TipRanks’ ‘Perfect 10’ List: 2 Top-Scoring Stocks with Dividend Yields of at Least 7%

Predicting market trends often feels more like art than science. Yet, despite its complexity, the data available can help decipher the nuances of stock movements.

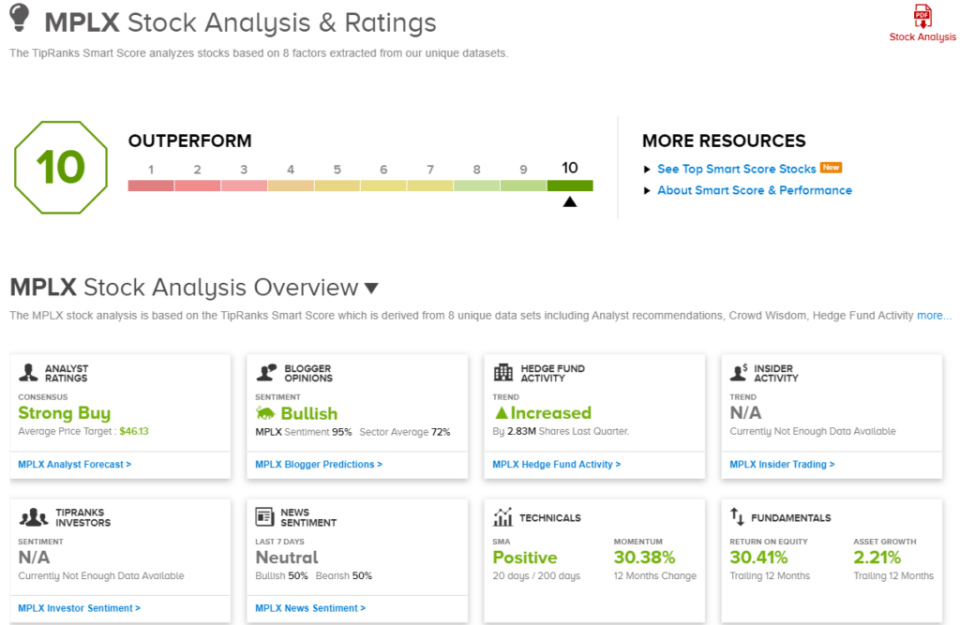

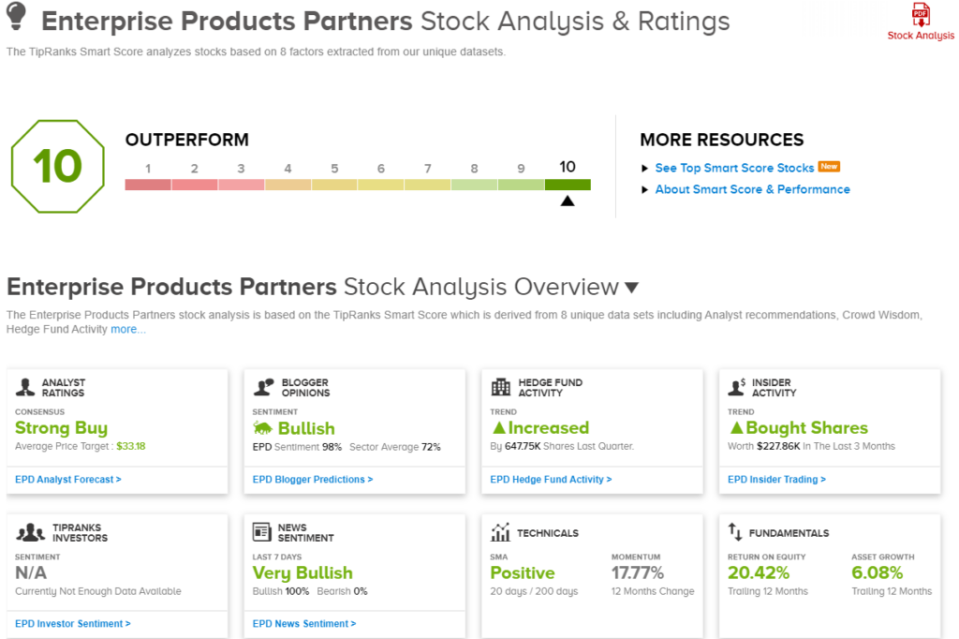

The TipRanks Smart Score is a perfect example. Scanning through the whole of the database and assembling the information for every stock according to 8 categories known to predict future share performance, the Smart Score combines those categories into a single score that allows investors to see at a glance how the stock is likely to move in the coming year.

That score is given on a scale from 1 to 10, with low scores indicating likely underperformance of the broader market, and higher scores indicating overperformance. A perfect score, a 10, is a rare gift for a stock. It doesn’t necessarily mean that every factor aligns perfectly – but it does indicate a potentially bright future for the stock in question.

Today, we’ve pulled up two ‘Perfect 10’ stocks, which are also fine defensive plays, with dividends yielding 7% or higher. At a time when volatility is returning to the markets, the combination of likely overperformance and a strong dividend return makes these stocks ones investors should take notice of.

MPLX LP (MPLX)

First up on our Perfect 10 list is a midstream company from the oil and gas industry, MPLX. Originally a division of Marathon Petroleum, the company spun off from its parent company in 2012 to operate as an independent partnership firm controlling the parent’s midstream transport assets. That’s a bit of a mouthful, but it boils down to MPLX operating a wide-ranging network of pipelines, terminal points, river tugs and barges, and other transport and storage assets that link hydrocarbon production regions across North America with the storage facilities, tank farms, refineries, and export terminals that bring crude oil, natural gas, and their refined products to the market. MPLX today boasts a market cap of $41.5 billion, and brought in $11.34 billion in revenue last year.

Prominent among MPLX’s assets are its rail and truck racks, maritime business, and export terminals. These facilities allow for the mass movement of hydrocarbon products, both refined and unrefined, independently of pipelines, and can put the products into the global distribution networks. The company also has facilities for processing natural gas and making use of natural gas liquids. MPLX is known for selling basic natural gas liquid products such as ethane, propane, butane, isobutane, and natural gasoline.

In the last reported quarter, for 1Q24, MPLX reported total revenues of $2.85 billion. While this was up 5.2% year-over-year, it just slipped under the forecast, missing by $50 million. At the bottom line, the company reported an EPS of 98 cents; this was up 7 cents per share year-over-year and came in 2 cents per share better than had been anticipated.

The solid earnings fully covered MPLX’s common share dividend payment, which was declared in April for 85 cents per share and was paid out on May 13. The annualized rate, of $3.40 per common share, gives a forward yield of 8.32%. MPLX has been paying out its regular stock dividend every quarter since 2013, and has a history of regularly increasing the payment.

This company’s solid business and high-yield dividend form the core of an upbeat outlook from Truist Securities. Analyst Neal Dingmann, who ranks amongst the top 1% of Street stock pros, writes of the stock, “MPLX has not only been active organically increasing its gathering & processing along with logistics & transportation segments, but the company recently completed an accretive acquisition and continues paying out notable shareholder returns. MPLX somewhat surprisingly to us bought back a number of units last quarter on top of its material dividend that is currently over an 8% yield. We forecast moderate growth ahead driven by liquids-rich Appalachian areas with the potential for material upside if/when natural gas prices return to more normal levels.”

The 5-star analyst follows these comments by reiterating his Buy rating on the stock, and he sets a price target of $48 to imply a one-year upside potential of nearly 17.5%. With the dividend yield added to this, the total one-year return could reach nearly 26%. (To watch Dingmann’s track record, click here)

The bullish Truist outlook on this stock is in line with the Street’s consensus. MPLX shares have a Strong Buy consensus rating based on 9 recent reviews that break down to a lopsided split of 8 Buys to 1 Hold. The shares are priced at $40.86 and the $46.13 average target price represents a 13% potential gain for the coming year. (See MPLX stock forecast)

Enterprise Products Partners (EPD)

The second stock we’ll look at here, Enterprise Products Partners, is another of the North American energy midstream companies. Enterprise is one of the sector’s largest companies, with a market cap exceeding $62 billion and nearly $50 billion in annual revenue. Like MPLX above, Enterprise operates as a partnership firm, and its activities involve the transport and distribution of hydrocarbon energy sources.

Specifically, Enterprise has a network of transport, distribution, and storage assets, including fractionation facilities, deepwater docks, and storage tanks with over 300 million barrels of liquid storage capacity and 14 billion cubic feet of natural gas capacity. The company’s pipeline assets total more than 50,000 miles. In addition to its transport services, the company can provide natural gas gathering and processing. Enterprise’s asset network is centered on the Gulf Coast, mainly in Texas and Louisiana, with a secondary center on the Texas-New Mexico state line. The assets branch out to the Southeast, the Appalachians, the Great Lakes, the Mississippi Valley, and into the Rocky Mountains.

Enterprise is expanding its business network, especially in the rich Permian Basin of Texas. The company is currently engaged in developing 3 new natural gas processing facilities in the Delaware Basin region of the larger Permian formation. The plants under development will significantly increase Enterprise’s ability to process natural gas and natural gas liquids in this important production region, and are expected to start coming online during 2Q26.

In its 1Q24 report, Enterprise showed a top line of $14.76 billion, beating the forecast by $940 million and growing by more than 18% year-over-year. The company’s earnings figure, reported as a GAAP EPS of 66 cents, was up 3 cents from the prior year period but missed the forecast by a penny per share.

Despite the small earnings miss, the EPS still more than covered the company’s dividend, which was declared on April 5 for a rate of 51.5 cents per common share. This payment, which was sent out on May 14, annualizes to $2.06 per share and provides investors with a forward yield of almost 7.2%..

This is another stock that has picked up attention from Truist, and when we check in again with analyst Dingmann, we find that he is bullish on the company’s expansion plans and potential for returns, writing, “Enterprise continues to benefit from solid incremental Permian and other key regional demand for its processing, gathering, marine and other segments. We believe the company is responding quite strategically by building out facilities where needed including the soon to be completed three Permian processing plants that will then total 19 for the region producing a total of 675,000 Bpd of NGLS. We forecast the notable buildout relatively soon leading to incremental shareholder return beyond the current solid level.”

Dingmann rates EPD as a Buy, while setting a price target of $35 to suggest a 22% one-year upside potential. With the dividend, the return here may hit as high as 30%.

Overall, this stock’s Strong Buy consensus rating has solid backing – the 12 recent analyst reviews include 11 Buys and just 1 Hold. The shares are trading for $28.65 and have an average target price of $33.18, together implying a 16% upside on the one-year horizon. (See EPD stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Yahoo Finance

Yahoo Finance