Eagle Materials (EXP) to Revamp Laramie Unit, Lift Capacity by 50%

Eagle Materials Inc. EXP has announced an ambitious plan to modernize and expand its Laramie, WY cement plant, enhancing its production capacity and operational efficiency. This initiative includes upgrading the existing plant and establishing an additional cement distribution facility in Northern Colorado. The modernized facility will serve several markets, including Northern Colorado, Nebraska, Utah, and Wyoming.

Boosting Capacity and Efficiency

The modernization project is set to increase the plant’s annual manufacturing capacity by 50%, raising it from 800,000 tons to approximately 1.2 million tons. This expansion is expected to significantly reduce manufacturing costs by 25%, thanks to the incorporation of state-of-the-art technology. The new kiln line will use lower-cost alternative fuels and natural gas instead of solid fuels, and streamlined maintenance programs will further enhance operating efficiencies.

Environmental Benefits

In addition to cost and capacity improvements, the project aims to make the plant more environmentally friendly. The CO2 intensity from the Laramie facility is anticipated to decrease by nearly 20% upon project completion. This aligns with Eagle Materials broader commitment to reduce carbon emissions and promote sustainability across its operations.

Strategic Investment

The total investment for the project, including the new distribution facility, is estimated at $430 million. The existing Laramie plant, operational since 1927, will undergo significant upgrades to meet modern standards and demands. The project has received primary regulatory approvals, and construction is slated to begin immediately, with an expected startup in the second half of 2026.

Meeting Market Demand

Eagle Materials' expansion underscores its dedication to being the premier cement supplier in the Mountain Region, catering to key cities like Denver and Salt Lake City. By enhancing capacity and reducing costs, the company is well-positioned to meet the growing demand for cement while maintaining its status as a low-cost producer.

In conclusion, Eagle Materials’ investment in modernizing the Laramie plant is a strategic move to bolster its market position, enhance operational efficiencies, and reduce environmental impact, ensuring long-term growth and sustainability.

Share Price Performance

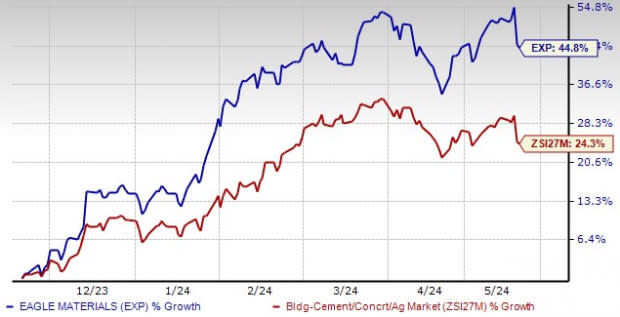

Shares of this leading U.S. manufacturer of heavy construction products and light building materials have gained 44.8% over the past six months, outperforming the Zacks Building Products - Concrete and Aggregates industry’s 24.3% growth.

Image Source: Zacks Investment Research

EXP is optimistic about its long-term growth, thanks to improving trends in population growth, well-documented housing production deficits and supply shortages, and a multi-year federal highway bill further boosted by state-level infrastructure spending.

Zacks Rank & Stocks to Consider

Currently, EXP carries a Zacks Rank #3 (Hold).

Here are some better-ranked stocks in the Zacks Construction sector:

Frontdoor, Inc. FTDR: Based in Memphis, TN, Frontdoor provides home service plans in the United States. The firm is benefiting from impressive customer retention rates. Thanks to the robust awareness of the Frontdoor brand, it has been shifting its attention toward capitalizing on customer demand.

Frontdoor’s earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, the average being 286.8%. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Quanex Building Products Corp. NX: Houston, TX-based Quanex Building provides components for the fenestration industry worldwide.

Quanex’s earnings surpassed the Zacks Consensus Estimate in the trailing two quarters, the average being 41.9%. It currently sports a Zacks Rank #1.

Arcosa, Inc. ACA: Dallas, TX-based Arcosa provides infrastructure-related products and solutions. The company remains focused on its long-term vision to lessen the complexity of Arcosa’s overall portfolio and shift its business mix toward less cyclical, higher-margin growth opportunities that leverage core strengths and drive long-term shareholder value creation.

Arcosa’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average being 43.9%. It currently carries a Zacks Rank #2 (Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Quanex Building Products Corporation (NX) : Free Stock Analysis Report

Eagle Materials Inc (EXP) : Free Stock Analysis Report

Frontdoor Inc. (FTDR) : Free Stock Analysis Report

Arcosa, Inc. (ACA) : Free Stock Analysis Report