Emerald Resources Plus Two ASX Growth Stocks With High Insider Stakes

In recent trading sessions, the Australian market has shown a mix of outcomes, with the ASX200 experiencing an uptick of 0.63%, driven primarily by strong performances in the energy and materials sectors. Amidst these market movements, stocks with high insider ownership like Emerald Resources have attracted attention for their potential resilience and alignment of interests between shareholders and management teams.

Top 10 Growth Companies With High Insider Ownership In Australia

Name | Insider Ownership | Earnings Growth |

Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

Cettire (ASX:CTT) | 28.7% | 29.9% |

Gratifii (ASX:GTI) | 15.6% | 112.4% |

Acrux (ASX:ACR) | 14.6% | 115.3% |

Doctor Care Anywhere Group (ASX:DOC) | 28.4% | 96.4% |

Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

Alpha HPA (ASX:A4N) | 28.3% | 95.9% |

Liontown Resources (ASX:LTR) | 16.4% | 63.9% |

DUG Technology (ASX:DUG) | 28.3% | 43.3% |

Plenti Group (ASX:PLT) | 12.6% | 68.5% |

Here's a peek at a few of the choices from the screener.

Emerald Resources

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Emerald Resources NL is a company focused on the exploration and development of mineral reserves in Cambodia and Australia, with a market capitalization of approximately A$2.51 billion.

Operations: The company generates revenue primarily from mine operations, totaling A$339.32 million.

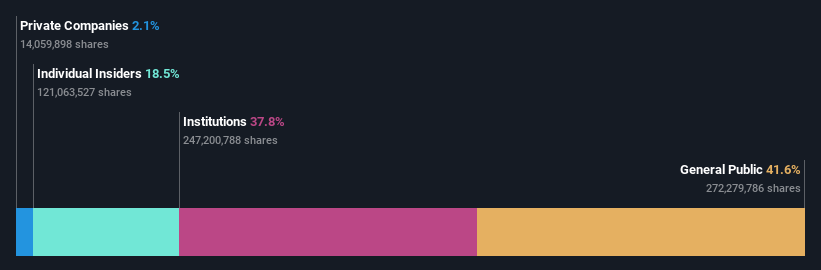

Insider Ownership: 18.5%

Earnings Growth Forecast: 22.8% p.a.

Emerald Resources, an Australian growth company with high insider ownership, reported a significant increase in earnings and sales for the half-year ended December 31, 2023. Sales rose to A$176.75 million from A$133.69 million, while net income increased to A$46.87 million from A$26.59 million year-over-year. The company is trading at 72.6% below its estimated fair value and expects robust future growth with earnings forecasted to grow by 22.76% annually and revenue by 19.4% annually, both outpacing the market projections.

Unlock comprehensive insights into our analysis of Emerald Resources stock in this growth report.

Our valuation report here indicates Emerald Resources may be undervalued.

Flight Centre Travel Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Flight Centre Travel Group Limited operates as a travel retailer serving both leisure and corporate sectors across Australia, New Zealand, the Americas, Europe, the Middle East, Africa, Asia, and internationally with a market capitalization of approximately A$4.50 billion.

Operations: The company's revenue is primarily generated from its leisure and corporate travel services, totaling A$1.28 billion and A$1.06 billion respectively.

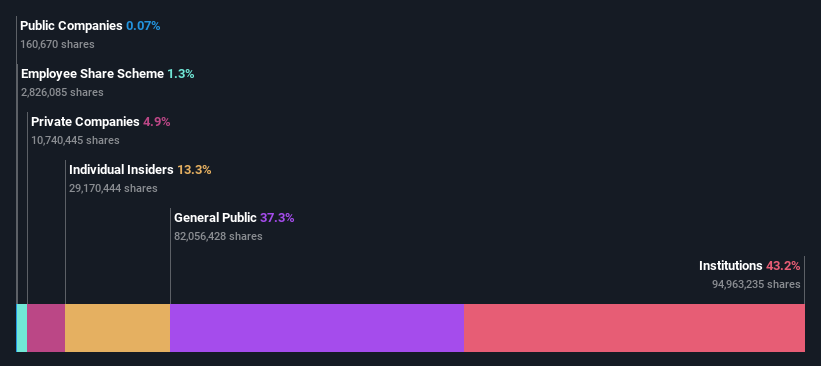

Insider Ownership: 13.3%

Earnings Growth Forecast: 19.2% p.a.

Flight Centre Travel Group, a key growth company in Australia with high insider ownership, has shown impressive financial recovery. For the half-year ended December 31, 2023, it reported a substantial increase in sales to A$1.29 billion and shifted from a net loss of A$19.78 million to a net income of A$86.6 million. Despite recent volatility in index membership, the company's earnings are expected to grow by 19.2% annually, outperforming the Australian market forecast of 13.6%.

Mineral Resources

Simply Wall St Growth Rating: ★★★★★☆

Overview: Mineral Resources Limited is an Australian mining services company with operations extending across Australia and internationally, boasting a market capitalization of approximately A$15.51 billion.

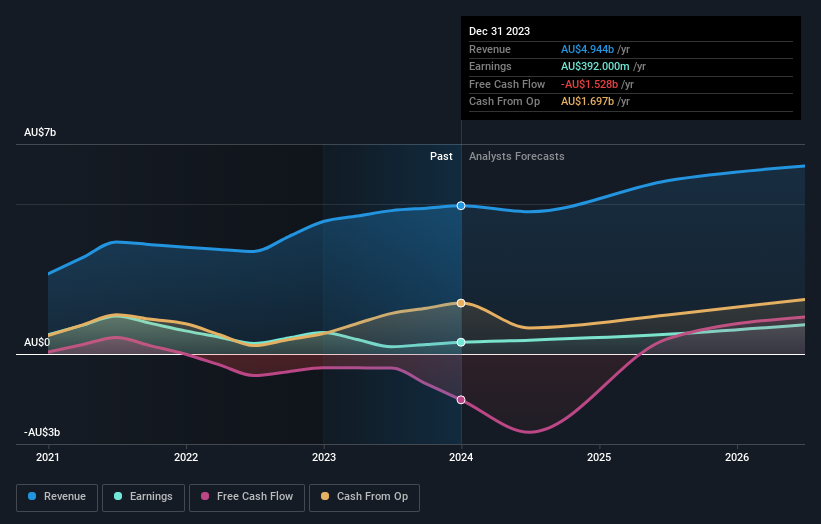

Operations: The company generates revenue from lithium (A$1.60 billion), iron ore (A$2.50 billion), and mining services (A$2.82 billion).

Insider Ownership: 11.6%

Earnings Growth Forecast: 29.2% p.a.

Mineral Resources, while trading at 28% below its estimated fair value, faces challenges with a lower profit margin of 7.9% compared to 16.3% last year and interest payments not well covered by earnings. Despite these issues, the company's revenue is expected to grow by 10.7% annually, outpacing the Australian market's 5%. Earnings are also forecasted to significantly increase at a rate of 29.2% per year, highlighting its potential as a growth entity with substantial future gains.

Summing It All Up

Navigate through the entire inventory of 89 Fast Growing ASX Companies With High Insider Ownership here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ASX:EMR ASX:FLT and ASX:MIN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance