it creates wider spreads between bid and ask prices, generating more profitable setups for market-makers. That’s why Bank of America Securities recently called Virtu “our stealth way to play retail engagement via payment for order flow.”

Even before Roaring Kitty’s return led to speculation about a meme stock revival, there were signs that retail activity in the market was picking up. This was likely spurred by the strong performance of popular tech stocks that have captured the imagination of the retail market, thanks to the prominent roles they are playing in the AI revolution.

For example, Robinhood (NASDAQ:HOOD), a preferred platform for retail traders, recently released its operational update for April 2024 and showed user growth of 90,000, bringing its total user base to 24 million funded customers. Net deposits to the platform over the past 12 months were $27.4 billion, a 35% increase from April 2023. These numbers illustrate that retail investors are returning to the market in droves, even before accounting for May’s unexpected return from Roaring Kitty.

Virtu recently reported first-quarter earnings. As a market maker, one of its key metrics is net trading income per day. The company reported $6 million in net trading income per day, representing a 46.3% increase from the final quarter of 2023’s $4.1 million per day.

While this was a large increase, it was a far cry from the company’s $11.9 million in net trading income per day from the first quarter in 2021, a period that captures the height of the original meme stock frenzy, not coincidentally the second-most profitable quarter in the company’s history.

Even if net trading income doesn’t quite reach those lofty heights, it should head higher, which will bode well for Virtu and its shareholders.

Inexpensive Valuation

Virtu is a high-tech business with a real moat. One can’t simply come in one day and start providing these complex services across different asset classes and markets worldwide. Despite this, shares are incredibly cheap.

In fact, shares trade at a single-digit price-to-earnings multiple of just 9.7x consensus 2024 earnings estimates. This means that Virtu is significantly cheaper than the S&P 500 (SPX), which trades at 23.8 times earnings.

This cheap multiple gives investors downside protection when investing in the stock while leaving plenty of room for upside on the table via valuation multiple expansion and/or earnings growth.

Returning Lots of Capital to Shareholders

In addition to this attractive valuation, Virtu also offers investors an attractive dividend yield of 4.1%. Virtu’s yield is significantly higher than that of the S&P 500, which yields 1.4%. Additionally, the company has paid dividends to its shareholders for eight consecutive years.

Beyond dividends, Virtu is returning capital to shareholders via share repurchases. During the first quarter, Virtu bought back two million shares for $36 million. Share repurchases benefit shareholders by reducing the number of shares outstanding and can also be seen as a signal that management views its stock as undervalued.

Between dividends and share repurchases, Virtu is returning significant capital to shareholders. If meme stock trading activity stays elevated for longer, Virtu could have more capital with which to buy back shares and potentially increase its dividend payout.

Smart Money

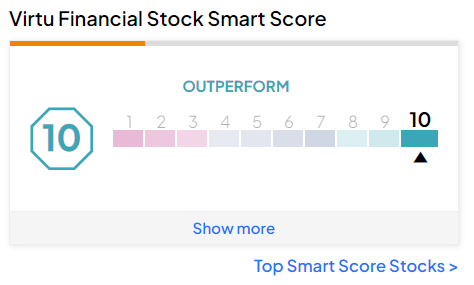

Virtu scores a “Perfect 10” rating from TipRanks’ Smart Score system, placing it in enviable company. The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating. The score is data-driven and does not involve any human intervention.

Is VIRT Stock a Buy, According to Analysts?

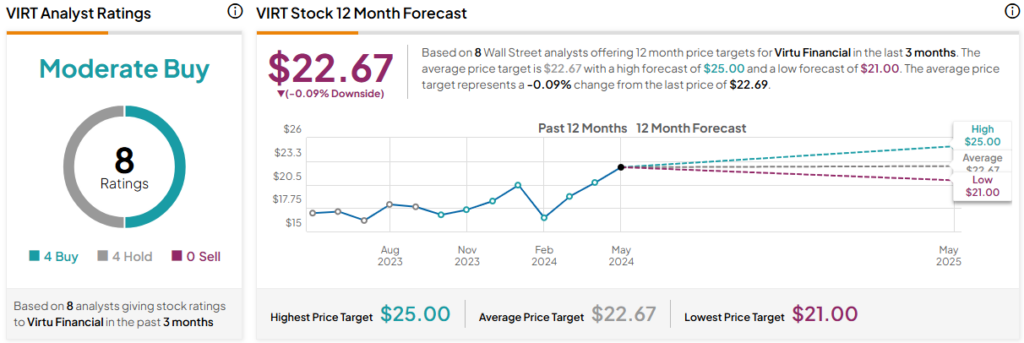

Turning to Wall Street, VIRT earns a Moderate Buy consensus rating based on four Buys, four Holds, and zero Sell ratings assigned in the past three months. The average VIRT stock price target of $22.67 implies that shares are fairly valued at the moment.

The Smart Way to Play the Meme Stock Roller Coaster

The influx of retail investors and surge in trading activity should benefit Virtu Financial, which stands to increase its net trading income further. Plus, shares of Virtu trade at an attractive single-digit multiple and yield over 4%. This makes Virtu Financial a smart way to play the meme stock renaissance rather than trying to time the roller coaster with meme stocks like Gamestop and AMC.