Whales with a lot of money to spend have taken a noticeably bullish stance on Texas Instruments.

Looking at options history for Texas Instruments (NASDAQ:TXN) we detected 24 trades.

If we consider the specifics of each trade, it is accurate to state that 58% of the investors opened trades with bullish expectations and 37% with bearish.

From the overall spotted trades, 6 are puts, for a total amount of $261,703 and 18, calls, for a total amount of $1,026,790.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $170.0 to $230.0 for Texas Instruments over the recent three months.

Analyzing Volume & Open Interest

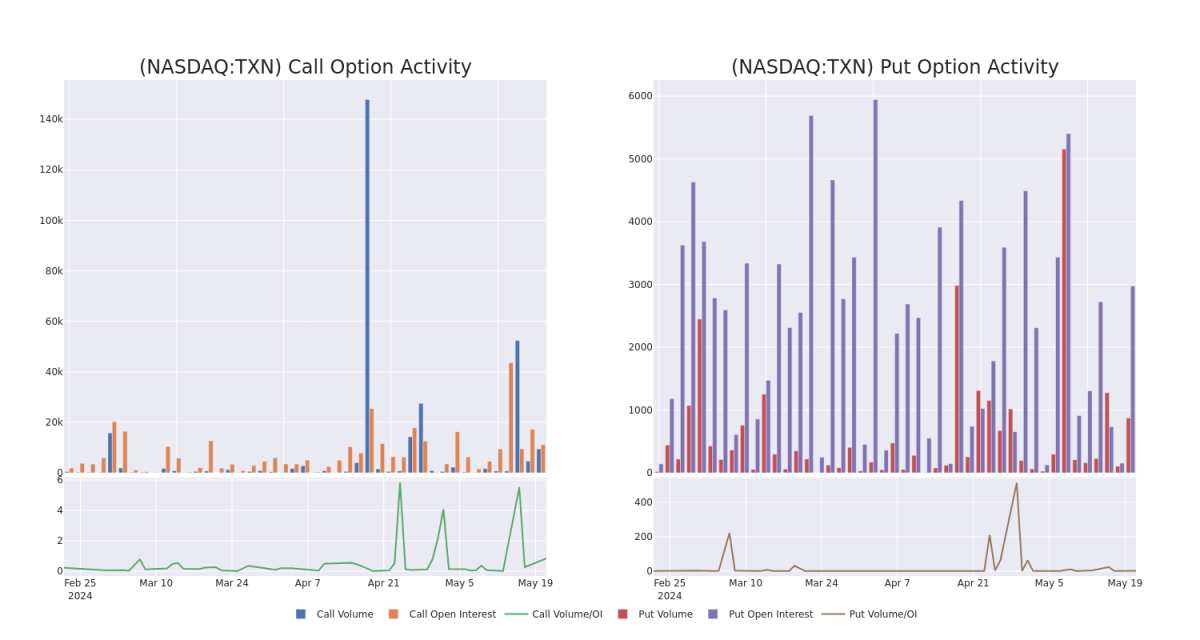

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Texas Instruments's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Texas Instruments's significant trades, within a strike price range of $170.0 to $230.0, over the past month.

Texas Instruments 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TXN | CALL | TRADE | BULLISH | 12/20/24 | $34.55 | $33.25 | $34.41 | $170.00 | $220.2K | 193 | 64 |

| TXN | CALL | TRADE | BEARISH | 10/18/24 | $21.15 | $20.8 | $20.8 | $185.00 | $104.0K | 464 | 150 |

| TXN | PUT | SWEEP | BEARISH | 07/19/24 | $6.35 | $6.2 | $6.3 | $200.00 | $95.7K | 202 | 220 |

| TXN | CALL | SWEEP | BULLISH | 09/20/24 | $3.9 | $3.75 | $3.9 | $220.00 | $88.9K | 8.7K | 1.0K |

| TXN | CALL | SWEEP | BEARISH | 05/24/24 | $2.08 | $2.0 | $2.0 | $197.50 | $61.3K | 1.1K | 317 |

About Texas Instruments

Dallas-based Texas Instruments generates over 95% of its revenue from semiconductors and the remainder from its well-known calculators. Texas Instruments is the world's largest maker of analog chips, which are used to process real-world signals such as sound and power. Texas Instruments also has a leading market share position in processors and microcontrollers used in a wide variety of electronics applications.

Following our analysis of the options activities associated with Texas Instruments, we pivot to a closer look at the company's own performance.

Current Position of Texas Instruments

- Trading volume stands at 1,891,336, with TXN's price down by -1.04%, positioned at $197.13.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 63 days.

Expert Opinions on Texas Instruments

5 market experts have recently issued ratings for this stock, with a consensus target price of $191.0.

- An analyst from Rosenblatt has revised its rating downward to Buy, adjusting the price target to $210.

- In a cautious move, an analyst from Jefferies downgraded its rating to Hold, setting a price target of $175.

- Consistent in their evaluation, an analyst from Mizuho keeps a Neutral rating on Texas Instruments with a target price of $170.

- An analyst from JP Morgan has decided to maintain their Overweight rating on Texas Instruments, which currently sits at a price target of $195.

- Maintaining their stance, an analyst from Susquehanna continues to hold a Positive rating for Texas Instruments, targeting a price of $205.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Texas Instruments with Benzinga Pro for real-time alerts.