Bitcoin Breakout: 2 Top Ranked Stocks for the Next Leg Higher

Broad stock market indexes have again made new all-time highs this week, confirming the current bull market. The ~6% pullback seen in the S&P 500 in April was as generic as a bull could have asked for, and the strong snapback to new highs should encourage investors looking to add risk to their portfolios.

Although I was exclaiming on the way down that this would be a fantastic buying opportunity, if you didn’t buy on the way down there is no need to fret because I believe we are on the cusp of another big bull run.

If that is indeed the case and investors are back to risk-on mode, there is one approach that is going to practically guarantee outperformance.

Image Source: TradingView

Bitcoin is Ready

For the last year or so, Bitcoin has acted as a proxy for risk, and been tightly correlated with US equities, especially technology stocks. Although correlations do come and go, as of now this one is still strong and for every 1% stocks gain, Bitcoin can jump 3-5%.

On Wednesday of this week, the price of Bitcoin clearly broke out from a bullish wedge/flag pattern. If you look back in the chart you can see this would be the third such breakout in the cryptocurrency since October, so fits within the standard bullish action.

Image Source: TradingView

Coinbase Global

Of course, you can go ahead and buy Bitcoin on the spot market, but another way to hitch a ride on this trend is with Coinbase Global COIN.

Coinbase is the leading cryptocurrency brokerage in the US, and primary access point to the crypto ecosystem for retail and some institutional investors. Coinbase Global crushed its most recent quarterly earnings expectations, driven by the growing trading activity in Bitcoin and other cryptos.

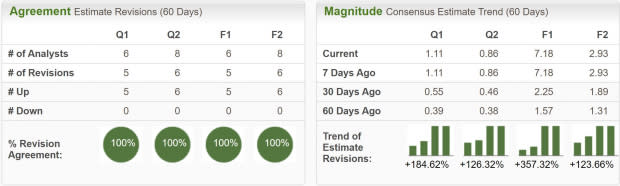

Earnings estimates have rocketed higher in the last two months, with FY24 climbing from $1.57 per share to $7.18 per share! Not surprisingly, this has earned the stock a Zacks Rank #1 (Strong Buy) rating.

Image Source: Zacks Investment Research

Like the underlying, Coinbase stock is also forming a compelling technical chart pattern. This descending wedge is a formation that COIN is familiar with, and if the stock can trade above the $220 level, it would signal a breakout.

A powerful breakout, with accompanying volume should send the stock to new highs.

Image Source: TradingView

Cleanspark

Another way to get exposure to Bitcoin in the stock market is through cryptocurrency miners. Cleanspark CLSK is a highly volatile miner, but potentially lucrative way to play the Bitcoin theme.

While Cleanspark is a less followed name than some of the other crypto miners like Marathon Digital MARA and Riot Platforms Inc. RIOT, I believe that Cleanspark is showing more promise in the near future.

Over the 3 months, 6 months, 12 months, and YTD Cleanspark has considerably outperformed both Marathon Digital and Riot Platforms and is actually the only one of the group with positive returns YTD. This relative strength shows considerable bullishness.

Image Source: TradingView

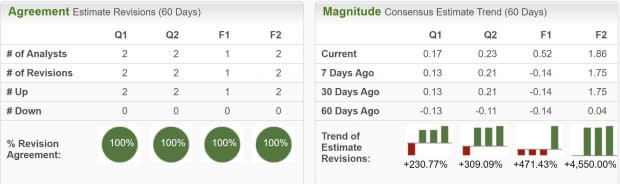

Additionally, Cleanspark has seen some heft revisions higher to its earnings estimates, giving it a Zacks Rank #2 (Buy) rating. FY25 earnings have been revised higher from $0.04 per share to $1.86, an incredible 4,550%.

Image Source: Zacks Investment Research

Like Coinbase and Bitcoin itself, Cleanspark stock is building a convincing technical pattern. A breakout from this very broad bull flag should send the stock higher. The breakout level is $17.70.

Image Source: TradingView

iShares Bitcoin Trust

Alternatively, if you want direct exposure to Bitcoin, while using exclusively the stock market, the iShares Bitcoin Trust IBIT ETF is a fantastic way to do so. Although the ETF does not currently have Zacks Rank coverage, I believe it to be the best Bitcoin ETF on the market.

IBIT has the second largest assets under management, second to Grayscale Bitcoin Trust ETF GBTC, but has considerably lower fees. GBTC has an annual fee of 1.5%, while IBIT is just 0.25%.

Bottom Line

For investors who are looking to add some high-flying stocks to their portfolios, and are also willing to stomach some additional volatility for those returns, Bitcoin and related stocks are a worthwhile consideration.

With the large upgrades in brokerage and mining stock, along with the bullish chart setups, now appears to be a timely opportunity to jump in.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marathon Digital Holdings, Inc. (MARA) : Free Stock Analysis Report

Grayscale Bitcoin Trust ETF (GBTC): ETF Research Reports

Riot Platforms, Inc. (RIOT) : Free Stock Analysis Report

Cleanspark, Inc. (CLSK) : Free Stock Analysis Report

Coinbase Global, Inc. (COIN) : Free Stock Analysis Report

iShares Bitcoin Trust (IBIT): ETF Research Reports