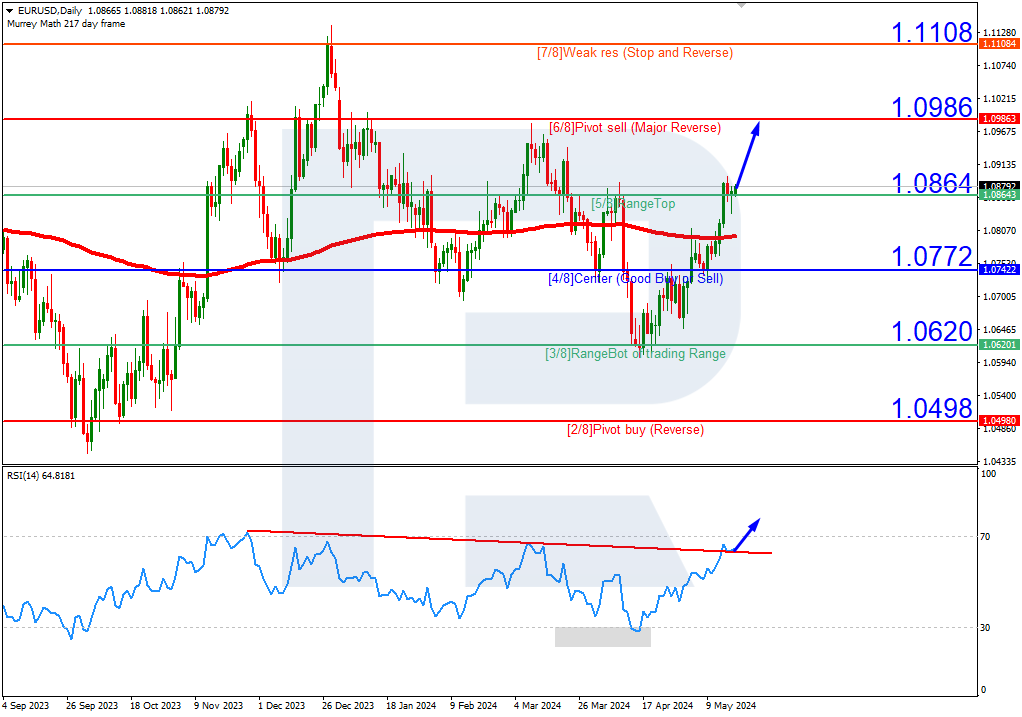

EUR/USD, “Euro vs US Dollar”

EUR/USD quotes have broken above the 200-day Moving Average on D1, indicating the potential development of an uptrend. The RSI has surpassed the resistance line. In this situation, the price is expected to rise further to 6/8 (1.0986). The scenario might be cancelled by a breakout of the 5/8 (1.0864) level, pushing the pair down to the 4/8 (1.0772) support level.

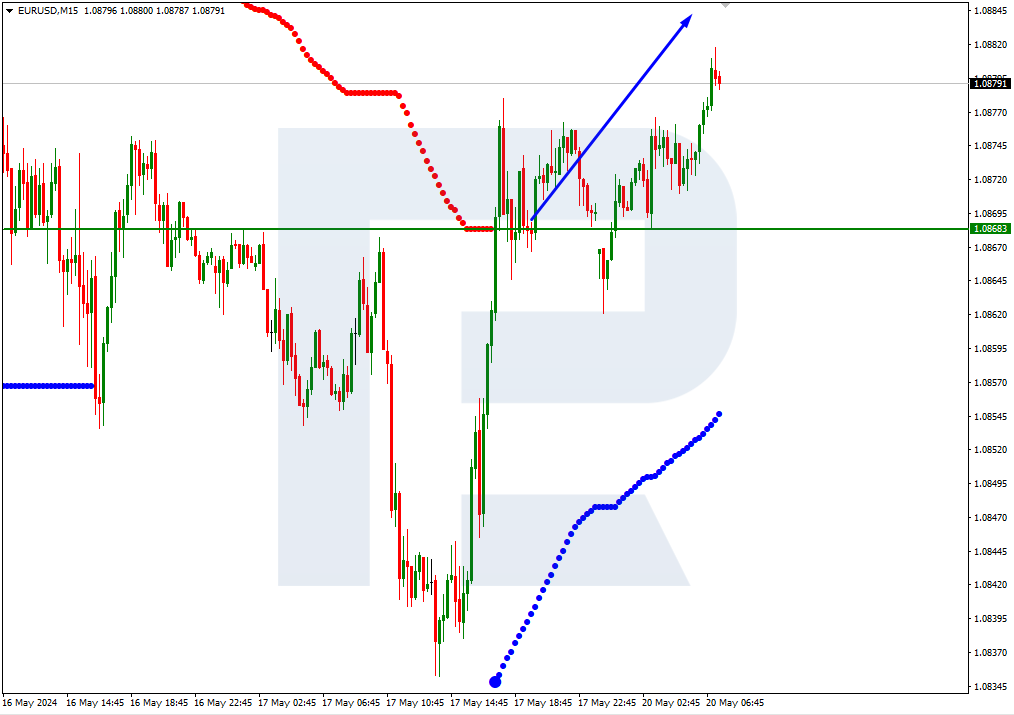

On M15, the upper line of the VoltyChannel is broken, which increases the probability of a price rise.

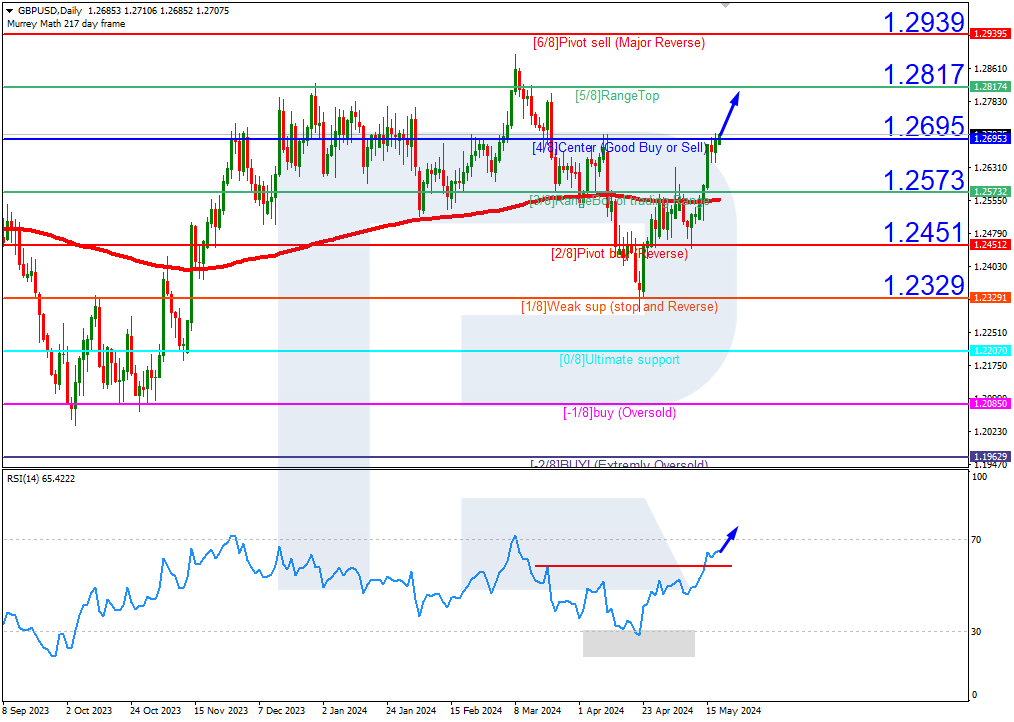

GBP/USD, “Great Britain Pound vs US Dollar”

GBP/USD quotes are above the 200-day Moving Average on D1, indicating a prevailing uptrend. The RSI has surpassed the resistance line. In this situation, the price is expected to rise further to 5/8 (1.2695). The scenario could be cancelled by a breakout of the 3/8 (1.2573) level, which might lead to a trend reversal, pushing the pair to the 2/8 (1.2451) support level.

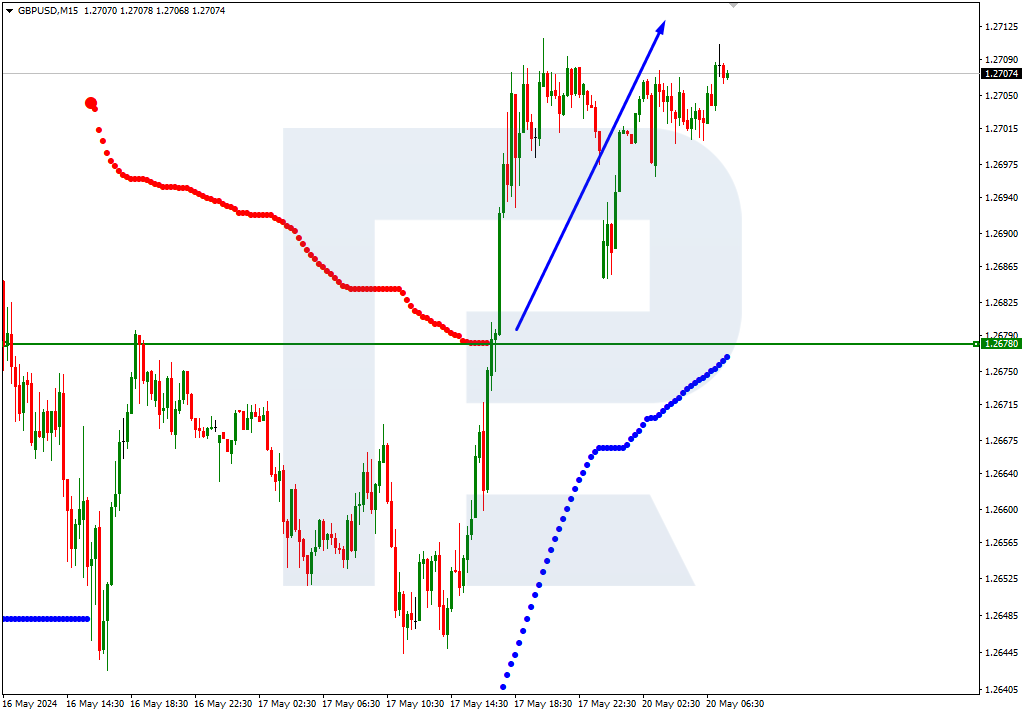

On M15, the upper line of the VoltyChannel is broken, which indicates a prevailing uptrend and increases the probability of a price rise.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD extends its upside above 0.6650 on softer US Dollar, investors await Australian GDP data

The AUD/USD pair extends the rally near 0.6655 during the early Asian session on Monday. The uptick of the pair is bolstered by the weaker US Dollar after the US Personal Consumption Expenditure Price Index report showed that inflation cooled faster than expected in April.

EUR/USD: Looming ECB rate cut, US employment data hint at volatile week

The EUR/USD pair spent most of the last week within familiar levels, partially due to the lack of relevant macroeconomic data throughout the first half of the week and partly amid comments from different Federal Reserve officials.

Gold holds below $2,350, geopolitical risks remain in focus

Gold price edges lower to $2,325 on Monday during the early Asian trading hours. The yellow metal trims gains after the US Personal Consumption Expenditure data for April showed price pressures cooled in April. Meanwhile, the ongoing Middle East geopolitical risks might provide some support to gold.

Bitcoin sets the stage for a potential “destruction of fiat currency“

In a recent tweet on the social media platform X, formerly Twitter, Peter Brandt, a seasoned analyst, suggested that Bitcoin price could be due for a massive uptrend. He compared the current BTC consolidation to the Stagflation Crisis of 1970.

Week ahead: ECB rate cut might get eclipsed by BoC surprise and NFP report

ECB set to slash rates on Thursday, focus on forward guidance. But will the BoC take the lead when it meets on Wednesday? US jobs report eyed on Friday as Fed unyielding on cuts. OPEC+ might extend some output reductions into 2025.