The digital advertising market is set to experience consistent growth over the next few years, primarily due to increased business spending on social media platforms. The incorporation of technologies such as artificial intelligence has enabled more personalized advertisements, resulting in increased conversion rates and customer engagement. This presents a compelling outlook for firms operating within this sector, like marketing aggregator Stagwell (NASDAQ:STGW). The stock is up over 20% in the past year due to strong revenue growth and a recent earnings beat. Thanks to promising long-term prospects, STGW is an opportunity that growth investors may find interesting.

Stagwell’s Aggressive M&A Growth

Stagwell is an aggregator that acquires and operates a marketing network that balances both the creative and technological aspects of marketing. The network consists of over 70 agencies spread across more than 34 countries, with a specialist workforce of over 13,000 working together to deliver effective business results for a client base of 4,000 brands worldwide. Stagwell continues to expand its global reach and digital capabilities through acquisitions.

Recently, it expanded by acquiring Team Epiphany and entered the EU by acquiring WNP, its first French agency. Furthermore, its digital creative presence in the UK was bolstered with the acquisition of Sidekick. Q2 2024 saw the acquisition of PROS, which added social and influencer capabilities in Brazil, and Luxine Relations Publiques, a Montreal-based full-service PR and Influencer Marketing agency.

Analysis of Stagwell’s Recent Financial Results

Stagwell recently reported a promising Q1 performance, exceeding expectations on several fronts. The most notable outcomes include revenue of $670 million, a year-over-year increase of 7.7%, exceeding forecasts by $50.48 million. In addition, non-GAAP EPS of $0.16 surpassed consensus projections by $0.03.

The company disclosed a significant first-quarter milestone: $66 million in net new business wins, contributing to a record trailing 12-month net new business wins total exceeding $280 million.

Management has maintained its 2024 guidance, aiming for 5% to 7% net revenue growth, an adjusted EBITDA of $400 million to $450 million, and an adjusted EPS of $0.75 – $0.88.

What Is the Price Target for STGW Stock?

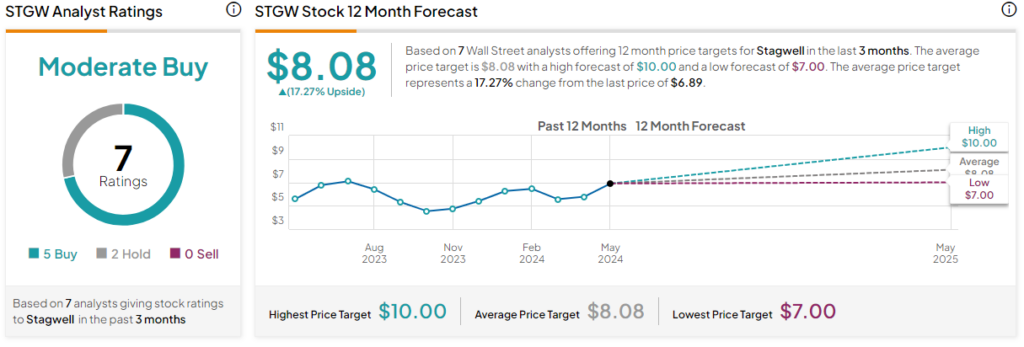

Analysts following the company have mainly been constructive on the stock. For example, B. Riley analyst Jeff Van Sinderen recently raised his price target on Stagwell from $9 to $10 while maintaining a Buy rating. He noted improving trends for the company and an expectation that the upcoming political season will lead to spending records, driving ad revenue.

Overall, Stagwell is rated a Moderate Buy based on the aggregate recommendations and price targets assigned by seven Wall Street analysts over the past three months. The average price target for STGW stock is $8.08, which represents a 17.27% upside from current levels.

The stock has enjoyed a nice bounce since the most recent earnings report and is up over 22% in the past month. It currently trades in the middle of its 52-week price range of $3.82-$8.59 and demonstrates positive price momentum, trading above the 20-day (6.53) and 50-day (6.22) moving averages.

Stagwell Takeaway: ASolid Option for Advertising Exposure

Marketing is big business, and Stagwell is aggregating a network of best-in-breed providers around the globe. Earnings are trending up, as is the stock, and prospects look promising for more of the same. The stock is a solid option for investors looking to add advertising exposure to their portfolios.