At first glance, cybersecurity specialist Fortinet (NASDAQ:FTNT) presents a tale of two cities. On the positive front, the company benefits from the growing cybersecurity market. As a protective agent against nefarious online threats, it can save enterprises heaps of trouble. On the other hand, Fortinet is underperforming its rivals. Still, the lackluster market action also makes FTNT’s valuation relatively attractive. Therefore, I am bullish on FTNT stock.

FTNT Stock Is a Case of Good but Not Great

When assessing FTNT stock (especially recently), it’s difficult not to come away with an underlying takeaway: Fortinet is a case of being good but not necessarily great. And that poses competitive risks as the company’s rivals seemingly present a better look.

For example, TipRanks reporter Sirisha Bhogaraju noted that for the first quarter of 2024, Fortinet published better-than-expected sales and earnings. Perhaps most notably, revenue increased by 7% on a year-over-year basis to $1.35 billion. Further, adjusted earnings per share expanded by 26.5% during the same timeframe to 43 cents.

Still, FTNT stock didn’t receive a benefit from the earnings print; it actually got punished. Bhogaraju wrote that “investors were disappointed with the 6.4% decline in Q1 2024 billings, a key indicator of future growth, to $1.41 billion.”

If that wasn’t enough, the reporter mentioned that the “mid-point of the company’s guidance range for Q2 billings indicates a decline of 1%. The company expects headwinds impacting its business to ease in the second half of the year.”

Fundamentally, Fortinet identified soft spending by enterprises as a major challenge. In addition, “competition from companies offering a consolidated cybersecurity platform” is impacting Fortinet. That’s not the greatest situation for FTNT stock. Subsequently, FTNT stock is up a bit over 6% on a year-to-date basis.

The price action compares poorly to that of rival Palo Alto Networks (NASDAQ:PANW). On a YTD basis, PANW gained 10%, but it’s not just about outright performance. In the trailing month, PANW gained over 14%, whereas FTNT fell 3%. In other words, near-term momentum is rising for Palo Alto while fading for Fortinet.

Even Zscaler (NASDAQ:ZS), which is off to a rough start in 2024, has gained almost 6% in the past month. That doesn’t seem very encouraging for FTNT stock until you factor in its valuation.

A Better Deal Presents a Compelling Case for Fortinet

At the moment, FTNT trades at 8.91x trailing-year revenue. Objectively, that’s rather high for the underlying software infrastructure space, which runs an average price-to-sales multiple of 4.24x. Still, compared to the competition, Fortinet seems very attractive.

Notably, while Palo Alto commands the cybersecurity spotlight, it does so at a price. PANW trades at 14.85x trailing-year revenue. Further, Zscaler trades at 13.88x sales, even though ZS is down nearly 16% YTD.

Of course, valuation isn’t everything – there are numerous other factors to consider when investing. However, the argument for FTNT stock is that while the underlying enterprise may not arguably offer the best narrative among the three cybersecurity firms, it presents the best deal to revenue – and by a wide margin.

Yes, it’s true that reduced enterprise spending is a problem for Fortinet. However, that’s also an issue for the rest of the cybersecurity ecosystem. At the same time, cybersecurity is a non-negotiable because of the severe damage that can result if enterprises operate without adequate protection.

According to one report, the global average cost of a data breach in 2023 stood at $4.45 million. However, as recent cyberattacks have demonstrated, one breach could impact millions of customers. That, in turn, can create a whole host of problems, not the least of which is ongoing reputational damage.

Therefore, in the cybersecurity realm, the old adage really does apply: an ounce of prevention is better than a pound of cure.

Fortinet could easily latch onto this narrative and benefit along a rising tide. What’s more, because of its much lower sales multiple, FTNT stock arguably represents lower fundamental risk.

Exploring the Projected Demand Context

In fairness to the competition, while FTNT stock may feature a lower revenue multiple, one other factor must be considered: analysts expect a lower demand profile.

For Fiscal 2024, Wall Street is looking for Fortinet to ring up $5.8 billion in sales. That’s up 9.3% from last year’s tally of $5.3 billion. In contrast, Palo Alto may hit revenue of $7.98 billion or up 15.8% against the prior year.

At that rate, PANW would be trading at around 12.9x sales. As for Zscaler, analysts anticipate Fiscal 2024 revenue of $2.12 billion or up 31.1%. Here, ZS would be trading at 12.64x sales. While these stats represent an improvement over their respective current multiples, the reality as things stand now, they’re still considerably higher than FTNT’s trailing-year multiple of 8.91x.

Theoretically, then, FTNT stock should enjoy a valuation “safety buffer” against its two rivals.

Is Fortinet Stock a Buy, According to Analysts?

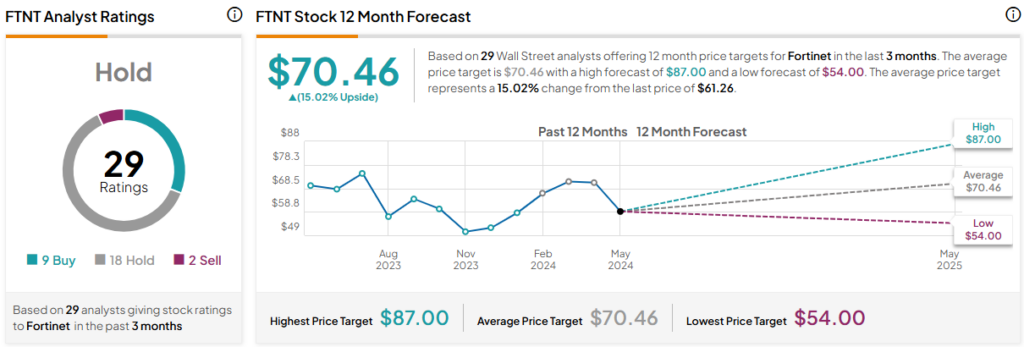

Turning to Wall Street, FTNT stock has a Hold consensus rating based on nine Buys, 18 Holds, and two Sell ratings. The average FTNT stock price target is $70.46, implying 15% upside potential.

The Takeaway: FTNT Stock Brings Good Value in a Relevant Sector

As a whole, Fortinet is a decent player in the burgeoning and pertinent cybersecurity industry. At the same time, it doesn’t have the oomph of other rivals. Still, this isn’t necessarily a bad thing because FTNT stock happens to be trading at a relative discount to its peers. As a result, investors shouldn’t overlook Fortinet.