The US stock market has surged to new heights, with the S&P 500 index reaching a record high of 5,325 points and the DJIA index touching 40,000 points. Investors are experiencing euphoria, spurred by the unexpectedly low US inflation figures released earlier.

Inflation has recently been a critical driver of market volatility, thus its stabilisation is a cause for significant optimism. The April CPI increase, lower than expected at just 0.3% month-on-month, suggests a potential return to a downward inflation trajectory. Year-on-year, the CPI climbed by 3.4% in April, a slight dip from 3.5% in March. Inflation peaked in June 2022 at 9.1%, and while there was progress, the current deceleration is encouraging for investors.

The April inflation report marked the first decline in year-on-year inflation since January 2024. The CPI rose slower, raising market hopes that the Federal Reserve might soon ease monetary conditions.

Technical analysis of S&P 500

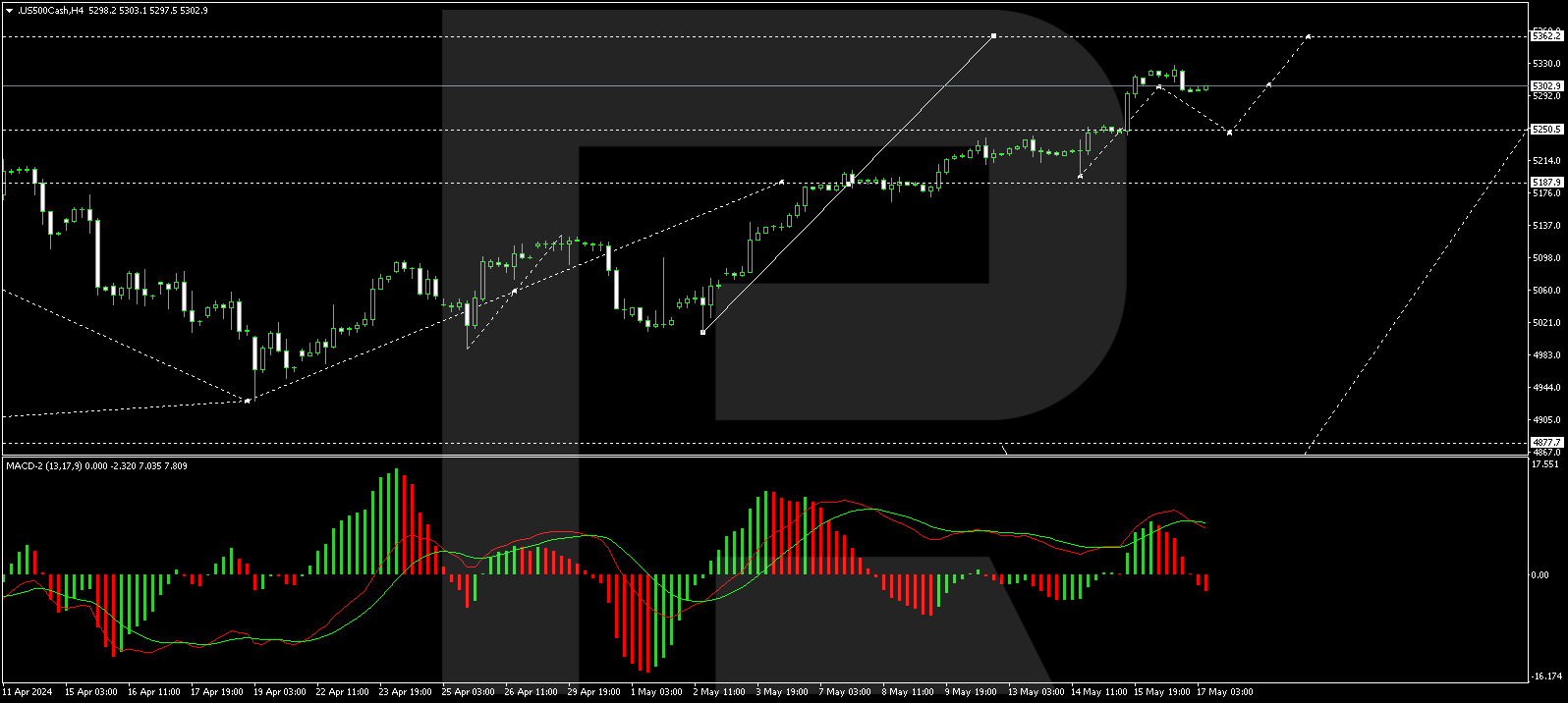

On the H4 chart of the S&P 500 index, a consolidation range has formed around the 5188.0 level. With an upward breakout, extending the fifth wave to 5363.0 is possible. The growth link to 5315.0 has been executed, and we now expect a consolidation range to form around this level. A downward breakout could lead to a range expansion to 5250.5, while an upward breakout could extend to 5363.0. The market is developing the fifth wave of growth without any significant correction, and a sharp decline along the trend to 4735.0 could begin at any moment. This scenario is technically supported by the MACD indicator, with its signal line at the maximums and pointing strictly downwards.

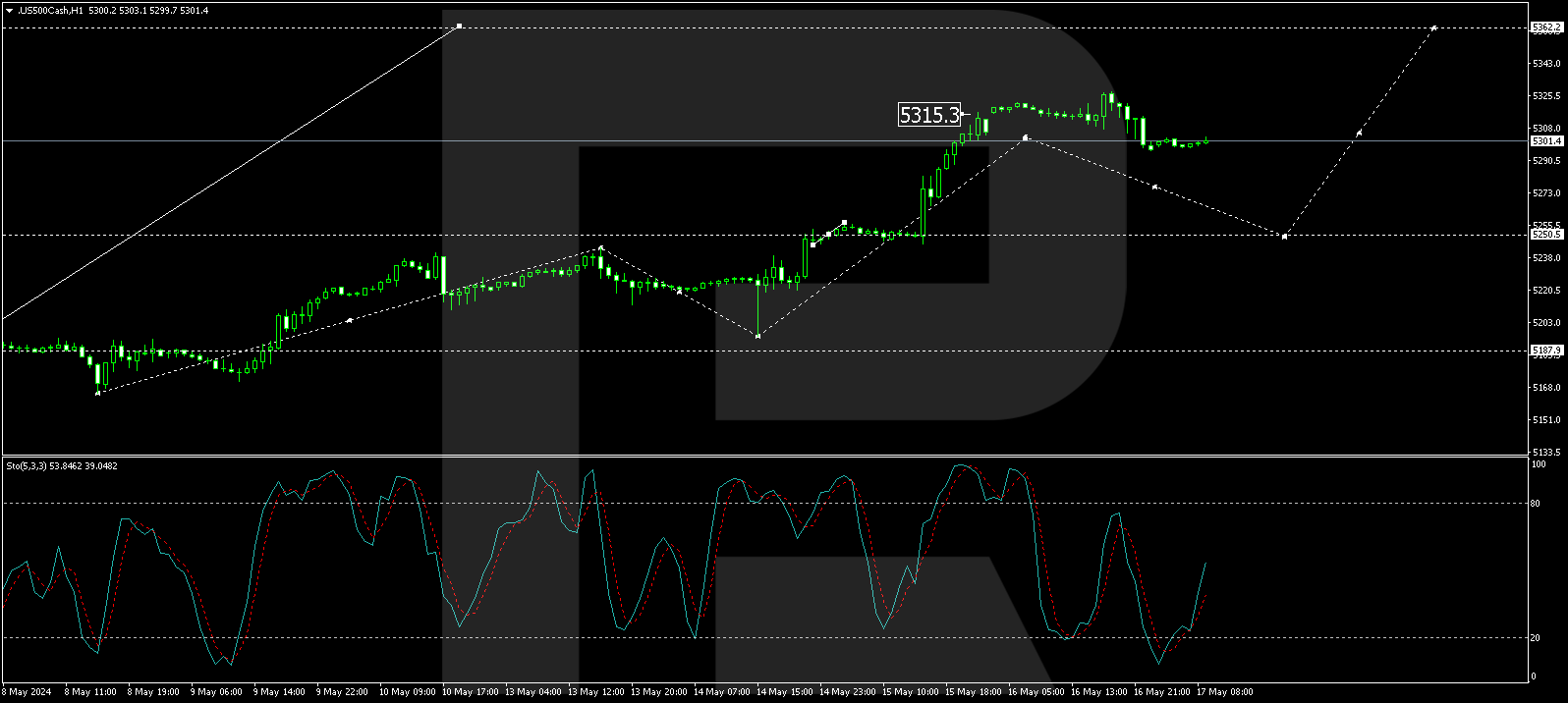

On the H1 chart, the upward move to 5315.5 has been completed. A consolidation range is forming around this level, and a downward impulse to 5296.0 has been fulfilled. We expect a growth link to 5315.5 (testing from below) today. A downward breakout from the range could lead to a continuation of the decrease wave to 5250.5. The Stochastic oscillator technically confirms this scenario, with its signal line above 20 and expected to rise to 80, indicating a potential for continued growth.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended content

Editors’ Picks

EUR/USD plummets to weekly lows near 1.0800 after US jobs data

EUR/USD stays under heavy pressure and trades at its lowest level in a week near 1.0800. The US Dollar continues to gather strength following the upbeat jobs data, which showed an increase of 272,000 in Nonfarm Payrolls in May, and weighs on the pair.

GBP/USD slumps below 1.2750 after encouraging US Payrolls

GBP/USD stays on the back foot and trades deep in negative territory below 1.2750 in the American session. The US Dollar outperforms its rivals following the impressive labor market data for May, forcing the pair to stretch lower heading into the weekend.

Gold falls toward $2,300 as US yields rally

Gold turned south and dropped below $2,320, erasing all of its weekly gains in the process. The benchmark 10-year US Treasury bond yield is up more than 3% on the day above 4.4% after strong US Nonfarm Payrolls data, dragging XAU/USD lower.

Bonk price approaches key reversal zone, 28% bounce likely

Bonk price crashed 30% from its recent peak and is gravitating towards a critical support zone. This correction presents a potential buying opportunity for investors anticipating a rebound and subsequent upward trend continuation for the meme coin.

GameStop stock gets slammed by early earnings release, 75 million share sale Premium

GameStop (GME) has once again rained on Keith Gill’s parade as executives disclosed a plan to sell as many as 75 million shares of the stock in at-the-market prices.